Nebraska Change Request Form 22 Use Form 22A for Individual Income Tax Nameaddress Changes 2013

What is the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

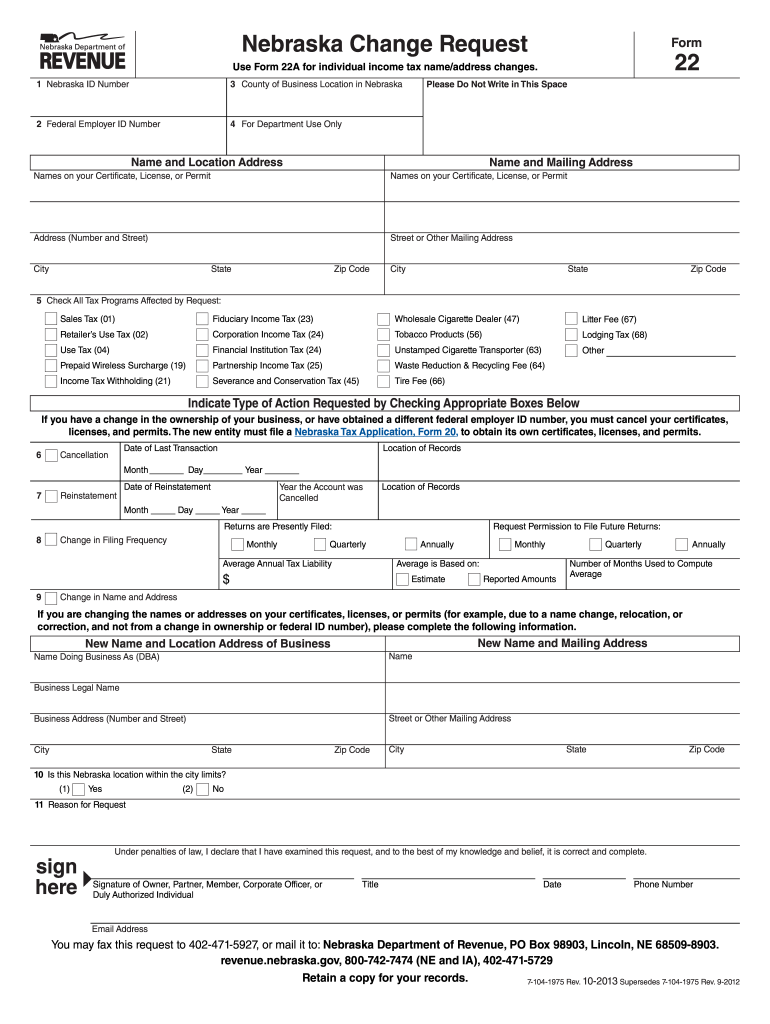

The Nebraska Change Request Form 22, commonly referred to as Form 22A, is a specific document designed for individuals who need to update their name or address in relation to their income tax records. This form is essential for ensuring that the Nebraska Department of Revenue has accurate and current information, which is crucial for tax processing and correspondence. By submitting this form, taxpayers can facilitate the proper handling of their tax returns and avoid potential issues with their tax filings.

Steps to Complete the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

Completing the Nebraska Change Request Form 22 involves several straightforward steps:

- Obtain the form from the Nebraska Department of Revenue website or through authorized channels.

- Fill in your personal information, including your current name, new name (if applicable), and address details.

- Provide your Social Security number and any other required identification information.

- Sign and date the form to validate your request.

- Submit the completed form electronically or via mail, depending on your preference.

Legal Use of the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

The Nebraska Change Request Form 22 is legally recognized as a valid method for individuals to update their personal information with the state’s tax authority. It complies with state regulations and is accepted for official use in tax matters. Ensuring that this form is filled out correctly and submitted in a timely manner helps maintain compliance with Nebraska tax laws and prevents potential penalties associated with inaccurate information.

Required Documents for the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

When submitting the Nebraska Change Request Form 22, it is important to have the following documents ready:

- A valid form of identification, such as a driver's license or state ID.

- Any legal documents that support a name change, if applicable (e.g., marriage certificate, divorce decree).

- Your Social Security number for verification purposes.

Form Submission Methods for the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

Taxpayers have multiple options for submitting the Nebraska Change Request Form 22. These include:

- Online submission through the Nebraska Department of Revenue's secure portal.

- Mailing the completed form to the appropriate address provided on the form.

- In-person submission at local tax offices, if preferred.

Filing Deadlines for the Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

It is essential to be aware of the filing deadlines associated with the Nebraska Change Request Form 22. Generally, updates should be made as soon as a change occurs to ensure that tax records are current. For specific deadlines related to tax filings and updates, taxpayers should refer to the Nebraska Department of Revenue's official guidelines or consult with a tax professional.

Quick guide on how to complete nebraska change request form 22 use form 22a for individual income tax nameaddress changes

Your assistance manual on how to prepare your Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

If you’re curious about how to finalize and transmit your Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes, here are some straightforward guidelines on how to simplify the tax filing process.

To begin, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, generate, and complete your income tax forms with ease. With its editor, you can toggle between text, checkboxes, and electronic signatures and revert to amend responses when necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes in just a few minutes:

- Create your account and start handling PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Click Get form to access your Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-valid eSignature (if required).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that filing on paper can lead to increased errors and delayed refunds. Naturally, prior to e-filing your taxes, verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct nebraska change request form 22 use form 22a for individual income tax nameaddress changes

FAQs

-

How can I sue someone for not filling out a change of address form and using my address as their business address (moved a year ago, CA)?

I do not think you have a lawsuit just because someone did not file a change of address with USPS. As per the previous answer, you would have to had suffered financial loss or injury due to the situation.As information, it is illegal to file a forwarding request on behalf of another person unless you have a power of attorney or are otherwise authorized to do so.To help stop receiving mail for previous residents write “Not at this address” on any first class mail and place it with outgoing mail. and write the names of those who should be receiving mail at your address on the mailbox (you may place it inside the flap where it is only visible to the carrier).Please note that any mail which has “or current resident”, or similar phrasing, will still be delivered to you even though it may also have the previous residents name. If you don’t want it, toss it into recycling.

Create this form in 5 minutes!

How to create an eSignature for the nebraska change request form 22 use form 22a for individual income tax nameaddress changes

How to create an electronic signature for the Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes online

How to create an electronic signature for your Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes in Chrome

How to generate an eSignature for signing the Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes in Gmail

How to make an eSignature for the Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes straight from your smart phone

How to make an electronic signature for the Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes on iOS

How to create an electronic signature for the Nebraska Change Request Form 22 Use Form 22a For Individual Income Tax Nameaddress Changes on Android devices

People also ask

-

What is the Nebraska Change Request Form 22 and how is Form 22A used for individual income tax name and address changes?

The Nebraska Change Request Form 22 is a document used to update personal information on state tax records. Form 22A is specifically designed for individual taxpayers to change their name or address, ensuring that their income tax information is current. By using Form 22A, individuals can avoid complications with their tax filings.

-

How can airSlate SignNow simplify the process of completing the Nebraska Change Request Form 22 use Form 22A?

airSlate SignNow streamlines the completion of the Nebraska Change Request Form 22 by providing an easy-to-use platform for electronic signatures and document management. Users can fill out Form 22A, sign it digitally, and send it directly to the Nebraska Department of Revenue. This simplifies the process and eliminates the need for printing and mailing.

-

Is there a cost associated with using airSlate SignNow to process the Nebraska Change Request Form 22?

Using airSlate SignNow to process the Nebraska Change Request Form 22 incurs a nominal subscription fee. This cost-effective solution allows unlimited eSigning and document management, making it affordable for businesses and individuals alike. The value provided far outweighs the price, especially for frequent tax-related changes.

-

What are the benefits of using airSlate SignNow for the Nebraska Change Request Form 22?

The primary benefits of using airSlate SignNow for the Nebraska Change Request Form 22 include speed, security, and accessibility. The platform allows users to complete and sign Form 22A from anywhere, eliminating delays caused by physical paperwork. Additionally, all documents are securely stored and easily accessible for future reference.

-

Can I integrate airSlate SignNow with other applications for handling the Nebraska Change Request Form 22?

Yes, airSlate SignNow offers various integrations with popular applications that enhance the handling of the Nebraska Change Request Form 22. This includes tools for CRM, document management, and workflow automation, enabling a seamless experience. Integrations ensure that your document processes are unified and more efficient.

-

What features does airSlate SignNow offer for managing the Nebraska Change Request Form 22?

AirSlate SignNow provides features such as template creation, automated workflows, and secure eSigning, all of which facilitate the management of the Nebraska Change Request Form 22. Users can create reusable templates for Form 22A, reducing the time it takes to make updates. These features enhance organization and improve turnaround times.

-

How does airSlate SignNow ensure the security of the Nebraska Change Request Form 22?

AirSlate SignNow employs high-level security measures to protect your data and documents, including encryption and secure access protocols. The Nebraska Change Request Form 22, once completed, is stored securely, ensuring that sensitive tax information is kept safe from unauthorized access. Compliance with industry regulations further enhances data security.

Get more for Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

- Quitclaim deed from husband and wife to llc idaho form

- Warranty deed from husband and wife to llc idaho form

- Idaho judgment form

- Idaho writ execution form

- Writ continuing garnishment 497305488 form

- Application and affidavit for writ of possession idaho form

- Contesting claim form

- Idaho garnishment form

Find out other Nebraska Change Request Form 22 Use Form 22A For Individual Income Tax Nameaddress Changes

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed