22 Nebraska Change Request Nebraska Department of Revenue 2015

What is the 22 Nebraska Change Request Nebraska Department Of Revenue

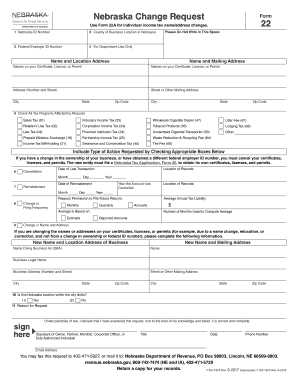

The 22 Nebraska Change Request is a specific form issued by the Nebraska Department of Revenue. This form is used by taxpayers to request changes to their previously submitted tax returns or to update their personal information. It serves as a formal method for individuals and businesses to communicate necessary adjustments to their tax filings, ensuring that all records are accurate and up to date. The form is essential for maintaining compliance with state tax regulations and for facilitating smooth processing of any amendments or updates.

Steps to complete the 22 Nebraska Change Request Nebraska Department Of Revenue

Completing the 22 Nebraska Change Request involves several clear steps to ensure accuracy and compliance. Begin by downloading the form from the Nebraska Department of Revenue website. Carefully read the instructions provided with the form to understand the requirements. Fill in your personal information, including your name, address, and tax identification number. Specify the changes you are requesting and provide any necessary documentation to support your request. Once completed, review the form for accuracy before signing it. Finally, submit the form according to the specified submission methods.

How to obtain the 22 Nebraska Change Request Nebraska Department Of Revenue

The 22 Nebraska Change Request can be obtained directly from the Nebraska Department of Revenue's official website. The form is typically available as a downloadable PDF, allowing users to fill it out electronically or print it for manual completion. Additionally, you may contact the Nebraska Department of Revenue for assistance or to request a physical copy of the form if needed. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Legal use of the 22 Nebraska Change Request Nebraska Department Of Revenue

The 22 Nebraska Change Request is legally recognized as a valid document for amending tax returns and updating taxpayer information. To ensure its legal validity, it must be completed accurately and submitted according to the guidelines set forth by the Nebraska Department of Revenue. The form must be signed by the taxpayer or their authorized representative, and any supporting documentation should be included to substantiate the requested changes. Adhering to these requirements helps avoid potential issues with tax compliance.

Form Submission Methods (Online / Mail / In-Person)

The 22 Nebraska Change Request can be submitted through various methods to accommodate different preferences. Taxpayers have the option to submit the form online through the Nebraska Department of Revenue's electronic filing system, if available. Alternatively, the completed form can be mailed to the appropriate address provided in the instructions. For those who prefer personal interaction, in-person submission at designated Department of Revenue offices is also an option. Each method has its own processing times, so taxpayers should choose the one that best suits their needs.

Required Documents

When submitting the 22 Nebraska Change Request, it is essential to include any required supporting documents. This may include copies of previous tax returns, W-2 forms, or other relevant financial documents that justify the changes being requested. Providing complete and accurate documentation helps expedite the processing of the request and reduces the likelihood of delays or complications. Always refer to the form instructions for a comprehensive list of required documents to ensure compliance.

Quick guide on how to complete 22 nebraska change request nebraska department of revenue

Your assistance manual on how to prepare your 22 Nebraska Change Request Nebraska Department Of Revenue

If you’re wondering how to finalize and send your 22 Nebraska Change Request Nebraska Department Of Revenue, here are several brief pointers on how to simplify tax processing.

To begin, simply establish your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax documents effortlessly. With its editing tool, you can toggle between text, checkboxes, and eSignatures and revisit to amend information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finish your 22 Nebraska Change Request Nebraska Department Of Revenue in moments:

- Create your account and begin working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your 22 Nebraska Change Request Nebraska Department Of Revenue in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to submit your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may increase error rates and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 22 nebraska change request nebraska department of revenue

FAQs

-

How could I be able to view a copy of my USPS change of address form? It’s been months since I filled it out, and I forgot whether I checked the box on the form as a “temporary” or “permanent” move. Silly question, but I honestly forgot.

To inquire about your change of address, contact a post office. You will not be able to view a copy of the form you filled out, but the information is entered into a database. They can tell you if it is temporary or permanent.

Create this form in 5 minutes!

How to create an eSignature for the 22 nebraska change request nebraska department of revenue

How to make an eSignature for the 22 Nebraska Change Request Nebraska Department Of Revenue in the online mode

How to create an electronic signature for the 22 Nebraska Change Request Nebraska Department Of Revenue in Google Chrome

How to create an eSignature for signing the 22 Nebraska Change Request Nebraska Department Of Revenue in Gmail

How to generate an eSignature for the 22 Nebraska Change Request Nebraska Department Of Revenue straight from your mobile device

How to create an eSignature for the 22 Nebraska Change Request Nebraska Department Of Revenue on iOS devices

How to generate an electronic signature for the 22 Nebraska Change Request Nebraska Department Of Revenue on Android

People also ask

-

What is the 22 Nebraska Change Request Nebraska Department Of Revenue?

The 22 Nebraska Change Request Nebraska Department Of Revenue is a specific form used to request changes to tax information in Nebraska. It allows businesses and individuals to update their tax records efficiently, ensuring compliance with state regulations.

-

How does airSlate SignNow facilitate the 22 Nebraska Change Request Nebraska Department Of Revenue?

airSlate SignNow streamlines the process of completing and submitting the 22 Nebraska Change Request Nebraska Department Of Revenue. Our platform allows users to eSign documents quickly and securely, reducing processing time signNowly.

-

Is airSlate SignNow a cost-effective solution for managing the 22 Nebraska Change Request Nebraska Department Of Revenue?

Yes, airSlate SignNow offers a cost-effective solution for handling the 22 Nebraska Change Request Nebraska Department Of Revenue. Our pricing plans are designed to accommodate businesses of all sizes, helping to reduce costs associated with document processing and storage.

-

What are the key features of airSlate SignNow related to the 22 Nebraska Change Request Nebraska Department Of Revenue?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking. These tools make completing the 22 Nebraska Change Request Nebraska Department Of Revenue more efficient and user-friendly.

-

Can I integrate airSlate SignNow with other applications for the 22 Nebraska Change Request Nebraska Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with various applications, allowing for seamless management of the 22 Nebraska Change Request Nebraska Department Of Revenue. This ensures that users can work within their existing workflows without interruption.

-

How does airSlate SignNow ensure the security of the 22 Nebraska Change Request Nebraska Department Of Revenue documents?

airSlate SignNow prioritizes security with robust encryption and compliance with industry standards. This guarantees that all documents related to the 22 Nebraska Change Request Nebraska Department Of Revenue are protected and confidential.

-

What benefits does airSlate SignNow offer for the 22 Nebraska Change Request Nebraska Department Of Revenue?

Using airSlate SignNow for the 22 Nebraska Change Request Nebraska Department Of Revenue boosts efficiency, reduces paperwork, and enhances collaboration. It helps users submit requests faster while ensuring they stay compliant with regulations.

Get more for 22 Nebraska Change Request Nebraska Department Of Revenue

Find out other 22 Nebraska Change Request Nebraska Department Of Revenue

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now