New Mexico Form PIT X Amended Return 2023

Understanding the New Mexico Form PIT X Amended Return

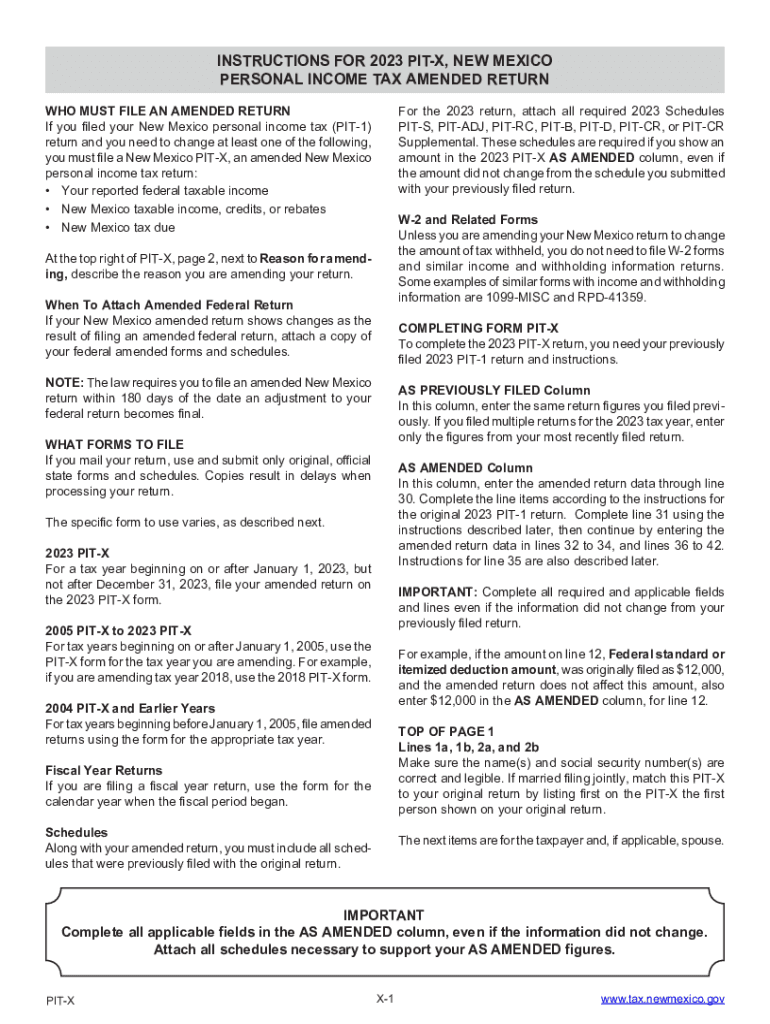

The New Mexico Form PIT X is used by taxpayers to amend their personal income tax returns. This form is essential for correcting any errors or omissions made on the original return, ensuring that the tax information is accurate and compliant with state regulations. The amended return allows individuals to adjust their income, deductions, credits, or filing status, which may result in a change in the tax liability. It is crucial for taxpayers to understand the implications of submitting this form, as it can affect their overall tax obligations.

Steps to Complete the New Mexico Form PIT X Amended Return

Completing the New Mexico Form PIT X involves several key steps. First, gather all relevant documents, including the original return and any supporting documentation for the changes being made. Next, fill out the form accurately, ensuring that all sections are completed. It is important to clearly indicate the changes made and provide explanations where necessary. After completing the form, review it for accuracy before submission. Finally, follow the appropriate submission methods to ensure that the amended return is filed correctly.

Key Elements of the New Mexico Form PIT X Amended Return

The New Mexico Form PIT X includes several critical components that taxpayers must address. These elements typically consist of personal identification information, details of the original return, and specific sections where changes are reported. Taxpayers must provide explanations for each amendment and ensure that all calculations are accurate. Additionally, the form may require the inclusion of any supporting documents that justify the changes made. Understanding these key elements is essential for a successful amendment process.

Legal Use of the New Mexico Form PIT X Amended Return

The legal use of the New Mexico Form PIT X is governed by state tax laws and regulations. Taxpayers are permitted to file an amended return to correct previous errors, but it is important to adhere to the guidelines set forth by the New Mexico Taxation and Revenue Department. Submitting this form within the designated time frame is crucial, as late submissions may result in penalties or interest. Taxpayers should also be aware of their rights and responsibilities when amending their tax returns to ensure compliance with state laws.

Filing Deadlines for the New Mexico Form PIT X Amended Return

Filing deadlines for the New Mexico Form PIT X are critical for taxpayers to observe. Generally, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Missing these deadlines can result in the inability to claim refunds or make necessary corrections. Taxpayers should keep track of these important dates to ensure timely submission and compliance with state tax regulations.

Who Issues the New Mexico Form PIT X Amended Return

The New Mexico Form PIT X is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides necessary forms, instructions, and guidelines for filing, making it a reliable resource for individuals seeking to amend their tax returns. Taxpayers can access the form and related information directly from the department's official resources.

Quick guide on how to complete new mexico form pit x amended return

Complete New Mexico Form PIT X Amended Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage New Mexico Form PIT X Amended Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign New Mexico Form PIT X Amended Return with ease

- Locate New Mexico Form PIT X Amended Return and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign New Mexico Form PIT X Amended Return while ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form pit x amended return

Create this form in 5 minutes!

How to create an eSignature for the new mexico form pit x amended return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nm pit x form?

The nm pit x form is a specialized electronic form designed for collecting information and signatures efficiently. With airSlate SignNow, businesses can create and customize nm pit x forms to streamline their document workflows while ensuring compliance and security.

-

How can I create an nm pit x form using airSlate SignNow?

Creating an nm pit x form with airSlate SignNow is simple. Users can start by selecting the template feature, customizing it based on their needs, and adding necessary fields for signatures and data input. The platform's intuitive interface makes this process quick and straightforward.

-

What are the pricing options for using nm pit x form on airSlate SignNow?

airSlate SignNow offers flexible pricing plans based on the features you need for creating nm pit x forms. There are options for businesses of all sizes, including a free trial for new users to explore the benefits without immediate commitment.

-

What features does the nm pit x form include?

The nm pit x form includes various features such as customizable fields, electronic signature options, and secure cloud storage. Additionally, airSlate SignNow enables automated workflows to enhance efficiency and ensure documents signNow the right stakeholders.

-

What are the benefits of using nm pit x form for my business?

Using the nm pit x form can signNowly improve operational efficiency by reducing paperwork and speeding up the document signing process. It also enhances security and compliance, ensuring that your data is protected while fostering better communication among your team.

-

Can I integrate nm pit x form with other platforms?

Yes, airSlate SignNow allows seamless integration of the nm pit x form with various third-party applications, including CRMs and project management tools. This capability lets businesses create a cohesive workflow across multiple platforms while managing their document processes effectively.

-

Is customer support available for users of nm pit x form?

Absolutely! airSlate SignNow offers robust customer support for users implementing the nm pit x form. You can access resources such as tutorials, FAQs, and direct assistance from the support team to ensure a smooth experience.

Get more for New Mexico Form PIT X Amended Return

Find out other New Mexico Form PIT X Amended Return

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document