Fillable Online Tax Ny CT 399 Staple Forms Here New York 2021

What is the 399 form?

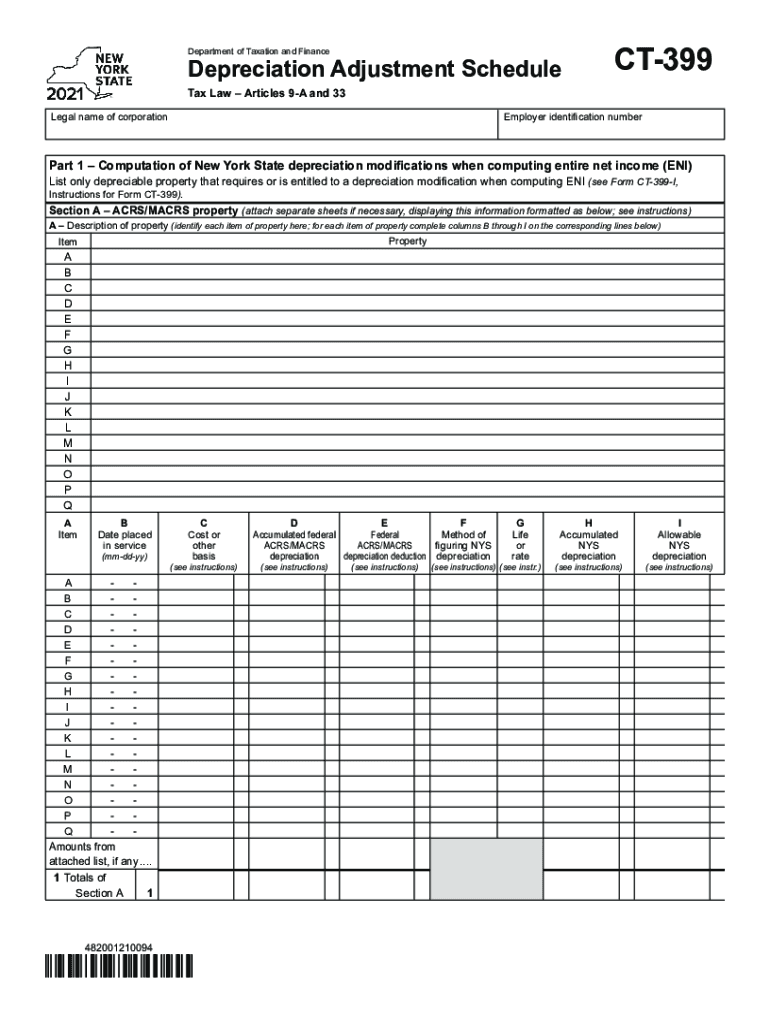

The 399 form, also known as the CT-399, is a tax form used in New York for reporting certain adjustments related to depreciation. This form is essential for businesses and individuals who need to report depreciation adjustments on their state tax returns. It helps ensure compliance with state tax regulations and provides a clear record of any adjustments made to previously reported depreciation amounts.

Steps to complete the 399 form

Completing the 399 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant financial documents, including prior tax returns and depreciation schedules.

- Fill in personal and business details: Provide your name, address, and any business identification numbers required.

- Report depreciation adjustments: Clearly outline any adjustments to depreciation, including the reason for the change and the amounts involved.

- Review for accuracy: Double-check all entries for completeness and correctness before submission.

- Submit the form: Choose your preferred method of submission, whether online or by mail, and ensure it is sent by the appropriate deadline.

Legal use of the 399 form

The 399 form is legally binding when completed accurately and submitted in accordance with New York state tax laws. It is crucial to follow the guidelines set forth by the New York State Department of Taxation and Finance to ensure that the form is accepted. Proper completion of the form can help avoid potential penalties or issues with tax compliance.

Filing deadlines for the 399 form

Filing deadlines for the 399 form may vary based on individual circumstances, such as the type of business entity and the fiscal year-end. Generally, the form must be submitted by the due date of your tax return. It is advisable to check the New York State Department of Taxation and Finance website for specific deadlines relevant to your situation.

Required documents for the 399 form

When completing the 399 form, several documents are typically required to support the information provided:

- Prior tax returns: Previous year’s tax returns may be necessary for reference.

- Depreciation schedules: Detailed records of depreciation claimed in previous years.

- Financial statements: Current financial statements may be needed to support any adjustments.

Form submission methods

The 399 form can be submitted through various methods, depending on your preference and the requirements set by the state. Common submission methods include:

- Online submission: Many taxpayers prefer to file electronically for convenience and speed.

- Mail: You can print the completed form and send it via postal service to the appropriate tax office.

- In-person submission: Some individuals may choose to deliver the form directly to a tax office for immediate processing.

Quick guide on how to complete fillable online tax ny ct 399 staple forms here new york

Effortlessly Prepare Fillable Online Tax Ny CT 399 Staple Forms Here New York on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Fillable Online Tax Ny CT 399 Staple Forms Here New York on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related processes today.

The Easiest Way to Modify and eSign Fillable Online Tax Ny CT 399 Staple Forms Here New York without Effort

- Find Fillable Online Tax Ny CT 399 Staple Forms Here New York and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Fillable Online Tax Ny CT 399 Staple Forms Here New York to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online tax ny ct 399 staple forms here new york

Create this form in 5 minutes!

How to create an eSignature for the fillable online tax ny ct 399 staple forms here new york

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 399 form and why is it important?

The 399 form is a crucial document used for various business transactions. It helps in accurately reporting income and ensuring compliance with tax regulations. Understanding its importance can simplify financial documentation for your business.

-

How can airSlate SignNow assist with the 399 form?

airSlate SignNow streamlines the process of completing and signing the 399 form electronically. Our easy-to-use platform ensures that all signatures are secure and legally binding, enhancing the efficiency of your document workflow.

-

Is there a cost associated with using airSlate SignNow for the 399 form?

Yes, there is a pricing structure for airSlate SignNow, but it is designed to be cost-effective. Depending on your needs, you can choose from various plans that allow for unlimited signatures and document management, including the handling of the 399 form.

-

What features does airSlate SignNow offer for managing the 399 form?

airSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking for the 399 form. These tools help simplify the process and ensure that all parties have access to the most current version of the document.

-

Can I integrate airSlate SignNow with other software to manage the 399 form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party tools like CRM systems and cloud storage services. This integration allows you to manage the 399 form and other documents efficiently without switching between platforms.

-

Is airSlate SignNow secure for signing the 399 form?

Yes, airSlate SignNow employs top-level encryption and security protocols to protect your data when signing the 399 form. You can rest assured that your sensitive information is safe throughout the signing process.

-

How can I track the status of my 399 form sent via airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 399 form in real-time. You'll receive notifications when the document is opened, reviewed, and signed, allowing you to manage important deadlines effectively.

Get more for Fillable Online Tax Ny CT 399 Staple Forms Here New York

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts 497298797 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective 497298798 form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497298799 form

- Agreement no children 497298800 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497298801 form

- Legal separation and property settlement agreement with adult children marital parties may have joint property or debts divorce 497298802 form

- Legal settlement agreement form

- Ca deed trust form

Find out other Fillable Online Tax Ny CT 399 Staple Forms Here New York

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document