IMPORTANT Real File State of New Mexico 2019

What is the New Mexico Todd Formn?

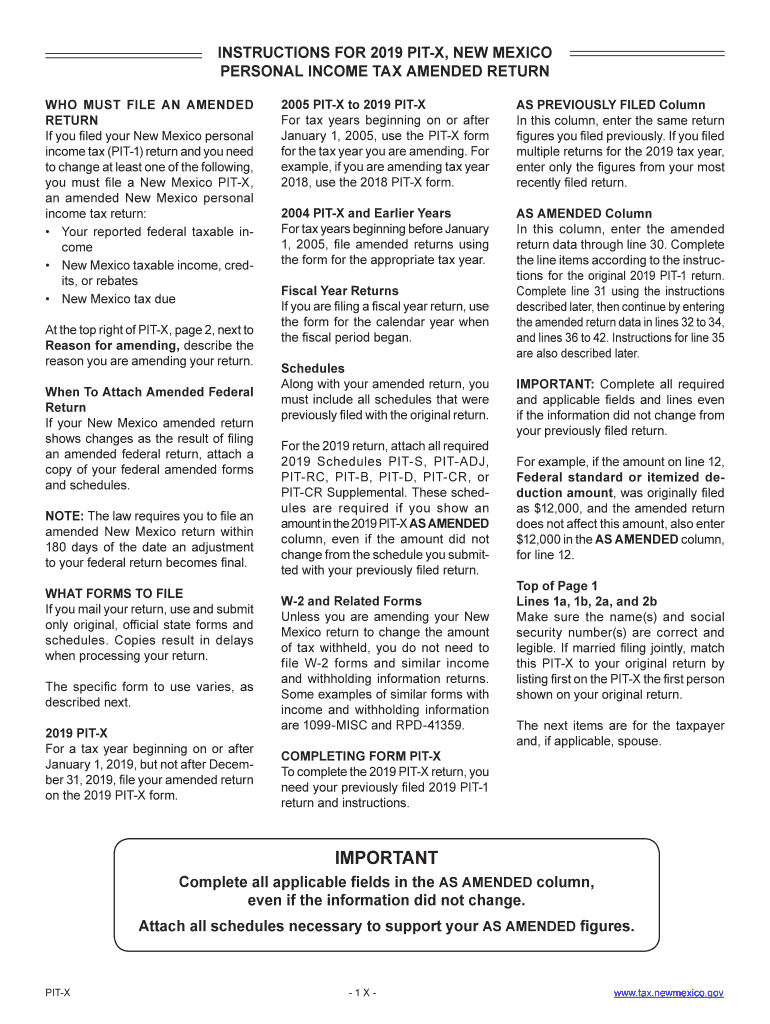

The New Mexico Todd Formn is a state-specific document used primarily for tax purposes. It serves as a formal declaration for individuals or entities to report their income and tax obligations to the state of New Mexico. This form is essential for ensuring compliance with state tax laws and regulations.

Understanding the Todd Formn is crucial for residents and businesses in New Mexico, as it outlines the necessary information required by the state tax authorities. This includes personal identification details, income sources, and applicable deductions or credits. Proper completion of this form can help avoid penalties and ensure accurate tax filings.

How to Obtain the New Mexico Todd Formn

Obtaining the New Mexico Todd Formn is straightforward. Individuals can access the form through the official New Mexico Taxation and Revenue Department website. The form is typically available in a downloadable PDF format, allowing users to print and fill it out manually or complete it electronically.

Additionally, local tax offices may provide physical copies of the Todd Formn. It is advisable to ensure that you are using the most current version of the form to comply with any updated regulations or requirements set by the state.

Steps to Complete the New Mexico Todd Formn

Completing the New Mexico Todd Formn requires careful attention to detail. Here are the steps to ensure accurate submission:

- Gather necessary documents, such as identification, income statements, and any relevant tax records.

- Download or obtain a physical copy of the Todd Formn.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income sources accurately, detailing all earnings for the tax year.

- Include any deductions or credits you may qualify for, as specified in the form instructions.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the New Mexico Todd Formn

The New Mexico Todd Formn is legally binding when completed and submitted in accordance with state regulations. It must be signed and dated by the taxpayer or authorized representative to validate the information provided. Failure to comply with the legal requirements can result in penalties or audits by the New Mexico Taxation and Revenue Department.

It is essential to understand that electronic signatures are accepted under U.S. law, provided they meet specific criteria. Using a secure and compliant eSignature solution can enhance the legitimacy of your submission while ensuring that your data remains protected.

Filing Deadlines for the New Mexico Todd Formn

Filing deadlines for the New Mexico Todd Formn vary depending on the tax year and the type of taxpayer. Generally, individual taxpayers must file their forms by April fifteenth of the following year. However, extensions may be available under certain circumstances, allowing additional time for submission.

It is crucial to stay informed about any changes to filing deadlines, as these can impact your tax obligations. Regularly checking the New Mexico Taxation and Revenue Department’s announcements can help ensure compliance.

Penalties for Non-Compliance with the New Mexico Todd Formn

Failure to file the New Mexico Todd Formn on time or providing inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. The state takes tax compliance seriously, and repeated non-compliance can result in more severe consequences.

To avoid penalties, it is advisable to file your Todd Formn accurately and on time. Utilizing electronic filing options can streamline the process and reduce the risk of errors.

Quick guide on how to complete important real file state of new mexico

Complete IMPORTANT Real File State Of New Mexico effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage IMPORTANT Real File State Of New Mexico on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign IMPORTANT Real File State Of New Mexico with ease

- Access IMPORTANT Real File State Of New Mexico and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign IMPORTANT Real File State Of New Mexico while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct important real file state of new mexico

Create this form in 5 minutes!

How to create an eSignature for the important real file state of new mexico

How to generate an electronic signature for your Important Real File State Of New Mexico online

How to make an electronic signature for your Important Real File State Of New Mexico in Chrome

How to create an electronic signature for signing the Important Real File State Of New Mexico in Gmail

How to generate an electronic signature for the Important Real File State Of New Mexico straight from your mobile device

How to make an electronic signature for the Important Real File State Of New Mexico on iOS devices

How to create an electronic signature for the Important Real File State Of New Mexico on Android

People also ask

-

What is the new mexico todd formn?

The new mexico todd formn is a specific document format essential for legal compliance in New Mexico. It streamlines the electronic signing process, making it easier for businesses and individuals to manage their documentation efficiently. With airSlate SignNow, you can quickly complete and eSign the new mexico todd formn within minutes.

-

How does airSlate SignNow work with the new mexico todd formn?

airSlate SignNow allows users to import, edit, and eSign the new mexico todd formn seamlessly. The platform provides an intuitive interface where users can fill out the necessary information and send the document for signature. This makes it easier to handle paperwork without the hassle of printing and scanning.

-

What are the pricing options for using airSlate SignNow for the new mexico todd formn?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Depending on the level of features you require for managing the new mexico todd formn, you can choose from multiple subscription tiers. Each plan is designed to be cost-effective and provide maximum value for users.

-

What features does airSlate SignNow provide for the new mexico todd formn?

airSlate SignNow offers multiple features specifically designed to optimize the handling of the new mexico todd formn. These include customizable templates, advanced eSigning options, and document tracking capabilities. By using these features, you can ensure proper management of your legal documents.

-

Are there benefits to using airSlate SignNow for the new mexico todd formn?

Yes, using airSlate SignNow for the new mexico todd formn has several benefits. It helps streamline the signing process, reduces turnaround time, and enhances security and compliance. Businesses can also signNowly cut overhead costs by eliminating paper-based methods.

-

Can I integrate airSlate SignNow with other applications for the new mexico todd formn?

Absolutely! airSlate SignNow supports integrations with various popular applications to enhance the management of the new mexico todd formn. This includes CRMs, project management software, and cloud storage solutions, allowing for a more seamless workflow.

-

Is airSlate SignNow secure for handling the new mexico todd formn?

Yes, airSlate SignNow prioritizes security for all documents, including the new mexico todd formn. The platform complies with industry standards and regulations for data protection, ensuring that your documents are encrypted and safe from unauthorized access.

Get more for IMPORTANT Real File State Of New Mexico

Find out other IMPORTANT Real File State Of New Mexico

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself