Form 1041 ES Estimated Income Tax for Estates and Trusts 2024-2026

What is the Form 1041 ES Estimated Income Tax For Estates And Trusts

The Form 1041 ES is used for estimated income tax payments for estates and trusts. This form is essential for fiduciaries who manage estates or trusts that are expected to owe tax. It allows them to make quarterly estimated tax payments to the IRS, ensuring compliance with federal tax obligations. The form is specifically designed to calculate the estimated tax liability based on the income generated by the estate or trust, which may include dividends, interest, and rental income.

How to use the Form 1041 ES Estimated Income Tax For Estates And Trusts

Using the Form 1041 ES involves several steps. First, determine the estate or trust's expected income for the year. This estimation should include all sources of income that the estate or trust will generate. Next, use the IRS guidelines to calculate the estimated tax liability based on the projected income. The form consists of payment vouchers that must be submitted along with the estimated tax payments. It is important to keep accurate records of all payments made and any correspondence with the IRS regarding the estate or trust.

Steps to complete the Form 1041 ES Estimated Income Tax For Estates And Trusts

Completing the Form 1041 ES requires careful attention to detail. Start by gathering all necessary financial information related to the estate or trust. Follow these steps:

- Estimate the total income for the year.

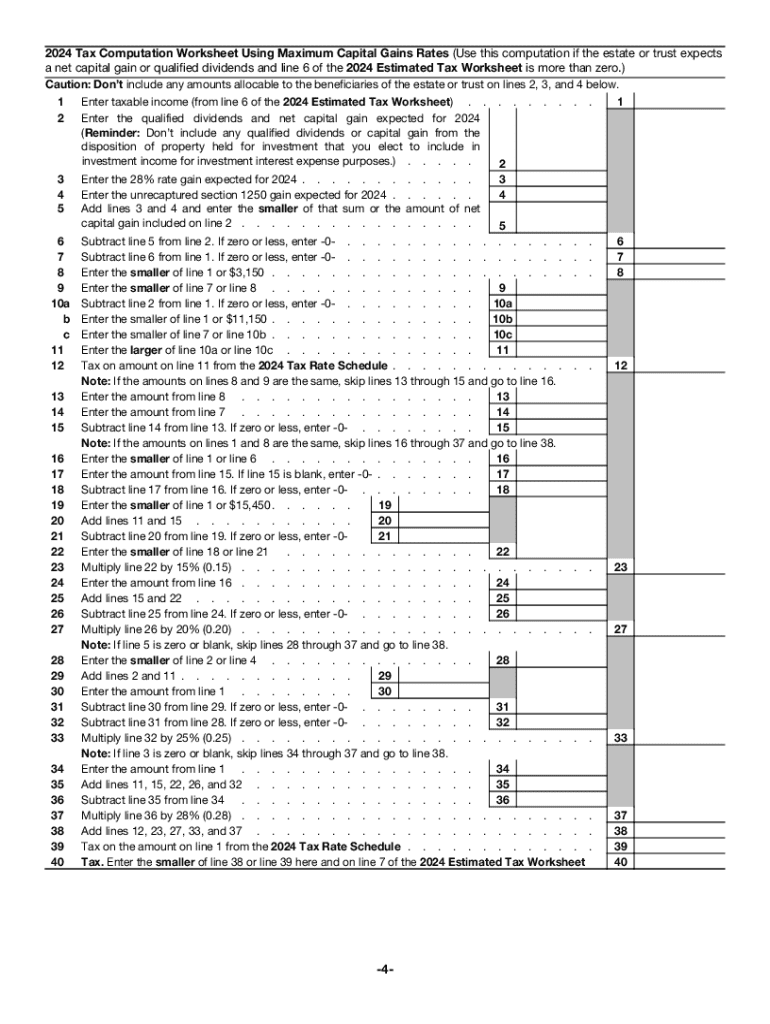

- Calculate the estimated tax based on the income using the appropriate tax rates.

- Fill out the payment vouchers included in the form.

- Submit the vouchers along with the estimated payments by the due dates.

Ensure that all calculations are accurate to avoid penalties for underpayment.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 ES are crucial for compliance. Generally, the estimated tax payments are due quarterly, with specific due dates falling on the fifteenth day of April, June, September, and January of the following year. It is essential to adhere to these deadlines to avoid interest and penalties. Fiduciaries should also be aware of any changes in tax law that may affect these dates.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Form 1041 ES. These guidelines outline eligibility criteria, calculation methods for estimated taxes, and the procedures for submitting payments. It is important to review these guidelines to ensure that all requirements are met and to understand any updates that may impact the filing process. The IRS website is a reliable source for the most current information.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1041 ES can result in significant penalties. The IRS may impose fines for late payments, underpayment of estimated taxes, or failure to file the form altogether. It is crucial for fiduciaries to understand these penalties and take proactive measures to ensure timely and accurate submissions to avoid financial repercussions.

Quick guide on how to complete form 1041 es estimated income tax for estates and trusts

Complete Form 1041 ES Estimated Income Tax For Estates And Trusts effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Form 1041 ES Estimated Income Tax For Estates And Trusts on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Form 1041 ES Estimated Income Tax For Estates And Trusts with ease

- Locate Form 1041 ES Estimated Income Tax For Estates And Trusts and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your edits.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1041 ES Estimated Income Tax For Estates And Trusts to maintain excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 es estimated income tax for estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 es estimated income tax for estates and trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1041es 2024 form used for?

The 1041es 2024 form is utilized by estates and trusts to make estimated tax payments. Understanding this form is essential for meeting tax obligations accurately and on time. With airSlate SignNow, you can digitally sign and manage documents related to your 1041es 2024 filings effortlessly.

-

How can airSlate SignNow help with filing the 1041es 2024?

airSlate SignNow streamlines the process of completing and submitting the 1041es 2024 form by providing an easy-to-use platform for eSigning documents. You can quickly gather signatures from relevant parties, ensuring compliance and simplifying your filing process. This efficiency helps you focus on managing the financial aspects of estates and trusts.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to various business needs, including basic, business, and enterprise tiers. Each plan provides essential features for managing documents like the 1041es 2024 efficiently. By assessing your needs, you can select a pricing option that suits the volume of documents you handle.

-

What features does airSlate SignNow offer for the 1041es 2024 form?

With airSlate SignNow, you can leverage features such as templates for the 1041es 2024, automated reminders, and secure document storage. These tools help ensure that your filing process is efficient, organized, and compliant with tax regulations. Additionally, the platform provides user-friendly navigation, making it simple to manage your documents.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow offers integrations with popular applications and services, enhancing its functionality for handling documents like the 1041es 2024. By connecting with tools such as CRMs and project management apps, you can streamline workflows and improve collaboration. This interconnectedness makes document management even more effective.

-

What are the benefits of using airSlate SignNow for eSigning the 1041es 2024?

Using airSlate SignNow for eSigning the 1041es 2024 provides numerous benefits, including increased efficiency and reduced turnaround times. With a digital signature, you can easily send documents for signature, track progress, and receive notifications once signed. This not only speeds up the process but also enhances security and reduces the need for paper-based processes.

-

Is airSlate SignNow secure for handling sensitive tax documents like the 1041es 2024?

Absolutely, airSlate SignNow prioritizes the security of sensitive documents, including the 1041es 2024 form. The platform employs industry-standard encryption and security protocols to protect your data throughout the signing process. You can confidently manage your tax documents knowing that airSlate SignNow is committed to safeguarding your information.

Get more for Form 1041 ES Estimated Income Tax For Estates And Trusts

- 120 marine form

- Sworn and subscribed before me form

- Certification of accuracy for lead based paint disclosure form

- South carolina landlord tenant form

- Municipal court sc judicial department form

- Other papers as required by law form

- Buy introducing feminism austin nutritional research form

- Sc judicial department south carolina courts form

Find out other Form 1041 ES Estimated Income Tax For Estates And Trusts

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template