Section I Contributions and Other Expenditures 2025-2026

What is the Section I Contributions And Other Expenditures

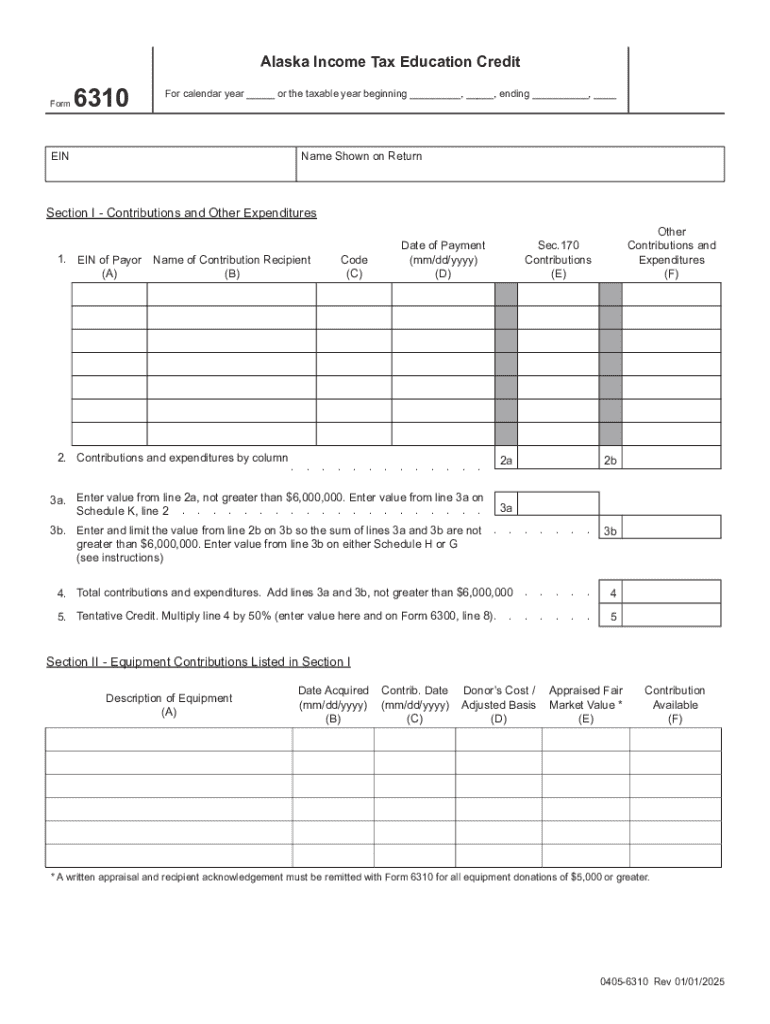

The Section I Contributions And Other Expenditures form is a crucial document used in various financial and political contexts in the United States. It is primarily designed to disclose contributions made and expenditures incurred by individuals or organizations. This form ensures transparency in financial dealings, particularly in political campaigns and fundraising activities. Understanding its purpose is essential for compliance with federal and state regulations.

How to use the Section I Contributions And Other Expenditures

Using the Section I Contributions And Other Expenditures form involves several steps. First, gather all relevant financial information, including details of contributions and expenditures. Next, accurately fill out the form, ensuring that all amounts are clearly stated and categorized correctly. It is important to follow the guidelines provided by the relevant authorities to ensure compliance. Finally, submit the completed form by the specified deadline to avoid penalties.

Key elements of the Section I Contributions And Other Expenditures

Several key elements must be included when completing the Section I Contributions And Other Expenditures form. These include:

- Contributor Information: Names and addresses of individuals or organizations making contributions.

- Expenditure Details: A clear breakdown of expenditures, including the purpose and amount.

- Date of Transactions: The dates on which contributions and expenditures occurred.

- Total Amounts: Summary of total contributions and total expenditures.

Accurate reporting of these elements is vital for maintaining compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Section I Contributions And Other Expenditures form can vary based on the specific regulations governing your situation. Generally, it is essential to submit the form before the due date for the relevant reporting period. Keeping track of these deadlines helps avoid late fees and potential penalties. It is advisable to consult the official guidelines or a legal expert for specific dates related to your circumstances.

Legal use of the Section I Contributions And Other Expenditures

The legal use of the Section I Contributions And Other Expenditures form is governed by federal and state laws. This form must be used to ensure compliance with campaign finance laws, which require transparency in political contributions and expenditures. Failure to use the form correctly can result in legal consequences, including fines and penalties. Understanding the legal framework surrounding this form is essential for individuals and organizations involved in political activities.

Examples of using the Section I Contributions And Other Expenditures

Examples of using the Section I Contributions And Other Expenditures form include:

- A political candidate reporting contributions received from supporters.

- A political action committee disclosing expenditures made for advertising campaigns.

- An organization detailing funds raised for a charitable cause and the expenses incurred.

These examples illustrate the form's versatility in various financial and political contexts, highlighting its importance in maintaining transparency.

Create this form in 5 minutes or less

Find and fill out the correct section i contributions and other expenditures

Create this form in 5 minutes!

How to create an eSignature for the section i contributions and other expenditures

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of Section I Contributions And Other Expenditures in document management?

Section I Contributions And Other Expenditures is crucial for tracking financial contributions and expenditures in your documents. It ensures compliance with regulations and provides transparency in financial reporting. By utilizing airSlate SignNow, businesses can easily manage these sections within their documents.

-

How does airSlate SignNow simplify the process of managing Section I Contributions And Other Expenditures?

airSlate SignNow simplifies the management of Section I Contributions And Other Expenditures by providing an intuitive interface for document creation and eSigning. Users can easily input and track contributions and expenditures, ensuring that all necessary information is accurately captured. This streamlines the workflow and reduces the risk of errors.

-

What features does airSlate SignNow offer for handling Section I Contributions And Other Expenditures?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning specifically designed for Section I Contributions And Other Expenditures. These features help users efficiently manage their documents while ensuring compliance and accuracy. Additionally, the platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for managing Section I Contributions And Other Expenditures?

Yes, airSlate SignNow is a cost-effective solution for managing Section I Contributions And Other Expenditures. With various pricing plans available, businesses can choose an option that fits their budget while still accessing powerful features. This affordability makes it an attractive choice for organizations of all sizes.

-

Can airSlate SignNow integrate with other tools for managing Section I Contributions And Other Expenditures?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, enhancing the management of Section I Contributions And Other Expenditures. This allows users to connect their existing systems, streamline workflows, and ensure that all financial data is synchronized across platforms.

-

How does airSlate SignNow ensure the security of Section I Contributions And Other Expenditures data?

airSlate SignNow prioritizes the security of your data, including Section I Contributions And Other Expenditures. The platform employs advanced encryption and security protocols to protect sensitive information. Additionally, users can set permissions and access controls to further safeguard their documents.

-

What benefits can businesses expect from using airSlate SignNow for Section I Contributions And Other Expenditures?

Businesses can expect numerous benefits from using airSlate SignNow for Section I Contributions And Other Expenditures, including increased efficiency, reduced paperwork, and improved compliance. The platform's user-friendly design allows for quick document processing, enabling teams to focus on their core activities while ensuring accurate financial reporting.

Get more for Section I Contributions And Other Expenditures

- The new mexico state chapter nmpeoorg form

- New mexico laboratory bench sheets form

- Adjunct course completion form new mexico public regulation nmprc state nm

- New mexico firefighters training academy new mexico public form

- Aarsi ccsd form

- Nevada non compete agreement template form

- Reference form 34387722

- 28 11 queens plaza north form

Find out other Section I Contributions And Other Expenditures

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free