Form CT 399 Depreciation Adjustment Schedule Tax Year 2020

What is the Form CT 399 Depreciation Adjustment Schedule Tax Year

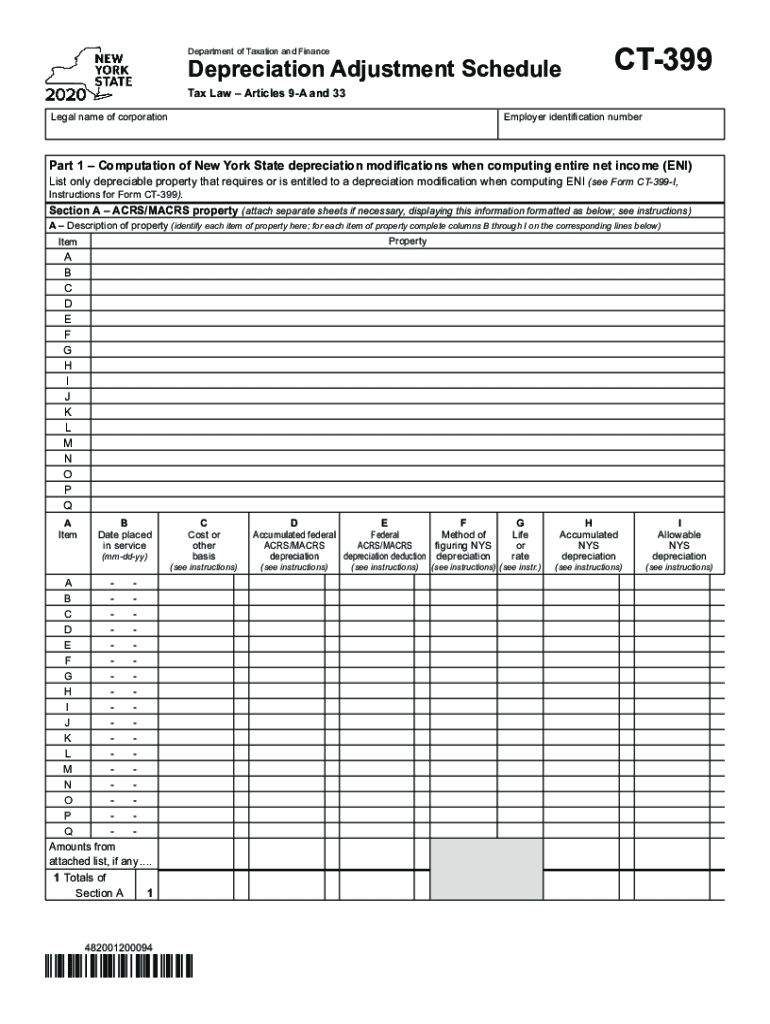

The Form CT 399, also known as the Depreciation Adjustment Schedule, is a critical document used by businesses in New York State to report adjustments to depreciation. This form is essential for ensuring that the depreciation claimed on state tax returns aligns with federal guidelines. The adjustments made on this form can significantly impact the taxable income of a business, making it important for accurate financial reporting. The CT 399 is specifically designed for tax years and must be completed for each taxable year in which depreciation adjustments occur.

Steps to complete the Form CT 399 Depreciation Adjustment Schedule Tax Year

Completing the Form CT 399 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including previous tax returns and records of asset purchases. Next, identify the assets for which depreciation adjustments are necessary. Fill out the form by providing details such as the asset description, date placed in service, and the amount of depreciation claimed. Be sure to calculate any adjustments based on changes in federal tax laws or asset usage. Finally, review the completed form for accuracy before submission to avoid potential penalties.

Key elements of the Form CT 399 Depreciation Adjustment Schedule Tax Year

The Form CT 399 includes several key elements that are crucial for proper completion. These elements typically consist of:

- Asset Information: Details about each asset, including its description and acquisition date.

- Depreciation Calculations: Calculated amounts for depreciation, including any adjustments required.

- Tax Year: The specific tax year for which the adjustments are being reported.

- Signature: A declaration that the information provided is accurate and complete, signed by an authorized individual.

Legal use of the Form CT 399 Depreciation Adjustment Schedule Tax Year

The legal use of the Form CT 399 is governed by New York State tax regulations. It is essential for businesses to ensure that the form is completed in accordance with state laws to avoid any legal repercussions. The adjustments reported on this form must be consistent with federal depreciation rules to maintain compliance. Failure to accurately report depreciation adjustments can lead to audits or penalties from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 399 are typically aligned with the overall tax filing deadlines for businesses in New York State. It is crucial to submit the form by the due date to avoid late fees or penalties. Generally, the form must be filed alongside the business's annual tax return. Keeping track of these important dates ensures that businesses remain compliant and avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 399 can be submitted through various methods, providing flexibility for businesses. Options typically include:

- Online Submission: Many businesses choose to file electronically through the New York State Department of Taxation and Finance website.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Businesses may also opt to submit the form in person at designated tax offices, ensuring immediate confirmation of receipt.

Quick guide on how to complete form ct 399 depreciation adjustment schedule tax year 2020

Complete Form CT 399 Depreciation Adjustment Schedule Tax Year effortlessly on any gadget

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your papers quickly without delays. Manage Form CT 399 Depreciation Adjustment Schedule Tax Year on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Form CT 399 Depreciation Adjustment Schedule Tax Year with ease

- Obtain Form CT 399 Depreciation Adjustment Schedule Tax Year and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choosing. Modify and eSign Form CT 399 Depreciation Adjustment Schedule Tax Year and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 399 depreciation adjustment schedule tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 399 depreciation adjustment schedule tax year 2020

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the significance of 399 nys in airSlate SignNow?

The term 399 nys refers to a specific regulatory framework that businesses must comply with when handling electronic signatures in New York. airSlate SignNow ensures full compliance with the 399 nys requirements, allowing organizations to eSign documents securely while adhering to state laws.

-

How does airSlate SignNow support compliance with 399 nys?

airSlate SignNow provides features that are designed to meet the compliance standards set by 399 nys, including secure encryption and audit trails. Users can confidently eSign documents knowing that their processes are aligned with legal requirements, minimizing risks associated with electronic signatures.

-

What are the pricing options for using airSlate SignNow with 399 nys compliance?

airSlate SignNow offers competitive pricing plans to cater to different business needs, ensuring that compliance with 399 nys is affordable. Pricing tiers are structured to provide value while accommodating various features that enhance the signing experience, making it a cost-effective choice for businesses.

-

What features does airSlate SignNow offer to meet the 399 nys standards?

airSlate SignNow includes features such as customizable templates, multi-party signing, and secure storage that support the requirements of 399 nys. These functionalities not only enhance the efficiency of document management but also ensure that all transactions follow the necessary legal protocols.

-

Can airSlate SignNow integrate with other tools while adhering to 399 nys?

Yes, airSlate SignNow seamlessly integrates with various business applications, including CRM systems and cloud storage solutions, while maintaining compliance with 399 nys. This allows organizations to streamline their workflows without compromising legal standards for electronic signatures.

-

What are the benefits of using airSlate SignNow for businesses in the 399 nys jurisdiction?

Using airSlate SignNow for businesses operating under 399 nys offers numerous benefits, such as faster document turnaround times and reduced paperwork. These advantages not only enhance operational efficiency but also provide assurance that electronic signatures are legally binding in accordance with state regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with 399 nys regulations?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for individuals who may not be familiar with 399 nys regulations. The platform provides intuitive navigation and helpful resources, ensuring that users can easily manage their eSigning processes without needing extensive legal knowledge.

Get more for Form CT 399 Depreciation Adjustment Schedule Tax Year

Find out other Form CT 399 Depreciation Adjustment Schedule Tax Year

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online