Schedule B Interest, Dividends and Certain Capital Gains and 2023

Understanding Schedule B for Interest, Dividends, and Certain Capital Gains

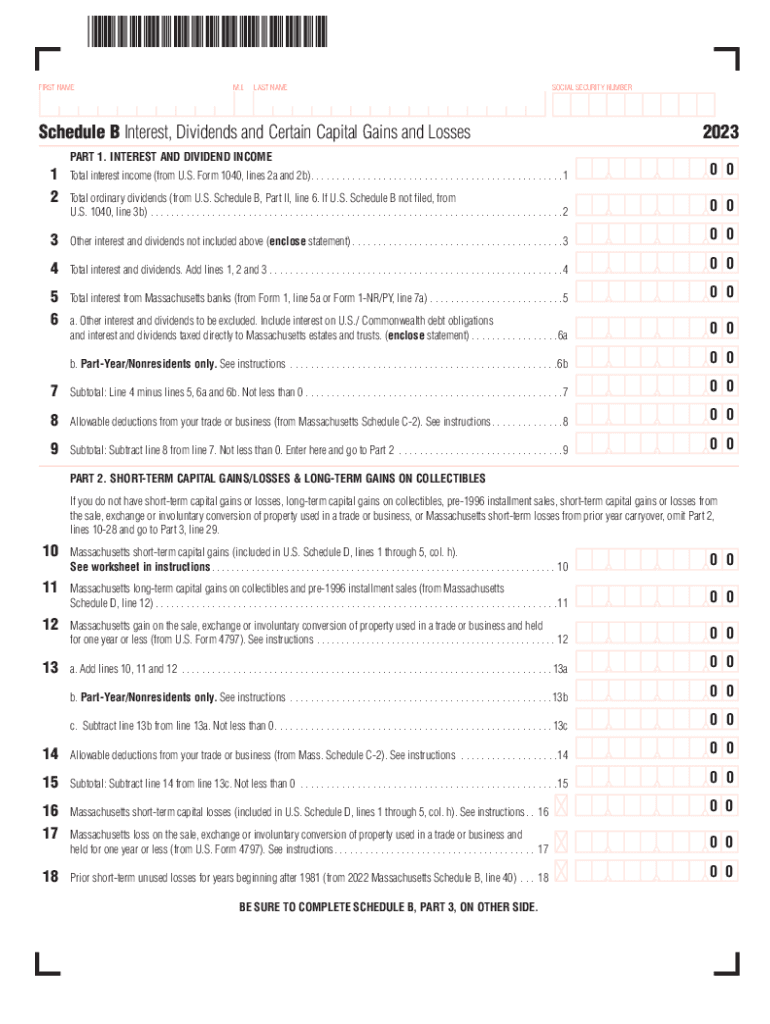

Schedule B is a crucial form for taxpayers in Massachusetts who need to report interest and dividends received, as well as certain capital gains. This form is typically used in conjunction with Massachusetts Form 2, which is the primary income tax return for individuals. The information reported on Schedule B helps the Massachusetts Department of Revenue (DOR) assess an individual's taxable income accurately. Taxpayers must disclose all sources of interest and dividends, ensuring compliance with state tax regulations.

Steps to Complete the Massachusetts Schedule B

Completing the Massachusetts Schedule B involves several important steps:

- Gather all relevant financial documents, including bank statements and investment records, to identify interest and dividends received.

- Fill out the personal information section at the top of the form, including your name, address, and Social Security number.

- Report each source of interest and dividends in the appropriate sections, ensuring that you include the correct amounts as per your financial records.

- Calculate the total interest and dividends, and transfer these totals to the appropriate line on your Massachusetts Form 2.

- Review the completed Schedule B for accuracy before submission.

Key Elements of Massachusetts Schedule B

Several key elements are essential when filling out Schedule B:

- Interest Income: This includes interest earned from savings accounts, bonds, and other investments.

- Dividend Income: Report dividends received from stocks and mutual funds.

- Capital Gains: Certain capital gains must be reported if they are derived from the sale of assets.

- Exemptions: Some interest and dividends may be exempt from taxation, which should be noted on the form.

Filing Deadlines for Schedule B

It is important to adhere to filing deadlines to avoid penalties. For most taxpayers, the deadline for submitting Massachusetts Form 2, along with Schedule B, is typically April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that all forms are submitted on time to remain compliant with state tax laws.

Required Documents for Schedule B Submission

To complete Schedule B accurately, taxpayers should have the following documents ready:

- Bank statements showing interest earned.

- Brokerage statements detailing dividends and capital gains.

- Any relevant tax forms received from financial institutions, such as 1099-INT or 1099-DIV.

Legal Use of Schedule B in Massachusetts

Using Schedule B is a legal requirement for Massachusetts residents who earn interest or dividends. Failing to report this income can lead to penalties and interest charges from the Massachusetts DOR. It is essential for taxpayers to understand their obligations and ensure that all income is reported accurately to maintain compliance with state tax laws.

Quick guide on how to complete schedule b interest dividends and certain capital gains and

Complete Schedule B Interest, Dividends And Certain Capital Gains And effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule B Interest, Dividends And Certain Capital Gains And on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-centric task today.

How to edit and eSign Schedule B Interest, Dividends And Certain Capital Gains And seamlessly

- Locate Schedule B Interest, Dividends And Certain Capital Gains And and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and select the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign Schedule B Interest, Dividends And Certain Capital Gains And and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b interest dividends and certain capital gains and

Create this form in 5 minutes!

How to create an eSignature for the schedule b interest dividends and certain capital gains and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the massachusetts schedule b and how does it relate to eSigning documents?

The massachusetts schedule b is a tax form used in Massachusetts that provides detailed information about a taxpayer’s income. When using airSlate SignNow, you can easily eSign documents such as the massachusetts schedule b, ensuring compliance and quick submission while maintaining legal validity.

-

How can airSlate SignNow help with filling out the massachusetts schedule b?

airSlate SignNow offers user-friendly features that allow you to digitally fill out and eSign the massachusetts schedule b. With customizable templates and the ability to save forms, it simplifies the process while ensuring accuracy and compliance with requirements.

-

Is airSlate SignNow a cost-effective solution for handling the massachusetts schedule b?

Yes, airSlate SignNow provides a cost-effective solution for managing documents like the massachusetts schedule b. Our competitive pricing plans cater to businesses of all sizes, making it easier to handle essential paperwork without breaking the bank.

-

What features does airSlate SignNow offer for managing the massachusetts schedule b?

airSlate SignNow includes features such as document templates, eSigning capabilities, and automated workflow management to streamline the process of handling the massachusetts schedule b. These features enhance productivity and ensure a seamless user experience.

-

Are there integrations available for processing the massachusetts schedule b with airSlate SignNow?

Yes, airSlate SignNow integrates with popular applications that facilitate the processing of the massachusetts schedule b. Our integrations with tools like Google Drive and Dropbox ensure you can easily access and manage your documents in one place.

-

What are the benefits of using airSlate SignNow for the massachusetts schedule b?

Using airSlate SignNow for the massachusetts schedule b streamlines the eSigning process, enhances document security, and provides a convenient way to manage paperwork digitally. This means less time spent on administrative tasks and more time for your core business activities.

-

Is it easy to get started with airSlate SignNow for the massachusetts schedule b?

Absolutely! Getting started with airSlate SignNow for the massachusetts schedule b is quick and easy. Simply sign up, select the appropriate template, and start filling out and eSigning your documents with our intuitive interface.

Get more for Schedule B Interest, Dividends And Certain Capital Gains And

- Under south carolina law an equine activity sponsor or equine professional is not liable form

- Chapter 103 public service commission form

- Grant bargain sell and release unto a limited liability company form

- Presents do remise release and forever quitclaim unto a form

- Grant bargain sell and release unto a corporation organized form

- Fairfax county agenda form

- All improvements located thereon lying in the county of state of south form

- Release unto a corporation organized under the laws of the state form

Find out other Schedule B Interest, Dividends And Certain Capital Gains And

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online