Form 1041 ES Estimated Income Tax for Estates and Trusts 2020

What is the Form 1041 ES Estimated Income Tax For Estates And Trusts

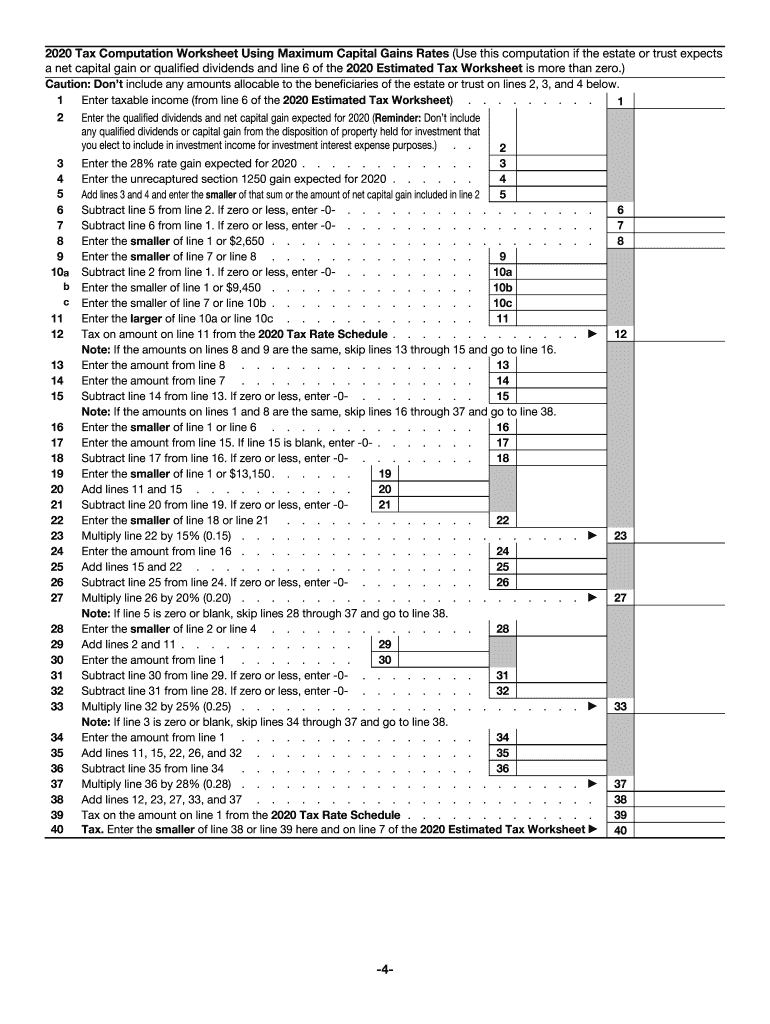

The Form 1041 ES is a crucial document for estates and trusts that need to estimate their income tax liabilities. This form is specifically designed for fiduciaries who must pay estimated taxes on income generated by the estate or trust. It allows the fiduciary to calculate and submit estimated tax payments to the IRS, ensuring compliance with federal tax obligations. Understanding this form is essential for proper estate management and tax planning.

How to use the Form 1041 ES Estimated Income Tax For Estates And Trusts

Using the Form 1041 ES involves several steps to ensure accurate tax estimation. First, the fiduciary must gather financial information regarding the estate or trust's income sources, such as dividends, interest, and rental income. Next, they should calculate the estimated income for the year and determine the applicable tax rate. The estimated tax payments can then be submitted quarterly, aligning with IRS deadlines. This proactive approach helps avoid penalties for underpayment and ensures that the estate or trust remains compliant with tax regulations.

Steps to complete the Form 1041 ES Estimated Income Tax For Estates And Trusts

Completing the Form 1041 ES requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to the estate or trust.

- Calculate the total estimated income for the year.

- Determine the applicable tax rate based on the estimated income.

- Fill out the Form 1041 ES with the calculated figures.

- Submit the form along with the estimated tax payments by the due dates.

By following these steps, fiduciaries can ensure that they meet their tax obligations effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 ES are critical for compliance. Generally, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. It is essential to mark these dates on the calendar to avoid late payment penalties. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these important dates helps fiduciaries manage their tax responsibilities efficiently.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 1041 ES can result in significant penalties. The IRS may impose fines for late payments, underpayment, or failure to file the form altogether. These penalties can accumulate quickly, leading to increased financial burdens for the estate or trust. Understanding these potential consequences emphasizes the importance of timely and accurate filing, helping fiduciaries avoid unnecessary costs.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1041 ES. These guidelines outline the necessary information, calculations, and submission methods. Adhering to these guidelines ensures that fiduciaries fulfill their tax obligations correctly. It is advisable to review the latest IRS publications and resources related to the Form 1041 ES to stay informed about any updates or changes to the filing process.

Quick guide on how to complete 2020 form 1041 es estimated income tax for estates and trusts

Prepare Form 1041 ES Estimated Income Tax For Estates And Trusts effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Form 1041 ES Estimated Income Tax For Estates And Trusts on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Form 1041 ES Estimated Income Tax For Estates And Trusts with ease

- Find Form 1041 ES Estimated Income Tax For Estates And Trusts and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1041 ES Estimated Income Tax For Estates And Trusts and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 1041 es estimated income tax for estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1041 es estimated income tax for estates and trusts

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

How does airSlate SignNow help in managing documents related to my 2018 estimated income?

airSlate SignNow simplifies the process of sending and eSigning documents that pertain to your 2018 estimated income. With our platform, you can electronically sign tax documents, invoices, and other related paperwork securely and efficiently, ensuring you stay organized and compliant with your financial records.

-

What features does airSlate SignNow offer to track my financial documents for 2018 estimated income?

Our platform offers robust tracking features including real-time notifications and document history, allowing you to monitor all transactions related to your 2018 estimated income. This transparency ensures you're always informed about your document status, reducing the likelihood of miscommunication.

-

Can I integrate airSlate SignNow with accounting software to manage my 2018 estimated income?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enhancing your ability to manage your 2018 estimated income efficiently. This integration allows for easy document transfers between platforms, streamlining your workflow and financial management.

-

What is the pricing structure of airSlate SignNow, especially for handling 2018 estimated income documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs while focusing on document management related to your 2018 estimated income. Our plans are designed to provide cost-effective solutions, ensuring you only pay for the features you actually use.

-

How secure is airSlate SignNow for managing sensitive documents tied to my 2018 estimated income?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption protocols to protect your sensitive documents related to your 2018 estimated income, ensuring they remain confidential and secure throughout the signing process.

-

Can I access airSlate SignNow from mobile devices for managing my 2018 estimated income?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to manage and sign documents related to your 2018 estimated income on the go. Whether you’re in the office or working remotely, our mobile app ensures you can stay productive anytime, anywhere.

-

What benefits can I expect from using airSlate SignNow for my 2018 estimated income documentation?

Using airSlate SignNow provides numerous benefits for managing your 2018 estimated income documentation, such as increased efficiency, reduced paperwork, and improved accuracy. Our user-friendly interface ensures a hassle-free experience, enabling you to focus on your business rather than paper shuffling.

Get more for Form 1041 ES Estimated Income Tax For Estates And Trusts

Find out other Form 1041 ES Estimated Income Tax For Estates And Trusts

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free