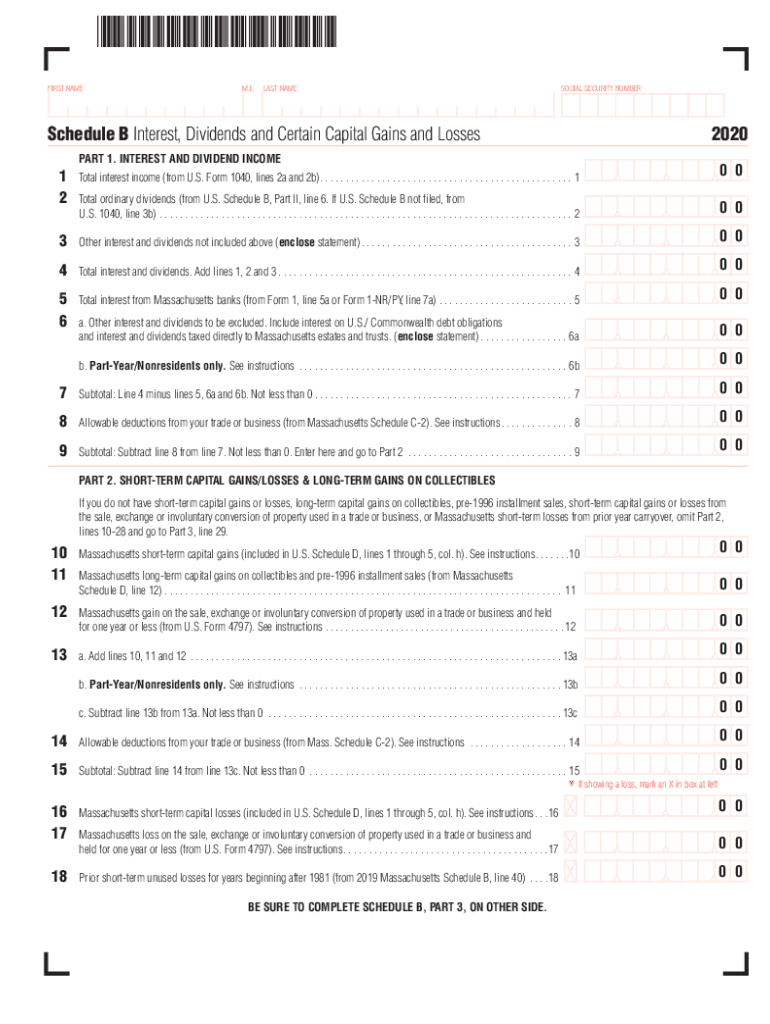

Schedule B Interest, Dividends and Certain Capital Gains and 2020

What is the Schedule B for Interest and Dividends?

The Schedule B is a crucial tax form used to report interest and dividend income, as well as certain capital gains. This form is part of the federal income tax return for individuals and is essential for taxpayers who have received over $1,500 in interest or dividends during the tax year. It helps the IRS track income sources that may not be reported elsewhere on the tax return. Understanding the Schedule B is vital for accurate tax reporting and compliance.

Steps to Complete the Schedule B

Completing the Schedule B involves several key steps:

- Gather Documentation: Collect all relevant documents, such as bank statements and dividend statements, that detail your interest and dividend income.

- Fill in Personal Information: Start by entering your name and Social Security number at the top of the form.

- Report Interest Income: List all sources of interest income in Part I of the form. Include amounts from savings accounts, bonds, and other investments.

- Report Dividend Income: In Part II, provide details about dividends received from stocks and mutual funds. Be sure to include any foreign dividends.

- Verify Totals: Ensure that the total interest and dividends reported match your documentation. This accuracy is crucial for compliance.

- Sign and Date: Finally, sign and date the form before submitting it with your tax return.

Legal Use of the Schedule B

The Schedule B is legally required for taxpayers who meet specific income thresholds. Failing to report interest and dividend income can lead to penalties and interest charges from the IRS. It is essential to ensure that all income is accurately reported to avoid legal complications. Additionally, the Schedule B must be filed alongside your main tax return to maintain compliance with federal tax laws.

Filing Deadlines for the Schedule B

The Schedule B must be filed by the same deadline as your federal income tax return. Typically, this is April 15th for most taxpayers. If you are unable to file by this date, you may request an extension, which usually extends the deadline by six months. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents for the Schedule B

To accurately complete the Schedule B, you will need several documents, including:

- Bank statements showing interest earned.

- Form 1099-INT from banks and financial institutions.

- Form 1099-DIV from corporations for dividends received.

- Statements for any foreign income received.

Having these documents on hand will streamline the process and help ensure that all income is reported correctly.

IRS Guidelines for the Schedule B

The IRS provides specific guidelines on how to complete the Schedule B, including instructions on what constitutes reportable interest and dividend income. It is essential to refer to the latest IRS publications or the official IRS website for updates and detailed instructions. Following these guidelines will help ensure that your tax filing is accurate and compliant with federal regulations.

Quick guide on how to complete schedule b interest dividends and certain capital gains and 547857129

Complete Schedule B Interest, Dividends And Certain Capital Gains And effortlessly on any gadget

Web-based document handling has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and eSign your documents rapidly without holdups. Manage Schedule B Interest, Dividends And Certain Capital Gains And on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Schedule B Interest, Dividends And Certain Capital Gains And with ease

- Obtain Schedule B Interest, Dividends And Certain Capital Gains And and click on Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and possesses the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Schedule B Interest, Dividends And Certain Capital Gains And and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b interest dividends and certain capital gains and 547857129

Create this form in 5 minutes!

How to create an eSignature for the schedule b interest dividends and certain capital gains and 547857129

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What is a ma schedule b?

A ma schedule b is a specific part of your business tax return that details income adjustments. It is crucial for accurately reporting business income, and understanding the ma schedule b can help ensure compliance with tax regulations. Utilizing airSlate SignNow can help streamline the process of signing and submitting these important documents with ease.

-

How does airSlate SignNow simplify handling ma schedule b forms?

airSlate SignNow simplifies the handling of ma schedule b forms by offering an intuitive platform that allows you to create, send, and eSign documents seamlessly. You'll find that our tool reduces the hassle of printing, signing, and scanning, making it easier to manage your tax documents. With a few clicks, you can securely complete your ma schedule b and ensure timely submission.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it a cost-effective solution for handling documents, including the ma schedule b. We understand that businesses come in different sizes, so we provide options that fit your budget while ensuring you get the features you need to manage your forms efficiently.

-

Can I integrate airSlate SignNow with other software for ma schedule b management?

Yes, airSlate SignNow can easily integrate with other software tools you may be using for managing your ma schedule b documents. This flexibility allows for a seamless workflow as you manage other business processes. Check out our integration options to see how we can enhance your document management experience.

-

What security measures does airSlate SignNow provide for confidential documents like ma schedule b?

airSlate SignNow prioritizes the security of your documents, including ma schedule b forms, by implementing advanced encryption and security protocols. Your data is protected at all stages—during storage and transmission—to ensure confidentiality and compliance. Feel confident knowing that your sensitive information is secure with airSlate SignNow.

-

What are the benefits of using airSlate SignNow for eSigning ma schedule b?

Using airSlate SignNow for eSigning your ma schedule b offers numerous benefits, such as increased efficiency and reduced turnaround time. Our easy-to-use interface allows you to quickly sign and send documents from anywhere, eliminating delays associated with traditional methods. Experience the convenience of getting your paperwork done without unnecessary hassles.

-

Does airSlate SignNow provide templates for ma schedule b?

Yes, airSlate SignNow provides customizable templates that can be used for ma schedule b filings. These templates streamline the process of preparing your tax documents, ensuring that you cover all necessary information required for accuracy. With our templates, you can save time and focus on other critical aspects of your business.

Get more for Schedule B Interest, Dividends And Certain Capital Gains And

- Letter from tenant to landlord about insufficient notice of rent increase delaware form

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase during lease delaware form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase delaware form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant delaware form

- De tenant landlord form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services delaware form

- Temporary lease agreement to prospective buyer of residence prior to closing delaware form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497302097 form

Find out other Schedule B Interest, Dividends And Certain Capital Gains And

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement