Form 1041 ES Estimated Income Tax for Estates and Trusts 2022

What is the Form 1041 ES Estimated Income Tax For Estates And Trusts

The Form 1041 ES is used to report estimated income tax for estates and trusts. This form is essential for fiduciaries managing estates or trusts that expect to owe tax on income generated during the tax year. The estimated income tax allows these entities to prepay their tax obligations in quarterly installments, helping to avoid penalties for underpayment. Understanding the purpose of this form is crucial for effective tax planning and compliance.

How to use the Form 1041 ES Estimated Income Tax For Estates And Trusts

Using the Form 1041 ES involves several steps. First, determine the expected income for the estate or trust for the year. This includes all sources of income, such as interest, dividends, and rental income. Next, calculate the estimated tax liability based on the anticipated income. The form provides a worksheet to assist in this calculation. Once the estimated tax is determined, complete the form and submit it according to the specified deadlines. It is important to keep accurate records of payments made and any correspondence with the IRS.

Steps to complete the Form 1041 ES Estimated Income Tax For Estates And Trusts

Completing the Form 1041 ES requires careful attention to detail. Follow these steps:

- Gather financial information for the estate or trust, including income sources and expenses.

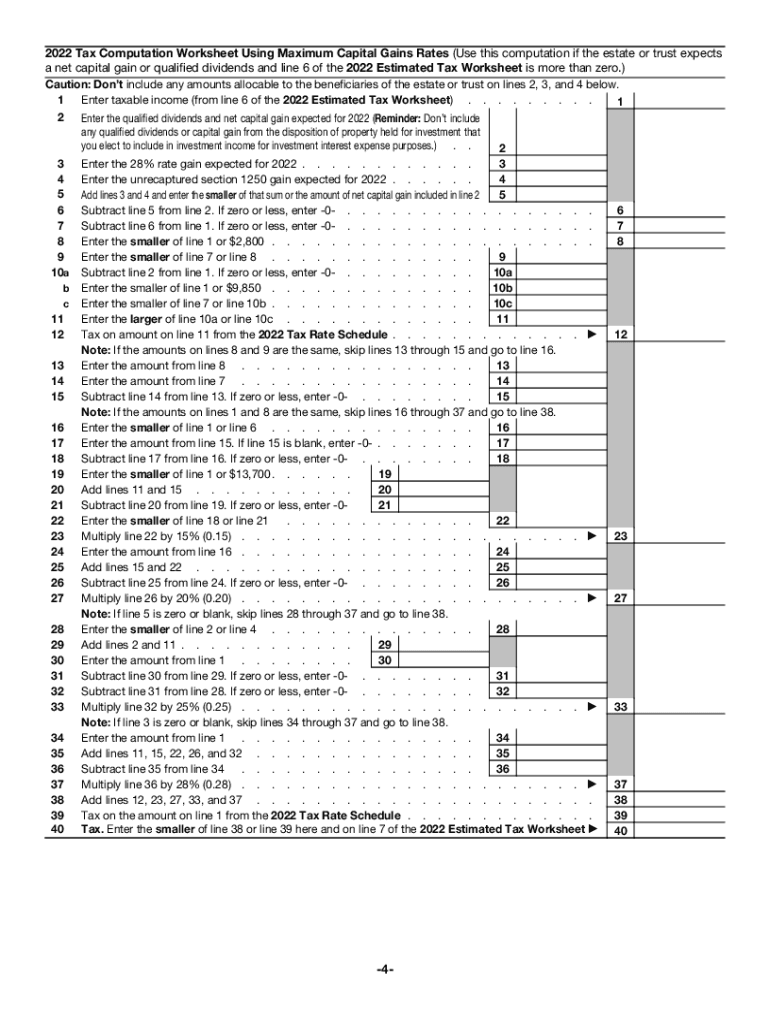

- Use the worksheet provided with the form to estimate the total income and calculate the tax liability.

- Fill out the form with the necessary details, including the fiduciary's name, address, and tax identification number.

- Calculate the estimated tax payments due for each quarter.

- Submit the completed form and payments by the deadlines to avoid penalties.

Legal use of the Form 1041 ES Estimated Income Tax For Estates And Trusts

The legal use of the Form 1041 ES is governed by IRS regulations. It is crucial for fiduciaries to ensure compliance with tax laws to avoid penalties. The form must be filed accurately and on time to maintain its legal validity. Additionally, the payments made through this form contribute to the overall tax obligations of the estate or trust, ensuring that they meet their tax responsibilities under U.S. law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 ES are critical for compliance. Estimated tax payments are typically due on the 15th day of April, June, September, and January of the following year. It is important to mark these dates on your calendar to ensure timely submission and avoid interest or penalties. If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1041 ES. These guidelines include instructions on how to estimate income, calculate taxes, and report payments. It is advisable to consult the IRS website or the instructions accompanying the form for the most current information. Adhering to these guidelines helps ensure that the form is filled out correctly and submitted in compliance with federal tax laws.

Quick guide on how to complete 2022 form 1041 es estimated income tax for estates and trusts

Effortlessly Prepare Form 1041 ES Estimated Income Tax For Estates And Trusts on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without complications. Manage Form 1041 ES Estimated Income Tax For Estates And Trusts on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Form 1041 ES Estimated Income Tax For Estates And Trusts with ease

- Locate Form 1041 ES Estimated Income Tax For Estates And Trusts and click on Get Form to begin.

- Utilize the tools provided to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing additional copies. airSlate SignNow manages your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 1041 ES Estimated Income Tax For Estates And Trusts and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 1041 es estimated income tax for estates and trusts

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing structure for signing documents related to 2018 estimated income?

airSlate SignNow offers flexible pricing plans to suit your needs, especially if you're handling documents related to your 2018 estimated income. Our plans are designed to be cost-effective, allowing businesses of all sizes to send and eSign documents efficiently. You can review our pricing page for detailed information on each plan.

-

How can airSlate SignNow help with tracking 2018 estimated income documentation?

With airSlate SignNow, you can easily track all documentation related to your 2018 estimated income. The platform provides a user-friendly dashboard showing the status of sent documents. This allows you to ensure that all necessary paperwork is completed and in compliance with your financial reporting.

-

What features make airSlate SignNow suitable for managing 2018 estimated income?

airSlate SignNow offers a range of features that are ideal for managing documents related to your 2018 estimated income. Some key features include easy eSigning, document sharing, and real-time collaboration. These tools streamline your document management process and enhance productivity.

-

Can I integrate airSlate SignNow with my accounting software for 2018 estimated income?

Yes, airSlate SignNow easily integrates with popular accounting software, making it convenient to manage your 2018 estimated income processes. This integration enables seamless transfer of data and documents, ensuring that your financial records remain accurate and up-to-date. Check our integration directory for specifics on compatible applications.

-

Is airSlate SignNow safe for sending documents regarding 2018 estimated income?

Absolutely! airSlate SignNow prioritizes the security of your documents, including those related to your 2018 estimated income. Our platform uses encryption and complies with industry standards to protect sensitive information. You can confidently send and eSign documents knowing your data is safe.

-

What benefits can businesses expect from using airSlate SignNow for 2018 estimated income documentation?

By using airSlate SignNow for your 2018 estimated income documentation, businesses can expect increased efficiency and reduced turnaround times. The platform's streamlined eSigning process helps eliminate delays associated with paper documents. Additionally, automating your workflows can save time and reduce manual errors.

-

How does airSlate SignNow support remote teams handling 2018 estimated income?

airSlate SignNow is designed to support remote teams managing documents related to 2018 estimated income efficiently. The platform allows team members to collaborate in real-time, regardless of their location. This ensures that document approval processes can continue uninterrupted, no matter where your team works.

Get more for Form 1041 ES Estimated Income Tax For Estates And Trusts

Find out other Form 1041 ES Estimated Income Tax For Estates And Trusts

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast