IRS Provides Guidance for Residents of Puerto Rico to Claim 2022-2026

Understanding IRS Guidance for Puerto Rico Residents

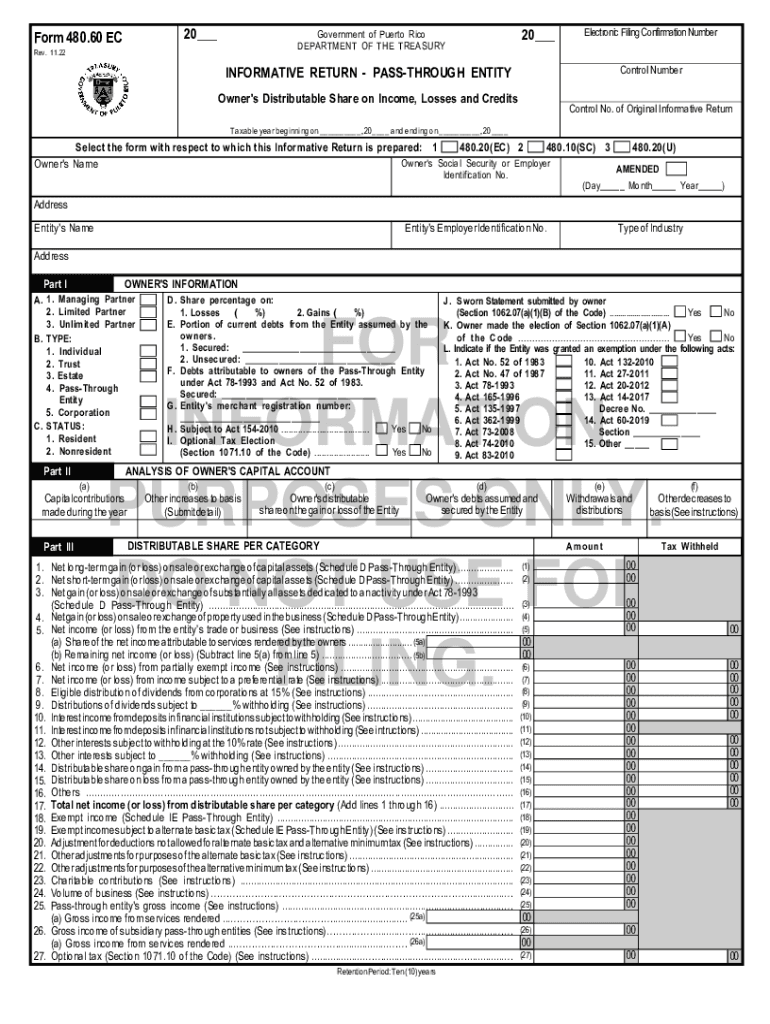

The IRS provides specific guidance for residents of Puerto Rico to claim tax benefits and file their taxes correctly. This guidance is essential for ensuring compliance with federal tax laws while recognizing the unique status of Puerto Rico in relation to the U.S. tax system. Residents need to understand how their income is treated, what forms are necessary, and what deductions or credits they may be eligible for under IRS rules.

Steps to Claim IRS Benefits for Puerto Rico Residents

To successfully claim benefits, Puerto Rico residents should follow these steps:

- Determine eligibility based on residency status and income level.

- Gather all necessary documentation, including income statements and previous tax returns.

- Complete the appropriate IRS forms, such as Form 1040-PR or Form 1040-SS, as applicable.

- Review the completed forms for accuracy and completeness.

- Submit the forms electronically or by mail, adhering to the specified deadlines.

Required Documents for Filing

When filing taxes under the IRS guidance, residents of Puerto Rico must prepare specific documents to support their claims. These documents typically include:

- Proof of income, such as W-2 forms or 1099s.

- Previous year’s tax returns for reference.

- Any relevant documentation for deductions or credits being claimed.

- Identification information, including Social Security numbers for all dependents.

Filing Deadlines and Important Dates

It is crucial for residents to be aware of the filing deadlines to avoid penalties. Generally, the tax return due date for residents of Puerto Rico aligns with the federal deadline, which is typically April 15. However, residents may qualify for extensions under certain circumstances. Keeping track of these dates ensures timely submissions and compliance with IRS regulations.

Eligibility Criteria for IRS Claims

Eligibility for claiming benefits under IRS guidance is determined by several factors, including:

- Residency status in Puerto Rico.

- Income level and source of income.

- Filing status, such as single, married, or head of household.

- Age and dependency status of individuals in the household.

Digital Submission Methods

Residents of Puerto Rico can file their tax returns digitally, which offers a convenient and efficient way to submit forms. Electronic filing can be done through the IRS website or authorized tax software. This method not only speeds up the processing time but also reduces the risk of errors that can occur with paper submissions.

Quick guide on how to complete irs provides guidance for residents of puerto rico to claim

Effortlessly Prepare IRS Provides Guidance For Residents Of Puerto Rico To Claim on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents rapidly without holdups. Handle IRS Provides Guidance For Residents Of Puerto Rico To Claim on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign IRS Provides Guidance For Residents Of Puerto Rico To Claim with Ease

- Find IRS Provides Guidance For Residents Of Puerto Rico To Claim and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a classic ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign IRS Provides Guidance For Residents Of Puerto Rico To Claim to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs provides guidance for residents of puerto rico to claim

Create this form in 5 minutes!

How to create an eSignature for the irs provides guidance for residents of puerto rico to claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of IRS Provides Guidance For Residents Of Puerto Rico To Claim?

The IRS Provides Guidance For Residents Of Puerto Rico To Claim assists individuals in understanding their tax obligations and eligibility for claims. This guidance helps residents navigate complex tax situations, ensuring they can maximize their benefits and minimize liabilities.

-

How can airSlate SignNow streamline claiming processes for residents of Puerto Rico?

airSlate SignNow offers a user-friendly platform that simplifies document preparation and electronic signing for claims. By integrating the IRS Provides Guidance For Residents Of Puerto Rico To Claim, residents can efficiently manage their tax-related documents and ensure compliance with IRS regulations.

-

What are the pricing options for airSlate SignNow when claiming IRS benefits?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including individual and business options. These plans provide access to features that support the IRS Provides Guidance For Residents Of Puerto Rico To Claim, ensuring users can file their claims affordably and efficiently.

-

What features does airSlate SignNow offer for tax document eSigning?

airSlate SignNow includes features such as customizable templates, document sharing, and secure eSigning capabilities. These features are essential for utilizing IRS Provides Guidance For Residents Of Puerto Rico To Claim, allowing residents to complete their claims process smoothly and securely.

-

Can airSlate SignNow integrate with other tax preparation software?

Yes, airSlate SignNow seamlessly integrates with various tax preparation software to enhance workflow efficiency. This functionality supports users in leveraging IRS Provides Guidance For Residents Of Puerto Rico To Claim, making it easier to import and export necessary documents for their claims.

-

What are the main benefits of using airSlate SignNow for IRS claims?

Using airSlate SignNow for IRS claims provides residents of Puerto Rico with a straightforward, efficient, and cost-effective solution. The platform not only helps in eSigning documents but also ensures adherence to the IRS Provides Guidance For Residents Of Puerto Rico To Claim, thus minimizing errors and maximizing potential returns.

-

Is airSlate SignNow compliant with IRS regulations?

Absolutely, airSlate SignNow is designed to comply with IRS regulations, ensuring that all eSigned documents meet legal standards. This compliance is especially important for residents who rely on the IRS Provides Guidance For Residents Of Puerto Rico To Claim for accurate and timely submissions.

Get more for IRS Provides Guidance For Residents Of Puerto Rico To Claim

- Download forms welcome to the orleans parish civil district

- Amoco production company versus texaco inc et al form

- Dane thomas vs state of louisiana the department of form

- State of louisiana court of appeal third circuit 07 891 form

- State of louisiana court of appeal third circuit versus form

- State of louisiana 16 judicial district court vs docket form

- District court cases in louisiana justia dockets ampampamp filings form

- In the criminal district court for the parish of orleans form

Find out other IRS Provides Guidance For Residents Of Puerto Rico To Claim

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile