Alaska Income Tax Education Credit Alaska Department of Revenue 2017

What is the Alaska Income Tax Education Credit?

The Alaska Income Tax Education Credit is a tax benefit designed to support residents who incur educational expenses. This credit allows eligible taxpayers to reduce their overall tax liability, making education more accessible and affordable. The Alaska Department of Revenue administers this program, ensuring that individuals who qualify can receive financial relief through their state income tax returns. Understanding the specifics of this credit is crucial for maximizing potential savings during tax season.

Eligibility Criteria for the Alaska Income Tax Education Credit

To qualify for the Alaska Income Tax Education Credit, taxpayers must meet specific criteria. Generally, eligible applicants include those who have incurred expenses related to higher education, vocational training, or other educational programs. The credit may be available for tuition, fees, and other necessary costs associated with education. It is important for individuals to review the detailed eligibility requirements set by the Alaska Department of Revenue to ensure compliance and maximize their benefits.

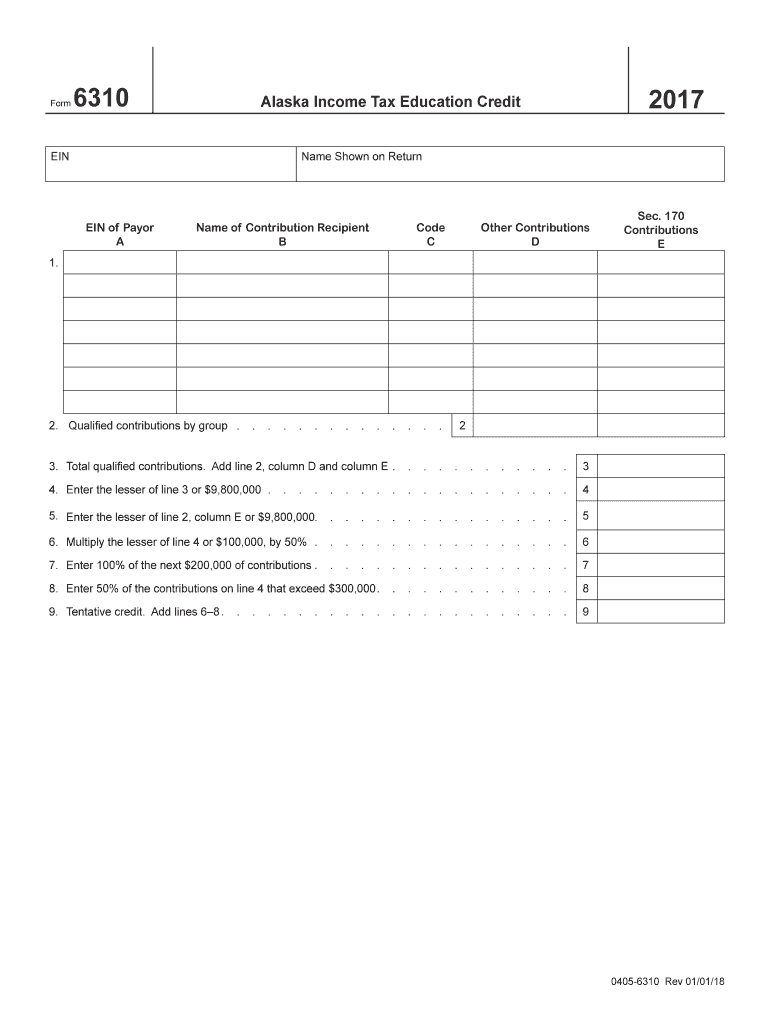

Steps to Complete the Alaska Income Tax Education Credit Form

Completing the Alaska Income Tax Education Credit form involves several key steps. First, gather all necessary documentation, including proof of educational expenses and any relevant tax documents. Next, accurately fill out the form, ensuring that all required fields are completed. It is essential to double-check the information for accuracy before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in-person, to ensure timely processing of your claim.

Required Documents for the Alaska Income Tax Education Credit

When applying for the Alaska Income Tax Education Credit, specific documents must be submitted to support your claim. These typically include:

- Proof of enrollment in an eligible educational institution

- Receipts or statements detailing educational expenses

- Tax forms from the previous year, if applicable

- Any additional documentation requested by the Alaska Department of Revenue

Having these documents ready can streamline the application process and help ensure that your claim is processed efficiently.

Form Submission Methods for the Alaska Income Tax Education Credit

The Alaska Income Tax Education Credit form can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission via the Alaska Department of Revenue's website

- Mailing the completed form to the appropriate tax office

- In-person submission at designated tax offices

Choosing the most convenient method for submission can help ensure that your application is received and processed in a timely manner.

Legal Use of the Alaska Income Tax Education Credit

The Alaska Income Tax Education Credit is governed by specific legal frameworks that dictate its use. Taxpayers must comply with regulations set forth by the Alaska Department of Revenue to ensure that their claims are valid. This includes adhering to eligibility requirements and accurately reporting educational expenses. Understanding the legal aspects of this credit can help taxpayers navigate the application process and avoid potential pitfalls.

Examples of Using the Alaska Income Tax Education Credit

Utilizing the Alaska Income Tax Education Credit can significantly impact taxpayers' financial situations. For instance, a student enrolled in a local university may claim tuition costs as part of their educational expenses, reducing their overall tax liability. Similarly, individuals pursuing vocational training can also benefit from this credit by claiming associated fees. These examples illustrate how the credit can assist various taxpayers in managing their education-related costs effectively.

Quick guide on how to complete alaska income tax education credit alaska department of revenue

Easily Prepare Alaska Income Tax Education Credit Alaska Department Of Revenue on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any holdups. Manage Alaska Income Tax Education Credit Alaska Department Of Revenue on any device through the airSlate SignNow Android or iOS apps and streamline any document-related process today.

Effortlessly Edit and Electronically Sign Alaska Income Tax Education Credit Alaska Department Of Revenue

- Obtain Alaska Income Tax Education Credit Alaska Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the entries and click the Done button to save your modifications.

- Decide how you would like to send your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Alaska Income Tax Education Credit Alaska Department Of Revenue to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska income tax education credit alaska department of revenue

Create this form in 5 minutes!

How to create an eSignature for the alaska income tax education credit alaska department of revenue

How to generate an eSignature for your Alaska Income Tax Education Credit Alaska Department Of Revenue in the online mode

How to make an eSignature for the Alaska Income Tax Education Credit Alaska Department Of Revenue in Google Chrome

How to create an electronic signature for putting it on the Alaska Income Tax Education Credit Alaska Department Of Revenue in Gmail

How to make an eSignature for the Alaska Income Tax Education Credit Alaska Department Of Revenue straight from your smart phone

How to make an electronic signature for the Alaska Income Tax Education Credit Alaska Department Of Revenue on iOS devices

How to generate an electronic signature for the Alaska Income Tax Education Credit Alaska Department Of Revenue on Android OS

People also ask

-

What is the impact of alaska income tax on eSigning documents?

Alaska does not impose a state income tax, which can affect how you handle financial documents related to transactions in the state. Using airSlate SignNow allows you to easily eSign all necessary documents, ensuring compliance without the added complexity of state income taxes.

-

How does airSlate SignNow help with alaska income tax documentation?

airSlate SignNow streamlines the process of creating and eSigning documents related to alaska income tax. With our user-friendly platform, businesses can ensure that all necessary forms are completed and submitted accurately and efficiently.

-

Are there any special features in airSlate SignNow for managing alaska income tax forms?

Yes, airSlate SignNow includes specific features designed to help users manage their alaska income tax forms effectively. With customizable templates and automated workflows, you can simplify your tax documentation process signNowly.

-

What are the pricing options for airSlate SignNow regarding alaska income tax services?

airSlate SignNow offers flexible pricing plans that fit various business needs, including those related to alaska income tax services. Our cost-effective solutions ensure that you can manage your document signing without straining your budget.

-

Can I integrate airSlate SignNow with accounting software for alaska income tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software to handle alaska income tax efficiently. This integration allows for a smooth exchange of data, making tax preparation easier and more accurate.

-

How secure is airSlate SignNow for handling alaska income tax documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive alaska income tax documents. Our platform uses encryption and secure cloud storage to ensure that all your data remains protected throughout the eSigning process.

-

Can I track the status of my alaska income tax documents with airSlate SignNow?

Yes, one of the key features of airSlate SignNow is the ability to track the status of your alaska income tax documents in real-time. This feature allows you to stay informed about the progress of your eSignatures, ensuring a timely filing.

Get more for Alaska Income Tax Education Credit Alaska Department Of Revenue

Find out other Alaska Income Tax Education Credit Alaska Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors