Massachusetts Department of Revenue Schedule B Int 2024-2026

Understanding the Massachusetts Department of Revenue Schedule B

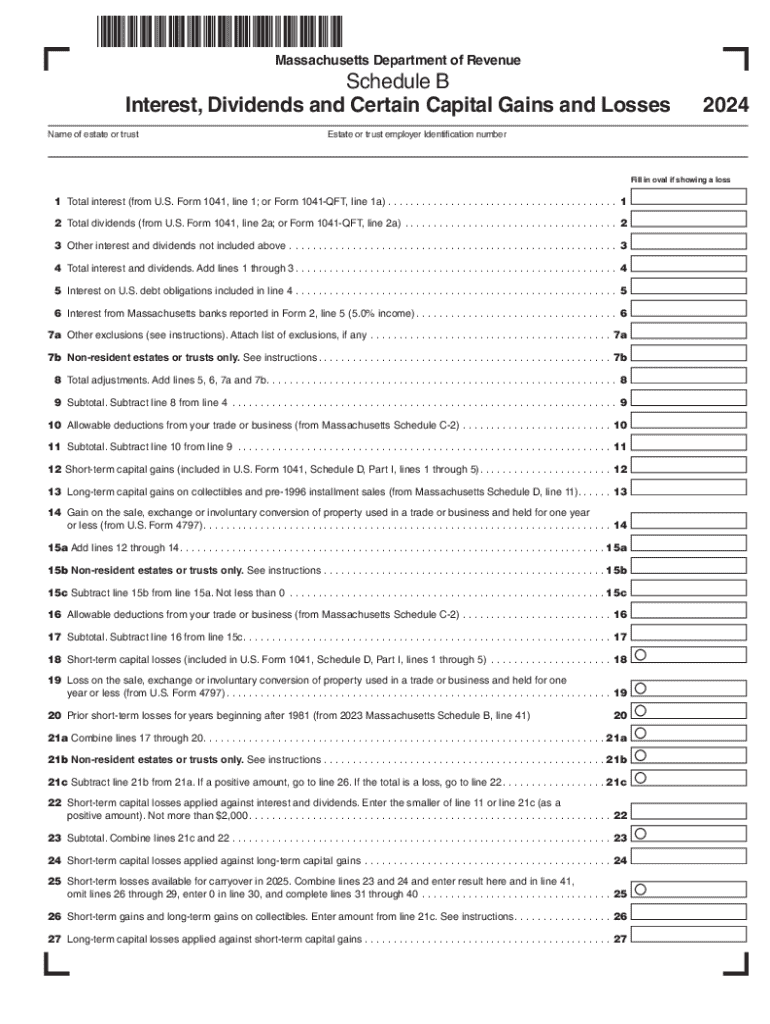

The Massachusetts Department of Revenue Schedule B is a crucial tax form used by individuals and businesses to report various types of income. This form specifically focuses on interest and dividend income, which must be disclosed for accurate tax calculations. It is essential for taxpayers to understand the purpose of this form, as it helps ensure compliance with state tax regulations and contributes to the overall accuracy of tax filings.

Steps to Complete the Massachusetts Department of Revenue Schedule B

Completing the Massachusetts Schedule B involves several key steps:

- Gather necessary documentation, including records of all interest and dividend income received during the tax year.

- Fill out the form accurately, ensuring that all income sources are reported. This includes interest from savings accounts, bonds, and dividends from stocks.

- Double-check all entries for accuracy to minimize errors that could lead to penalties.

- Submit the completed form along with your Massachusetts tax return by the designated deadline.

Legal Use of the Massachusetts Department of Revenue Schedule B

The Schedule B form is legally required for taxpayers who earn interest or dividend income. Failing to report this income can result in penalties and interest on unpaid taxes. It is important for taxpayers to be aware of their legal obligations when completing their tax returns. Proper use of the Schedule B ensures compliance with Massachusetts tax laws and helps avoid any potential legal issues.

Filing Deadlines for the Massachusetts Department of Revenue Schedule B

Taxpayers must adhere to specific filing deadlines for the Massachusetts Schedule B. Generally, the deadline for filing individual income tax returns, including the Schedule B, is April fifteenth. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about these deadlines to ensure timely submissions and avoid penalties.

Required Documents for the Massachusetts Department of Revenue Schedule B

To complete the Schedule B, taxpayers should prepare the following documents:

- Forms 1099-INT and 1099-DIV, which report interest and dividend income, respectively.

- Bank statements or brokerage statements that detail the income earned.

- Any relevant documentation related to tax-exempt interest, if applicable.

Penalties for Non-Compliance with the Massachusetts Department of Revenue Schedule B

Non-compliance with the reporting requirements of the Schedule B can lead to significant penalties. Taxpayers who fail to report income may face fines, interest on unpaid taxes, and potential audits by the Massachusetts Department of Revenue. It is essential for taxpayers to understand the importance of accurate reporting to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue schedule b int

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue schedule b int

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ma dor schedule b feature in airSlate SignNow?

The ma dor schedule b feature in airSlate SignNow allows users to efficiently manage and sign documents related to their business operations. This feature streamlines the process of completing necessary paperwork, ensuring compliance and accuracy. With airSlate SignNow, you can easily access and utilize the ma dor schedule b for your documentation needs.

-

How does airSlate SignNow pricing work for ma dor schedule b users?

airSlate SignNow offers flexible pricing plans tailored for users needing the ma dor schedule b feature. Depending on your business size and requirements, you can choose from various subscription options that provide access to essential tools and functionalities. This ensures that you get the best value while managing your documents efficiently.

-

What are the key benefits of using airSlate SignNow for ma dor schedule b?

Using airSlate SignNow for ma dor schedule b provides numerous benefits, including enhanced efficiency and reduced turnaround times for document signing. The platform's user-friendly interface makes it easy for teams to collaborate and manage their documents seamlessly. Additionally, it ensures that all signed documents are securely stored and easily accessible.

-

Can I integrate airSlate SignNow with other tools for ma dor schedule b?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easy to incorporate the ma dor schedule b feature into your existing workflows. This allows you to connect with tools like CRM systems, project management software, and more. By integrating these tools, you can enhance productivity and streamline your document management processes.

-

Is airSlate SignNow secure for handling ma dor schedule b documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all ma dor schedule b documents are protected with advanced encryption and compliance measures. The platform adheres to industry standards to safeguard your sensitive information. You can confidently manage and sign your documents knowing they are secure.

-

How can I get started with airSlate SignNow for ma dor schedule b?

Getting started with airSlate SignNow for ma dor schedule b is simple. You can sign up for a free trial to explore the features and functionalities available. Once you're ready, choose a pricing plan that suits your needs and start managing your documents efficiently with the ma dor schedule b feature.

-

What types of documents can I manage with ma dor schedule b in airSlate SignNow?

With the ma dor schedule b feature in airSlate SignNow, you can manage a variety of documents, including contracts, agreements, and compliance forms. The platform is designed to handle different document types, making it versatile for various business needs. This flexibility allows you to streamline your documentation process effectively.

Get more for Massachusetts Department Of Revenue Schedule B Int

- Ct 1040nrpy booklet 2016 connecticut nonresident and ctgov form

- Supplemental schedule ct 1040wh connecticut income ctgov form

- 2013 schedule nr nonresident and partyear resident computation of illinois tax nonresident and partyear resident computation of form

- Form it 360 1 new york change of city resident in

- D claration de la retenue d39imp t la administration des form

- Infraction deferral program elkhart county prosecutors office form

- Snap authorized representative form

Find out other Massachusetts Department Of Revenue Schedule B Int

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure