How to Amend a New Mexico Tax Return E File 2022

Steps to complete the New Mexico tax PIT-X instructions

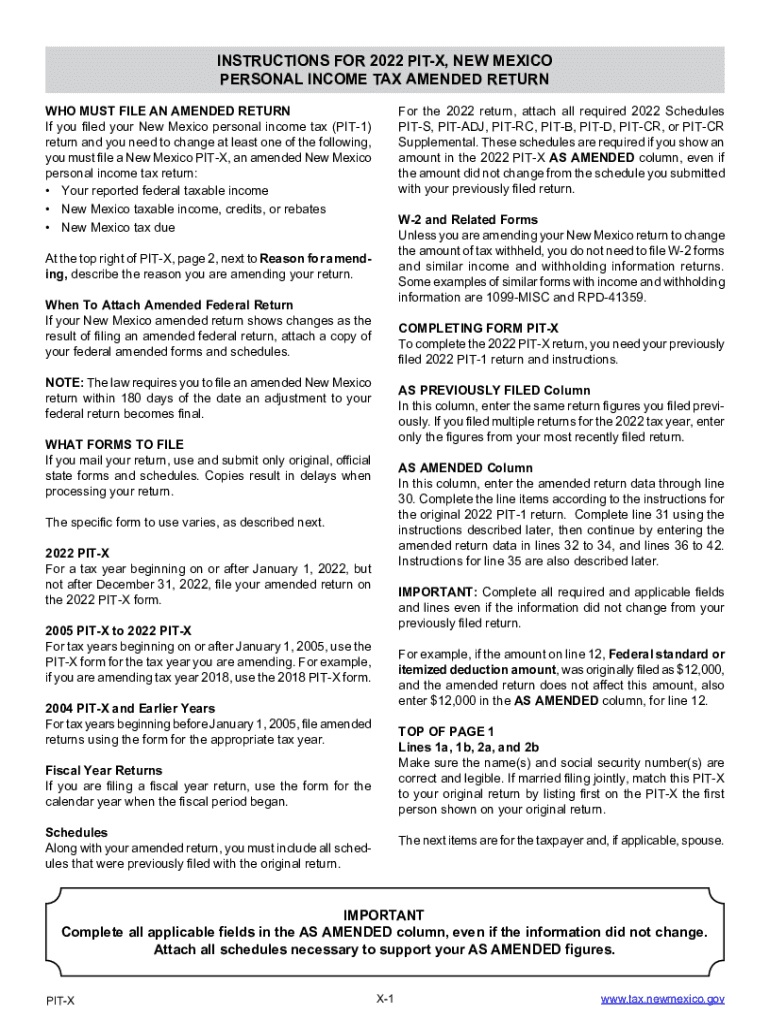

Completing the New Mexico tax PIT-X instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including your original tax return and any supporting documentation that reflects the changes you wish to make. Next, carefully fill out the PIT-X form, ensuring that you provide correct information regarding your income, deductions, and credits. Pay close attention to the sections that require you to explain the reasons for the amendments. After completing the form, review it thoroughly to check for any errors or omissions.

Once you are satisfied with the accuracy of the PIT-X, sign and date the form. If you are filing jointly, both spouses must sign. Finally, submit your amended return either electronically or by mailing it to the appropriate address as indicated in the instructions. Keep a copy of the completed form and any correspondence for your records.

Legal use of the New Mexico tax PIT-X instructions

The legal use of the New Mexico tax PIT-X instructions is essential for ensuring that your amended tax return is valid and accepted by the state tax authorities. The PIT-X form is specifically designed for taxpayers who need to correct errors or make changes to their previously filed returns. To ensure legal compliance, it is important to follow the instructions precisely and provide accurate information.

Additionally, the use of electronic signatures is permitted under U.S. law, provided that the eSignature solution meets the requirements set forth by the ESIGN Act and UETA. This means that using a reliable electronic signature platform can help you securely sign your PIT-X form, making it legally binding. Always confirm that you are using a compliant method for signing and submitting your documents to avoid any potential issues.

Required documents for the New Mexico tax PIT-X instructions

When completing the New Mexico tax PIT-X instructions, you will need to gather several required documents to support your amendments. These documents typically include:

- Your original tax return (the one you are amending)

- Any W-2 forms or 1099 forms that report income

- Documentation for any deductions or credits you are claiming

- Any correspondence from the New Mexico Taxation and Revenue Department

- Proof of payment for any taxes owed or refunds received

Having these documents on hand will help facilitate the completion of the PIT-X form and ensure that all information provided is accurate and verifiable.

Filing deadlines for the New Mexico tax PIT-X instructions

Filing deadlines for the New Mexico tax PIT-X instructions are crucial for taxpayers to keep in mind to avoid penalties. Generally, you must file your amended return within three years from the original due date of the return or within two years from the date you paid the tax, whichever is later. This means that if you filed your original return on April 15, you typically have until April 15 of the third year following that date to submit your PIT-X.

It is important to monitor these deadlines closely, as late submissions may result in the rejection of your amendments or additional penalties. Always check for any updates or changes to filing deadlines from the New Mexico Taxation and Revenue Department.

Form submission methods for the New Mexico tax PIT-X instructions

There are several methods available for submitting your New Mexico tax PIT-X instructions. You can choose to file electronically through the New Mexico Taxation and Revenue Department's online portal, which often provides a quicker processing time. Alternatively, you may choose to print the completed form and mail it to the designated address provided in the instructions.

If you opt to submit your form by mail, ensure that you send it to the correct address and consider using a trackable mailing option for confirmation of delivery. In-person submissions may also be possible at local tax offices, but checking availability and hours beforehand is advisable.

Quick guide on how to complete how to amend a new mexico tax return e file

Effortlessly Prepare How To Amend A New Mexico Tax Return E File on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle How To Amend A New Mexico Tax Return E File on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The Easiest Method to Edit and eSign How To Amend A New Mexico Tax Return E File with Ease

- Find How To Amend A New Mexico Tax Return E File and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant parts of the documents or obscure sensitive information with tools specifically supplied by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, text message, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious browsing for forms, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Edit and eSign How To Amend A New Mexico Tax Return E File and guarantee excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to amend a new mexico tax return e file

Create this form in 5 minutes!

How to create an eSignature for the how to amend a new mexico tax return e file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the new mexico tax pit x instructions?

The new mexico tax pit x instructions provide detailed information on how to accurately file your taxes in New Mexico. These instructions guide you through various forms and requirements specific to the state, ensuring compliance and accuracy in your filing.

-

How can airSlate SignNow help with new mexico tax pit x instructions?

airSlate SignNow simplifies the process of signing and sending documents related to new mexico tax pit x instructions. Our platform allows you to easily upload, eSign, and share necessary documents with tax professionals or authorities, all while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for new mexico tax pit x instructions?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs, including a cost-effective solution for handling documents associated with new mexico tax pit x instructions. You can choose a plan based on the number of users and features you require.

-

What features does airSlate SignNow offer for managing new mexico tax pit x instructions?

airSlate SignNow offers features such as eSignature, document tracking, and templates that help you manage all aspects of new mexico tax pit x instructions efficiently. These tools enable seamless document management, ensuring you meet filing deadlines and requirements.

-

Can I integrate airSlate SignNow with other tax software for new mexico tax pit x instructions?

Absolutely! airSlate SignNow integrates with various tax software solutions that can assist you in completing your new mexico tax pit x instructions. This integration streamlines your workflow and enhances productivity by connecting your eSigning process with your tax preparation tools.

-

What benefits does eSigning provide for new mexico tax pit x instructions?

eSigning with airSlate SignNow enhances the process of completing new mexico tax pit x instructions by eliminating the need for paper documents. It improves efficiency, reduces turnaround times, and allows for easier collaboration with tax professionals, ensuring a seamless experience.

-

How secure is airSlate SignNow when handling new mexico tax pit x instructions?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption and security measures to protect your documents related to new mexico tax pit x instructions, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for How To Amend A New Mexico Tax Return E File

- Notice of commencement compensation payments for workers compensation missouri form

- Residential real estate sales disclosure statement missouri form

- Notice of dishonored check civil keywords bad check bounced check missouri form

- Stopped payment 497313240 form

- Mo medical records form

- Mutual wills containing last will and testaments for unmarried persons living together with no children missouri form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children missouri form

- Mutual wills or last will and testaments for unmarried persons living together with minor children missouri form

Find out other How To Amend A New Mexico Tax Return E File

- Sign Virginia Claim Myself

- Sign New York Permission Slip Free

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement