Tax Alaska 2015

What is the Tax Alaska

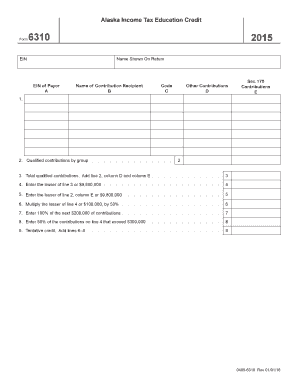

The Tax Alaska form is a specific document used for reporting and filing taxes in the state of Alaska. It is essential for individuals and businesses to accurately report their income and fulfill their tax obligations. Understanding the nuances of this form is crucial for compliance with state tax laws. The form may vary based on the taxpayer's status, such as individual, business, or organization, and it is designed to capture relevant financial information required by the state tax authority.

How to use the Tax Alaska

Using the Tax Alaska form involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary financial documents, including income statements, deductions, and credits. Once the required information is collected, taxpayers can fill out the form either digitally or on paper. It is important to follow the instructions provided with the form carefully to avoid errors that could lead to delays or penalties. After completing the form, individuals can submit it through the designated channels, ensuring that they meet all filing deadlines.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires a systematic approach:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Review the instructions accompanying the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form by the appropriate deadline, either online or via mail.

Legal use of the Tax Alaska

The Tax Alaska form must be used in accordance with state tax laws to ensure its legal validity. This includes adhering to guidelines set forth by the Alaska Department of Revenue. The form must be filled out truthfully, and any misrepresentation can result in penalties. Additionally, electronic submissions must comply with eSignature laws to be considered legally binding. Utilizing a reliable eSigning platform can enhance the security and legitimacy of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial for taxpayers to observe to avoid penalties. Generally, the deadline for individual taxpayers is April 15 of each year, while businesses may have different deadlines based on their fiscal year. It is advisable to check the Alaska Department of Revenue’s website for the most current deadlines and any changes that may occur. Marking these dates on a calendar can help ensure timely filing and compliance.

Required Documents

To complete the Tax Alaska form, several documents are typically required. These may include:

- W-2 forms for wage earners

- 1099 forms for independent contractors

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any additional documentation required for specific credits or deductions

Having these documents ready can streamline the process of completing the form and ensure accuracy in reporting.

Quick guide on how to complete tax alaska 6967209

Complete Tax Alaska effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without any hold-ups. Handle Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Tax Alaska with ease

- Find Tax Alaska and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Alaska and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax alaska 6967209

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967209

How to make an eSignature for the Tax Alaska 6967209 in the online mode

How to make an electronic signature for the Tax Alaska 6967209 in Google Chrome

How to create an electronic signature for putting it on the Tax Alaska 6967209 in Gmail

How to make an eSignature for the Tax Alaska 6967209 from your smartphone

How to make an electronic signature for the Tax Alaska 6967209 on iOS devices

How to create an electronic signature for the Tax Alaska 6967209 on Android

People also ask

-

How does airSlate SignNow help with Tax Alaska documentation?

airSlate SignNow streamlines the process of preparing and signing tax-related documents for businesses operating in Alaska. With its easy-to-use platform, you can quickly create, send, and eSign necessary documents, ensuring compliance and efficiency in handling Tax Alaska requirements.

-

What are the pricing plans for using airSlate SignNow for Tax Alaska needs?

airSlate SignNow offers several pricing plans designed to accommodate various business needs when dealing with Tax Alaska documentation. Plans range from basic to advanced features, allowing you to choose one that fits your budget and operational requirements without compromising on quality.

-

Can I integrate airSlate SignNow with other software for managing Tax Alaska documents?

Yes, airSlate SignNow easily integrates with a variety of software solutions, enhancing your capability to manage Tax Alaska documentation effectively. Whether it's accounting software or ERP systems, these integrations ensure a seamless workflow for all your tax-related processes.

-

What features make airSlate SignNow suitable for handling Tax Alaska contracts?

airSlate SignNow comes equipped with essential features such as customizable templates, automated workflows, and secure eSignature capabilities, making it ideal for managing Tax Alaska contracts. These features help you save time and reduce error rates in documentation, ensuring a smoother tax submission process.

-

How secure is airSlate SignNow for handling sensitive Tax Alaska information?

Security is a top priority for airSlate SignNow when managing sensitive Tax Alaska information. The platform employs advanced encryption methods and compliance with industry standards, guaranteeing that your documents and personal data are always protected against unauthorized access.

-

Is there a mobile app for airSlate SignNow to manage Tax Alaska documents on the go?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage your Tax Alaska documents from anywhere. With the app, you can review, sign, and send documents easily, ensuring you stay on top of your tax obligations while on the move.

-

What support options are available for airSlate SignNow users dealing with Tax Alaska?

airSlate SignNow provides comprehensive support options for users managing Tax Alaska documentation. Assistance is available via email, phone, and live chat, ensuring that you have the resources needed to navigate any challenges you may encounter.

Get more for Tax Alaska

Find out other Tax Alaska

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document