NON TAX FILER STATEMENT Form

What is the NON TAX FILER STATEMENT

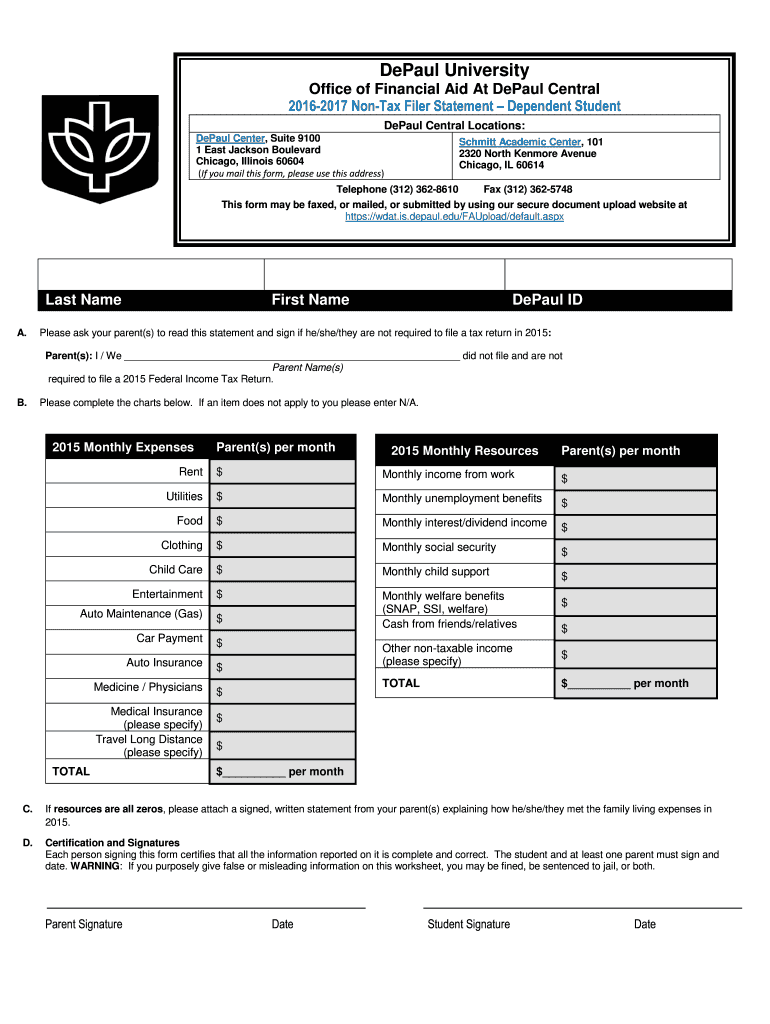

The NON TAX FILER STATEMENT is a document used by individuals who are not required to file a federal income tax return. This statement serves as a formal declaration of a person's non-filing status, often needed for various purposes, such as applying for financial aid, housing assistance, or other government programs. It provides verification that the individual did not earn enough income to necessitate filing a tax return, which can be important for eligibility assessments in different programs.

How to use the NON TAX FILER STATEMENT

This statement is typically used to confirm non-filing status when required by institutions or agencies. Users should fill out the form accurately, providing necessary personal information and confirming their income status. Once completed, the statement can be submitted to the requesting agency, such as a school or government body, to satisfy documentation requirements. It is essential to keep a copy for personal records and future reference.

Steps to complete the NON TAX FILER STATEMENT

Completing the NON TAX FILER STATEMENT involves several straightforward steps:

- Gather necessary personal information, including your name, address, and Social Security number.

- Indicate your non-filing status clearly, specifying the tax year in question.

- Provide any additional information requested, such as income details or reasons for non-filing.

- Review the statement for accuracy before signing and dating it.

- Make copies for your records and submit the original to the requesting agency.

Legal use of the NON TAX FILER STATEMENT

The NON TAX FILER STATEMENT is legally recognized as a valid document for confirming an individual's tax status. It is important to ensure that the information provided is truthful and accurate, as providing false information can lead to legal consequences. Institutions may require this statement to comply with federal regulations, particularly in contexts such as financial aid or public assistance programs.

Eligibility Criteria

To be eligible to use the NON TAX FILER STATEMENT, individuals typically must meet specific criteria, including:

- Being below the income threshold set by the IRS for mandatory tax filing.

- Not having any filing requirements due to age or dependency status.

- Being able to provide supporting documentation if requested by the agency requiring the statement.

Required Documents

When preparing to submit a NON TAX FILER STATEMENT, individuals should have the following documents ready:

- Proof of income, if applicable, such as W-2 forms or pay stubs.

- Identification documents, including a driver's license or state ID.

- Any previous tax returns, if available, to support non-filing status.

Quick guide on how to complete non tax filer statement

Complete NON TAX FILER STATEMENT effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the essential tools to rapidly create, modify, and eSign your documents without delays. Manage NON TAX FILER STATEMENT on any device using airSlate SignNow’s Android or iOS applications and enhance any documentation process today.

The easiest way to modify and eSign NON TAX FILER STATEMENT without hassle

- Locate NON TAX FILER STATEMENT and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, such as email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Adapt and eSign NON TAX FILER STATEMENT and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non tax filer statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a NON TAX FILER STATEMENT and why is it important?

A NON TAX FILER STATEMENT is a document that verifies an individual’s income status, typically used for financial assessments. This statement is essential for those who do not file tax returns but need to provide income documentation, such as for loans or government assistance.

-

How can airSlate SignNow help me create a NON TAX FILER STATEMENT?

With airSlate SignNow, you can easily create a NON TAX FILER STATEMENT using our customizable templates. Our platform allows you to input necessary information and get your documents eSigned without any hassle, making it efficient for both you and your clients.

-

Is there a cost associated with generating a NON TAX FILER STATEMENT using airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include the functionality to generate a NON TAX FILER STATEMENT. Our solutions are designed to be cost-effective, ensuring you get valuable features without breaking the bank.

-

What features does airSlate SignNow offer for managing a NON TAX FILER STATEMENT?

AirSlate SignNow provides features like easy document creation, eSignature capabilities, and secure storage for your NON TAX FILER STATEMENT. You can also track document status and send reminders, ensuring a smooth signing process.

-

Can I integrate airSlate SignNow with other applications for my NON TAX FILER STATEMENT needs?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your NON TAX FILER STATEMENT alongside your existing workflows. Whether it's CRMs or cloud storage solutions, our integrations enhance your document management efficiency.

-

What benefits does using airSlate SignNow provide when handling a NON TAX FILER STATEMENT?

Using airSlate SignNow for your NON TAX FILER STATEMENT offers several benefits, including increased efficiency, enhanced security, and remarkable ease of use. You can finalize and send documents quickly, streamlining your operations and improving client satisfaction.

-

Is airSlate SignNow suitable for small businesses needing a NON TAX FILER STATEMENT?

Yes, airSlate SignNow is ideal for small businesses that require a NON TAX FILER STATEMENT. Our solution is designed to meet the needs of organizations of all sizes, offering cost-effective and robust features that support your documentation needs.

Get more for NON TAX FILER STATEMENT

- Apartment rules and regulations indiana form

- Agreed cancellation of lease indiana form

- Amendment of residential lease indiana form

- In unpaid rent form

- Commercial lease assignment from tenant to new tenant indiana form

- Tenant consent to background and reference check indiana form

- Indiana month 497306995 form

- Residential rental lease agreement indiana form

Find out other NON TAX FILER STATEMENT

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors