Alaska Income Tax Education Credit 2020

What is the Alaska Income Tax Education Credit

The Alaska Income Tax Education Credit is a tax benefit designed to assist residents in offsetting the costs associated with education. This credit is particularly aimed at those who have incurred expenses for tuition and related fees while pursuing higher education or vocational training. By providing financial relief, this credit encourages individuals to further their education and enhance their skills in the workforce.

Eligibility Criteria

To qualify for the Alaska Income Tax Education Credit, applicants must meet specific criteria. Primarily, the taxpayer must be a resident of Alaska for the tax year in question. Additionally, the education expenses must be for an eligible institution, which includes accredited colleges, universities, and vocational schools. The credit is available to individuals who are enrolled at least half-time in a degree or certificate program and have incurred qualified expenses.

Steps to Complete the Alaska Income Tax Education Credit

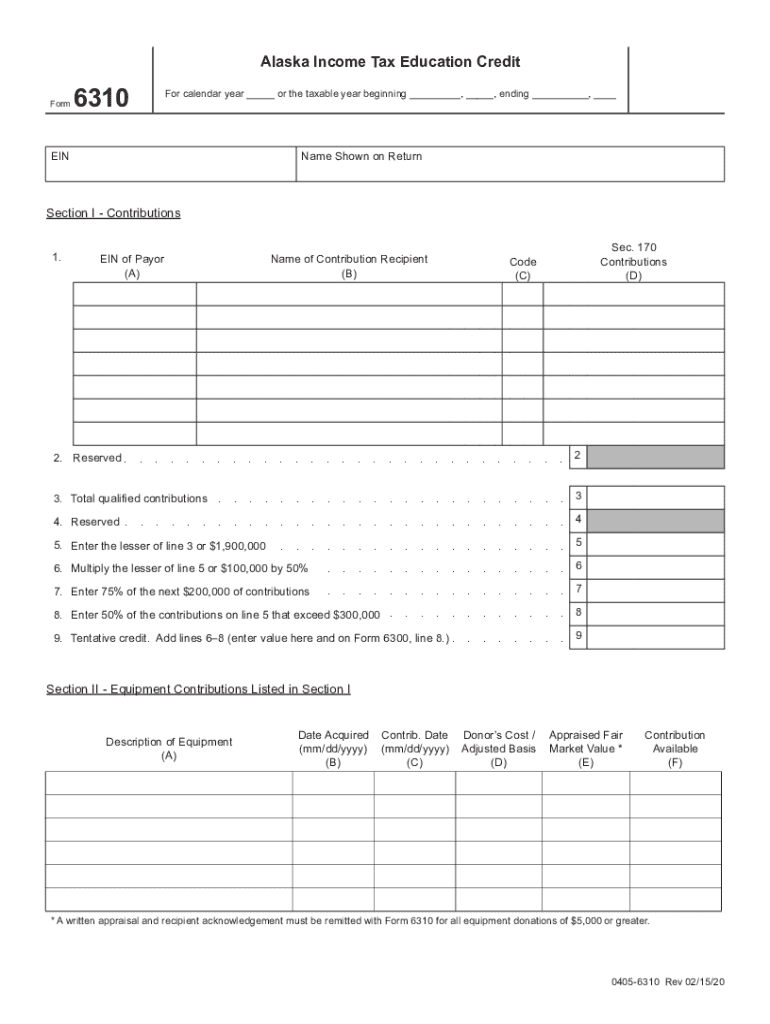

Completing the Alaska Income Tax Education Credit requires careful attention to detail. First, gather all necessary documentation, including proof of enrollment and receipts for qualified educational expenses. Next, fill out the appropriate sections of the form 6310, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, submit the form electronically or via mail, depending on your preference.

Key Elements of the Alaska Income Tax Education Credit

The Alaska Income Tax Education Credit includes several key elements that taxpayers should be aware of. These elements encompass the maximum credit amount available, which can vary based on the taxpayer's income and the number of qualifying expenses. Additionally, it is important to understand the types of expenses that qualify for the credit, such as tuition, fees, and required course materials. Familiarity with these components can help maximize the benefits of the credit.

Required Documents

When applying for the Alaska Income Tax Education Credit, certain documents are essential for a successful application. Taxpayers must provide proof of enrollment in an eligible institution, such as an acceptance letter or enrollment verification. Receipts for tuition and other qualified expenses must also be included. Furthermore, it is advisable to keep copies of all submitted documents for personal records and future reference.

Form Submission Methods

The form 6310 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file electronically, which is often faster and more efficient. Alternatively, the form can be printed and mailed to the appropriate state tax office. In-person submissions may also be possible at designated tax offices, providing another avenue for those who prefer face-to-face interactions.

Legal Use of the Alaska Income Tax Education Credit

The Alaska Income Tax Education Credit is governed by specific legal guidelines to ensure its proper use. Taxpayers must adhere to the regulations set forth by the state tax authority, which include maintaining accurate records of educational expenses and ensuring that all claims are legitimate. Misuse of the credit can lead to penalties, making it crucial for applicants to understand the legal framework surrounding this tax benefit.

Quick guide on how to complete alaska income tax education credit

Easily Set Up Alaska Income Tax Education Credit on Any Gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Alaska Income Tax Education Credit on any gadget with the airSlate SignNow applications for Android or iOS and enhance any document-focused procedure today.

How to Modify and Electronically Sign Alaska Income Tax Education Credit Effortlessly

- Locate Alaska Income Tax Education Credit and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from a device of your choice. Adjust and electronically sign Alaska Income Tax Education Credit and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska income tax education credit

Create this form in 5 minutes!

How to create an eSignature for the alaska income tax education credit

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the form 6310 used for?

The form 6310 is utilized for various documentation processes within businesses. It serves as an essential tool for formalizing agreements and ensuring compliance. By incorporating airSlate SignNow with form 6310, users can streamline document workflows efficiently.

-

How does airSlate SignNow support the form 6310?

airSlate SignNow offers an intuitive interface for managing the form 6310 seamlessly. Users can upload, fill out, and eSign form 6310 completely online, reducing the time spent on paperwork. This efficient process enhances accuracy and keeps your workflow organized.

-

Is there a cost associated with using the form 6310 in airSlate SignNow?

airSlate SignNow provides a cost-effective solution for using the form 6310. Subscription plans vary based on features and usage, allowing businesses to choose what suits their needs best. The potential savings from reduced paper use and improved efficiency make it a valuable investment.

-

Can I integrate form 6310 with other applications?

Yes, airSlate SignNow allows for seamless integration of the form 6310 with various productivity applications. This integration helps streamline workflows by connecting with tools such as CRM systems, document management software, and more. Users can automate processes while maintaining control over their documents.

-

What are the benefits of using airSlate SignNow for form 6310?

Using airSlate SignNow for form 6310 offers numerous benefits, including enhanced security, easy accessibility, and improved collaboration. The platform ensures that documents are signed and stored securely while providing real-time tracking. This results in a more efficient process for all parties involved.

-

Is airSlate SignNow compliant with legal standards for form 6310?

Absolutely, airSlate SignNow complies with legal standards and regulations necessary for electronic signatures on form 6310. The platform adheres to eSignature laws, ensuring that all signed documents are legally binding. This commitment to compliance instills confidence in users and their clients.

-

How can airSlate SignNow improve the efficiency of handling the form 6310?

airSlate SignNow improves efficiency for handling the form 6310 by automating document workflows and enabling quick eSigning. With features like mobile signing and document templates, users can manage their paperwork with ease. This results in faster turnaround times and a more productive work environment.

Get more for Alaska Income Tax Education Credit

- Sale of a business package wisconsin form

- Legal documents for the guardian of a minor package wisconsin form

- New state resident 497431237 form

- Commercial property sales package wisconsin form

- General partnership package wisconsin form

- Wisconsin declaration form

- Contract for deed package wisconsin form

- Wi will form

Find out other Alaska Income Tax Education Credit

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship