Schedule B Interest, Dividends and Certain Capital Gains and 2022

What is the Schedule B Interest, Dividends And Certain Capital Gains

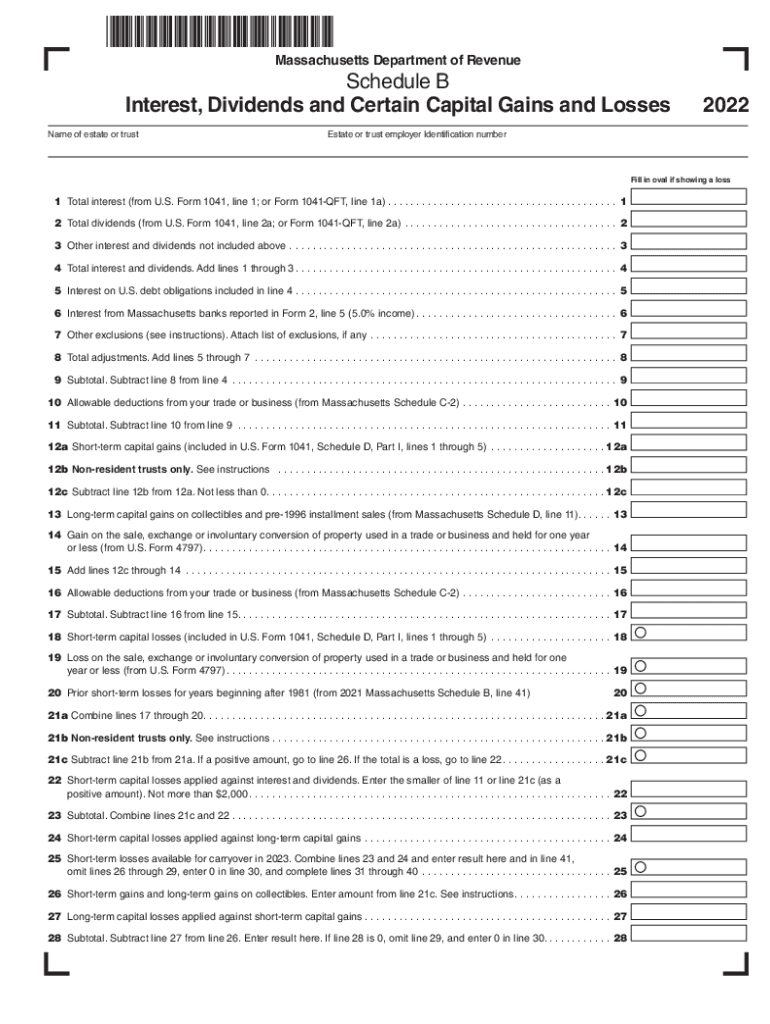

The Massachusetts Schedule B is a tax form used to report interest, dividends, and certain capital gains. This form is essential for individuals who have received income from various sources, including bank accounts, investments, and other financial instruments. By accurately completing the Schedule B, taxpayers ensure compliance with state tax regulations and provide a clear account of their income sources.

This form is particularly relevant for those who earn more than a specified amount from interest and dividends, as it helps determine the appropriate tax liability. Understanding the components of the Schedule B is crucial for accurate tax reporting and financial planning.

How to use the Schedule B Interest, Dividends And Certain Capital Gains

Using the Massachusetts Schedule B involves several steps to ensure accurate reporting of income. First, gather all relevant financial documents, such as bank statements and investment records, that detail interest and dividend earnings. Next, fill out the form by entering the total amounts received from each source in the designated sections.

It is important to categorize the income correctly, distinguishing between interest income, dividend income, and capital gains. After completing the form, review it for accuracy before submitting it with your Massachusetts tax return. This careful approach helps avoid potential errors that could lead to penalties or audits.

Steps to complete the Schedule B Interest, Dividends And Certain Capital Gains

Completing the Massachusetts Schedule B requires a systematic approach. Follow these steps:

- Collect all necessary documents, including 1099 forms, bank statements, and investment reports.

- Identify and total your interest income from savings accounts and bonds.

- Calculate your dividend income from stocks and mutual funds.

- Determine any capital gains from the sale of investments.

- Fill out the Schedule B form, entering the totals in the appropriate fields.

- Double-check your entries for accuracy and completeness.

- Submit the completed Schedule B with your Massachusetts tax return.

Legal use of the Schedule B Interest, Dividends And Certain Capital Gains

The Massachusetts Schedule B must be completed in accordance with state tax laws to ensure its legal validity. This form is recognized by the Massachusetts Department of Revenue as an official document for reporting income. Accurate completion is essential, as any discrepancies may lead to legal repercussions, including fines or penalties.

Moreover, using electronic tools for filling out and submitting the Schedule B can enhance the legal standing of the document. Ensuring compliance with eSignature regulations and maintaining proper records are critical for the legitimacy of the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Massachusetts Schedule B align with the overall state tax return deadlines. Typically, individual taxpayers must submit their returns by April fifteenth of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day.

It is crucial to be aware of any changes in deadlines or extensions that may occur, especially in light of specific circumstances such as natural disasters or public health emergencies. Staying informed ensures timely filing and helps avoid penalties for late submissions.

Penalties for Non-Compliance

Failure to comply with the requirements of the Massachusetts Schedule B can result in significant penalties. These may include fines for late filing, inaccuracies, or failure to report income. The Massachusetts Department of Revenue may impose interest on unpaid taxes as well, increasing the overall financial burden.

To mitigate these risks, it is advisable to file the Schedule B accurately and on time. Seeking assistance from tax professionals can also provide guidance and help ensure compliance with all regulations.

Quick guide on how to complete schedule b interest dividends and certain capital gains and 627571471

Complete Schedule B Interest, Dividends And Certain Capital Gains And effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule B Interest, Dividends And Certain Capital Gains And on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Schedule B Interest, Dividends And Certain Capital Gains And with ease

- Locate Schedule B Interest, Dividends And Certain Capital Gains And and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the document or redact sensitive information with tools expressly designed for that purpose, provided by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Schedule B Interest, Dividends And Certain Capital Gains And and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b interest dividends and certain capital gains and 627571471

Create this form in 5 minutes!

How to create an eSignature for the schedule b interest dividends and certain capital gains and 627571471

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Schedule B?

The Massachusetts Schedule B is a form used by residents to report additional income from sources such as interest and dividends. Understanding this form is essential for accurate tax filing and compliance in Massachusetts. airSlate SignNow can help streamline the process by allowing you to eSign documents related to the Massachusetts Schedule B with ease.

-

How can airSlate SignNow assist with completing the Massachusetts Schedule B?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Massachusetts Schedule B quickly. With customizable templates and an intuitive interface, you can efficiently manage your tax documents. This ensures that your filings are accurate and submitted on time, helping you avoid potential penalties.

-

Is there a cost associated with using airSlate SignNow for Massachusetts Schedule B?

Yes, airSlate SignNow offers different pricing plans that cater to various needs, including options for individual users and businesses. You can choose a plan that provides the features you require for efficiently managing your Massachusetts Schedule B tasks. Most users find the cost-effective solutions cost-efficient, especially when considering the time savings.

-

What features does airSlate SignNow offer for managing tax documents like the Massachusetts Schedule B?

airSlate SignNow offers features such as templates, secure eSignature capabilities, and document tracking for your Massachusetts Schedule B and other tax-related forms. These functionalities simplify the signing process and ensure your documents are handled efficiently. The platform also integrates with other business tools to enhance your workflow.

-

Can I use airSlate SignNow on mobile devices for the Massachusetts Schedule B?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage your Massachusetts Schedule B on the go. You can access, complete, and eSign your documents directly from your smartphone or tablet. This flexibility is ideal for busy professionals who need to stay productive wherever they are.

-

How does airSlate SignNow ensure the security of my Massachusetts Schedule B documents?

Security is a top priority for airSlate SignNow. The platform employs industry-standard encryption and compliance measures to protect your Massachusetts Schedule B and other sensitive documents. You can rest assured that your information is safe while using our eSigning and document management services.

-

Can airSlate SignNow integrate with other software I use for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software and other business applications. This means you can easily transfer information related to your Massachusetts Schedule B without manual entry. These integrations enhance your productivity and streamline your overall tax filing process.

Get more for Schedule B Interest, Dividends And Certain Capital Gains And

Find out other Schedule B Interest, Dividends And Certain Capital Gains And

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract