CT 399 I Department of Taxation and Finance 2014

What is the CT 399 I Department Of Taxation And Finance

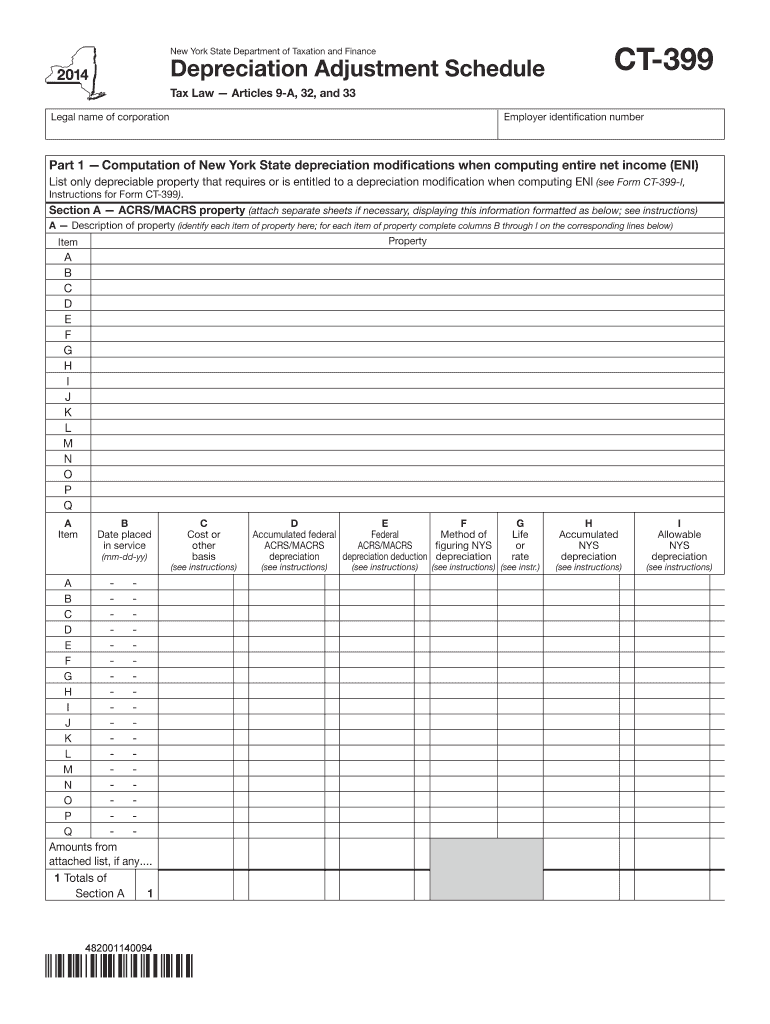

The CT 399 I Department Of Taxation And Finance form is a specific document used for tax reporting purposes in the state of New York. This form is designed to assist taxpayers in declaring their tax obligations accurately and efficiently. It is essential for individuals and businesses to understand the purpose and requirements of this form to ensure compliance with state tax laws. The CT 399 I serves as a declaration of income and is part of the broader tax filing process mandated by the New York State Department of Taxation and Finance.

Steps to complete the CT 399 I Department Of Taxation And Finance

Completing the CT 399 I form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the form through the New York State Department of Taxation and Finance website or a trusted digital platform. Fill in the required fields with accurate information, ensuring that all figures are correct. After completing the form, review it carefully for any errors or omissions. Finally, sign and submit the form electronically or via mail, depending on your preference and the guidelines provided by the state.

Legal use of the CT 399 I Department Of Taxation And Finance

The legal use of the CT 399 I Department Of Taxation And Finance form is crucial for maintaining compliance with state tax regulations. This form must be filled out accurately to avoid penalties or legal issues. Taxpayers are required to use this form to report their income and tax liabilities to the state. It is also important to understand that submitting this form electronically is legally valid, provided that it meets the requirements set forth by the IRS and the New York State Department of Taxation and Finance. Utilizing a secure eSignature platform can further reinforce the legal standing of your submission.

Form Submission Methods (Online / Mail / In-Person)

The CT 399 I form can be submitted through various methods, providing flexibility for taxpayers. The most efficient way is to submit the form online using a secure eSignature platform, which allows for quick processing and confirmation. Alternatively, taxpayers can mail the completed form to the designated address provided by the New York State Department of Taxation and Finance. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own processing timeline, so it's important to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the CT 399 I Department Of Taxation And Finance form are critical to avoid penalties and ensure compliance. Typically, the form must be submitted by the designated tax filing deadline, which is usually aligned with the federal tax deadline. It is important to stay informed about any changes in tax law that may affect filing dates. Additionally, taxpayers should mark their calendars for any extensions or special deadlines that may apply to their specific tax situation.

Key elements of the CT 399 I Department Of Taxation And Finance

The CT 399 I form includes several key elements that are essential for accurate tax reporting. These elements typically consist of personal identification information, income details, deductions, and credits applicable to the taxpayer's situation. It is important to provide complete and accurate information in each section of the form. Understanding these key elements helps taxpayers avoid common mistakes and ensures that their tax filings are processed smoothly.

Quick guide on how to complete ct 399 i department of taxation and finance

Your assistance manual on how to prepare your CT 399 I Department Of Taxation And Finance

If you’re interested in understanding how to finalize and submit your CT 399 I Department Of Taxation And Finance, here are several brief instructions on how to simplify tax processing.

To start, you just need to establish your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, create, and finalize your tax paperwork effortlessly. Utilizing its editor, you can navigate between text, checkboxes, and electronic signatures, and revisit to amend details as required. Streamline your tax administration with advanced PDF editing, electronic signing, and user-friendly sharing.

Adhere to the following steps to complete your CT 399 I Department Of Taxation And Finance in just a few minutes:

- Set up your account and start editing PDFs in no time.

- Access our directory to obtain any IRS tax form; browse through various editions and schedules.

- Click Get form to launch your CT 399 I Department Of Taxation And Finance in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to apply your legally-recognized eSignature (if required).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that filing on paper can lead to more return mistakes and delay refunds. It goes without saying, before electronically filing your taxes, visit the IRS website for reporting rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 399 i department of taxation and finance

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

Create this form in 5 minutes!

How to create an eSignature for the ct 399 i department of taxation and finance

How to create an electronic signature for the Ct 399 I Department Of Taxation And Finance in the online mode

How to make an electronic signature for your Ct 399 I Department Of Taxation And Finance in Google Chrome

How to create an electronic signature for signing the Ct 399 I Department Of Taxation And Finance in Gmail

How to make an electronic signature for the Ct 399 I Department Of Taxation And Finance straight from your smart phone

How to generate an electronic signature for the Ct 399 I Department Of Taxation And Finance on iOS

How to create an electronic signature for the Ct 399 I Department Of Taxation And Finance on Android OS

People also ask

-

What is the CT 399 I Department Of Taxation And Finance?

The CT 399 I Department Of Taxation And Finance is a specific document required for tax exemption in New York. It allows businesses to claim exemption from sales and use taxes. Understanding this document is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with CT 399 I Department Of Taxation And Finance forms?

airSlate SignNow streamlines the process of preparing and signing CT 399 I Department Of Taxation And Finance forms. With its electronic signing capabilities, users can efficiently manage documents, ensuring they are completed accurately and submitted without delays.

-

Is airSlate SignNow cost-effective for managing the CT 399 I Department Of Taxation And Finance?

Yes, airSlate SignNow offers a cost-effective solution for managing the CT 399 I Department Of Taxation And Finance documents. By eliminating paper and postage costs, businesses can save money while improving their document workflows.

-

What features of airSlate SignNow are beneficial for filing the CT 399 I Department Of Taxation And Finance?

AirSlate SignNow offers features like custom templates, secure e-signatures, and real-time tracking, all beneficial for filing the CT 399 I Department Of Taxation And Finance. These features ensure that documents are completed promptly and remain compliant with tax regulations.

-

Can I integrate airSlate SignNow with my existing financial software for CT 399 I Department Of Taxation And Finance?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, enhancing the management of CT 399 I Department Of Taxation And Finance documents. This integration helps streamline workflows and maintain organized records.

-

What are the benefits of using airSlate SignNow for CT 399 I Department Of Taxation And Finance?

Using airSlate SignNow for CT 399 I Department Of Taxation And Finance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Businesses can focus more on their core activities rather than on document management.

-

Is electronic signing of CT 399 I Department Of Taxation And Finance forms legally accepted?

Yes, electronic signing of CT 399 I Department Of Taxation And Finance forms is legally accepted in many jurisdictions. With airSlate SignNow, you can ensure that your electronic signatures are compliant and valid, protecting your business interests.

Get more for CT 399 I Department Of Taxation And Finance

Find out other CT 399 I Department Of Taxation And Finance

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online