Revenue Nebraska Gov Form 22 2017

What is the Nebraska Change Form?

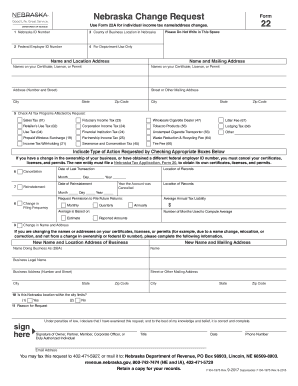

The Nebraska change form, specifically known as the Nebraska Department of Revenue Form 22, is a document used for various administrative changes, including name and address updates for businesses and individuals. This form is essential for ensuring that the state has accurate records for tax purposes and other legal requirements. It is crucial to complete this form accurately to avoid any discrepancies that may arise during tax assessments or audits.

How to Use the Nebraska Change Form

Using the Nebraska change form involves a few straightforward steps. First, you need to determine the specific changes you wish to make, whether it's a name change, address update, or other modifications. Next, download the form from the Nebraska Department of Revenue website or access it through a secure digital platform. After filling out the necessary fields, ensure that all information is accurate and complete. Finally, submit the form according to the provided instructions, either online, by mail, or in person, depending on your preference and the nature of the changes.

Steps to Complete the Nebraska Change Form

Completing the Nebraska change form requires careful attention to detail. Follow these steps:

- Gather all necessary information, including your current name, address, and the new details you wish to provide.

- Access the Nebraska change form, ensuring you have the most recent version.

- Fill in the required fields accurately, double-checking for any errors.

- Sign and date the form, as necessary, to validate your request.

- Submit the form through your chosen method, ensuring you keep a copy for your records.

Legal Use of the Nebraska Change Form

The Nebraska change form is legally recognized for updating personal and business information with the state. It is important to use this form correctly to comply with state regulations. Failure to update your information can lead to penalties, including issues with tax filings or legal notifications. By utilizing the Nebraska change form, you ensure that your records are current, which can help in avoiding complications with state authorities.

Required Documents for the Nebraska Change Form

When submitting the Nebraska change form, certain documents may be required to support your request. These can include:

- Proof of identity, such as a driver's license or state ID.

- Documentation of the name change, if applicable, such as a marriage certificate or court order.

- Any previous forms or documents that may be relevant to the changes being requested.

Having these documents ready can streamline the process and help ensure that your request is processed without delays.

Form Submission Methods

The Nebraska change form can be submitted through various methods, making it convenient for users. You can choose to:

- Submit the form online through the Nebraska Department of Revenue's secure portal.

- Mail the completed form to the appropriate department, ensuring you use the correct address.

- Deliver the form in person at designated state offices, which may provide immediate confirmation of receipt.

Selecting the right submission method depends on your preference for speed and convenience.

Quick guide on how to complete 3 county of business location in nebraska

Your assistance manual on how to prepare your Revenue Nebraska Gov Form 22

If you’re looking to learn how to generate and submit your Revenue Nebraska Gov Form 22, here are some simple guidelines to facilitate tax declaration.

To start, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to edit, generate, and finalize your tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and revert to modify answers when required. Streamline your tax handling with advanced PDF editing, eSigning, and accessible sharing.

Follow the instructions below to finalize your Revenue Nebraska Gov Form 22 in a matter of minutes:

- Create your account and begin working on PDFs shortly.

- Utilize our directory to obtain any IRS tax form; browse through variants and schedules.

- Click Obtain form to launch your Revenue Nebraska Gov Form 22 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting via paper can increase errors and postpone refunds. It goes without saying, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 3 county of business location in nebraska

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

Create this form in 5 minutes!

How to create an eSignature for the 3 county of business location in nebraska

How to generate an eSignature for the 3 County Of Business Location In Nebraska online

How to generate an electronic signature for the 3 County Of Business Location In Nebraska in Google Chrome

How to generate an eSignature for putting it on the 3 County Of Business Location In Nebraska in Gmail

How to create an eSignature for the 3 County Of Business Location In Nebraska right from your smartphone

How to make an eSignature for the 3 County Of Business Location In Nebraska on iOS

How to generate an electronic signature for the 3 County Of Business Location In Nebraska on Android

People also ask

-

What is the Nebraska change form and how can it be used with airSlate SignNow?

The Nebraska change form is a document that allows individuals or businesses to update their information or agreements efficiently. With airSlate SignNow, you can easily create, send, and eSign this form, ensuring that changes are documented swiftly and securely.

-

How does airSlate SignNow streamline the Nebraska change form process?

airSlate SignNow streamlines the Nebraska change form process by providing a user-friendly platform for document management. Users can fill out the form electronically, add signatures, and send it for approval, all in one place, reducing the time needed for manual paperwork.

-

What pricing options are available for using airSlate SignNow for Nebraska change forms?

airSlate SignNow offers flexible pricing plans tailored to various business needs. Whether you’re a small business or a large enterprise, you can find a plan that fits your budget for managing Nebraska change forms and other documents efficiently.

-

Are there templates available for the Nebraska change form within airSlate SignNow?

Yes, airSlate SignNow provides customizable templates for the Nebraska change form, making it easier for users to create compliant documents. These templates can be easily modified to suit specific requirements, saving time in the document preparation process.

-

Can I integrate airSlate SignNow with other software for Nebraska change forms?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow with Nebraska change forms. This integration allows you to connect with CRM, project management tools, and more, boosting efficiency in your operations.

-

What benefits does using airSlate SignNow provide for managing Nebraska change forms?

Using airSlate SignNow for Nebraska change forms offers numerous benefits, including enhanced security for document signing, real-time tracking of document status, and reduced turnaround time. These features help businesses maintain compliance while minimizing administrative burdens.

-

Is airSlate SignNow secure for handling sensitive Nebraska change forms?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive Nebraska change forms. The platform employs advanced encryption and authentication measures to ensure that your data is protected during transmission and storage.

Get more for Revenue Nebraska Gov Form 22

- Income support claim form

- Application for term grazing permit fs2200 usda forest service fs usda form

- Form ct 1040v ct gov ct

- Home occupation permit application sacramento city code cityofsacramento form

- Red flags when buying a puppy mccann dog training form

- X 03 state swppp inpection form draper city ut draper ut

- Gump and ayers scholarship fund slcc form

- Utah unconditional waiver and release upon progress payment form

Find out other Revenue Nebraska Gov Form 22

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement