Schedule B Interest, Dividends and Certain Capital Gains and 2019

Understanding the Massachusetts Schedule B

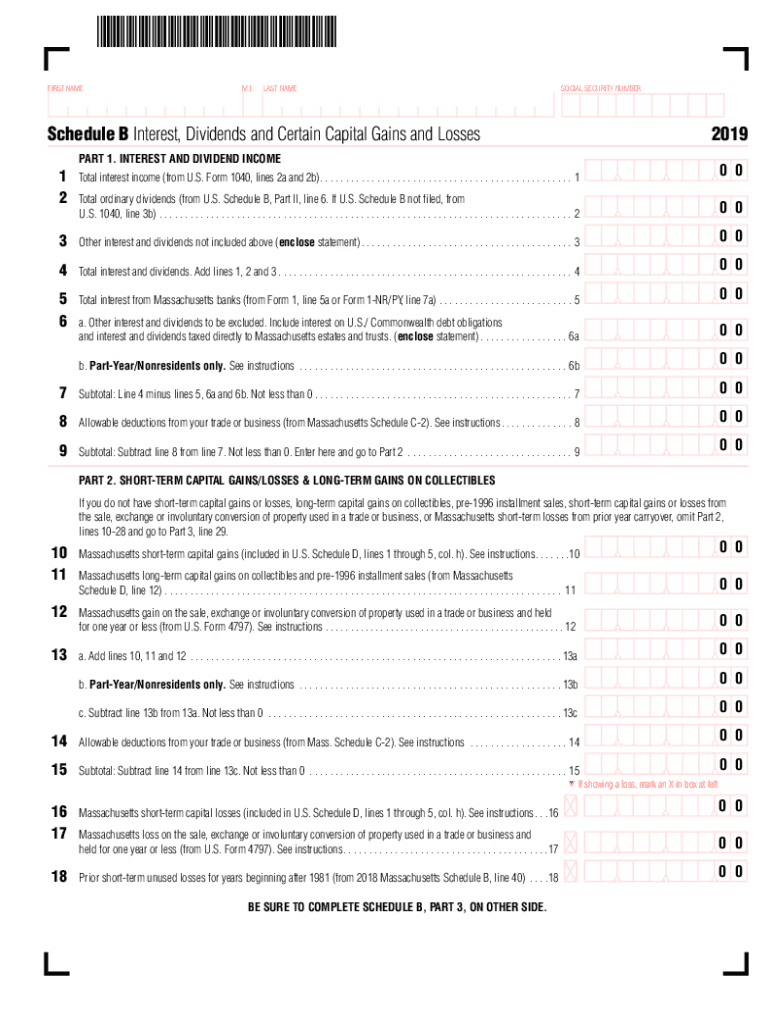

The Massachusetts Schedule B is a tax form used to report interest, dividends, and certain capital gains. This form is essential for individuals who have income from these sources, as it helps in calculating the total taxable income. The information reported on Schedule B is used to determine the appropriate tax liability for the taxpayer. It is important to accurately complete this form to ensure compliance with state tax laws.

Steps to Complete the Massachusetts Schedule B

Filling out the Massachusetts Schedule B involves several key steps:

- Gather all relevant financial documents, including bank statements and investment records.

- Identify all sources of interest and dividend income received during the tax year.

- Calculate the total amounts for each source of income and enter them in the appropriate sections of the form.

- Report any capital gains from the sale of investments, ensuring to include only those that are applicable.

- Review the completed form for accuracy before submission.

Legal Use of the Massachusetts Schedule B

The Massachusetts Schedule B is legally binding when completed and submitted according to state regulations. It is crucial for taxpayers to ensure that all reported income is accurate and reflects their financial activities for the year. Falsifying information on this form can lead to penalties and legal repercussions. Compliance with the Massachusetts Department of Revenue guidelines ensures that the form is accepted and processed without issues.

Filing Deadlines for the Massachusetts Schedule B

Taxpayers must be aware of the filing deadlines associated with the Massachusetts Schedule B to avoid penalties. Typically, the form is due on the same date as the individual income tax return, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check with the Massachusetts Department of Revenue for any updates or changes to these deadlines.

Required Documents for the Massachusetts Schedule B

To accurately complete the Massachusetts Schedule B, taxpayers should prepare the following documents:

- Bank statements showing interest earned

- Brokerage statements detailing dividends and capital gains

- Form 1099-INT for interest income

- Form 1099-DIV for dividend income

- Any additional documentation related to capital gains

Examples of Using the Massachusetts Schedule B

Consider a taxpayer who received interest from a savings account and dividends from stocks. They would report these amounts on the Schedule B to ensure they are taxed appropriately. For instance, if they earned five hundred dollars in interest and one thousand dollars in dividends, they would list these amounts in the designated sections of the form. This reporting helps to accurately reflect their income and comply with tax obligations.

Quick guide on how to complete schedule b interest dividends and certain capital gains and

Complete Schedule B Interest, Dividends And Certain Capital Gains And effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule B Interest, Dividends And Certain Capital Gains And on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Schedule B Interest, Dividends And Certain Capital Gains And without difficulty

- Locate Schedule B Interest, Dividends And Certain Capital Gains And and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Schedule B Interest, Dividends And Certain Capital Gains And and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule b interest dividends and certain capital gains and

Create this form in 5 minutes!

How to create an eSignature for the schedule b interest dividends and certain capital gains and

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is Massachusetts Schedule B?

Massachusetts Schedule B is a tax form used by residents to report interest and dividend income. Understanding this form is crucial for accurate tax filing, especially for individuals and businesses that want to ensure compliance with state tax laws. Using a tool like airSlate SignNow can help streamline the process of eSigning and submitting these documents.

-

How can airSlate SignNow assist with Massachusetts Schedule B?

airSlate SignNow provides an easy-to-use platform for eSigning tax documents, including Massachusetts Schedule B. Our solution simplifies the signing process, allowing you to securely send and receive documents quickly. This efficiency is vital during tax season when time is of the essence.

-

What features does airSlate SignNow offer for managing Massachusetts Schedule B?

airSlate SignNow offers features such as customizable templates, secure storage, and automated workflows tailored for Massachusetts Schedule B. These functionalities ensure that you can manage your documents efficiently while keeping them compliant with Massachusetts tax regulations. Additionally, our platform allows you to collect eSignatures effortlessly.

-

Is airSlate SignNow cost-effective for small businesses handling Massachusetts Schedule B?

Yes, airSlate SignNow is a cost-effective solution for small businesses needing to handle Massachusetts Schedule B and other documents. Our pricing plans are designed to cater to businesses of all sizes, allowing you to optimize your document management without breaking the bank. This affordability ensures that even startups can manage their tax forms efficiently.

-

What are the benefits of using airSlate SignNow for Massachusetts Schedule B?

Using airSlate SignNow for your Massachusetts Schedule B offers several benefits, including faster processing times and reduced paper usage. Digital signatures are legally binding and compliant, which adds an extra layer of security to your tax submissions. Furthermore, our platform enhances collaboration by allowing multiple parties to sign documents seamlessly.

-

Can airSlate SignNow integrate with accounting software for Massachusetts Schedule B?

Yes, airSlate SignNow integrates with various accounting software solutions, making it easier to manage your Massachusetts Schedule B and other financial documents. This integration allows for seamless data transfer between systems, reducing the risk of errors and improving overall efficiency in your financial workflows. You can link your eSigning processes directly to your accounting practices.

-

How secure is airSlate SignNow for handling sensitive documents like Massachusetts Schedule B?

airSlate SignNow prioritizes security, utilizing encryption and secure storage measures for all documents, including Massachusetts Schedule B. Our platform complies with industry standards to ensure that your sensitive information remains protected from unauthorized access. You can confidently eSign and manage your tax documents knowing they are secure.

Get more for Schedule B Interest, Dividends And Certain Capital Gains And

Find out other Schedule B Interest, Dividends And Certain Capital Gains And

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer