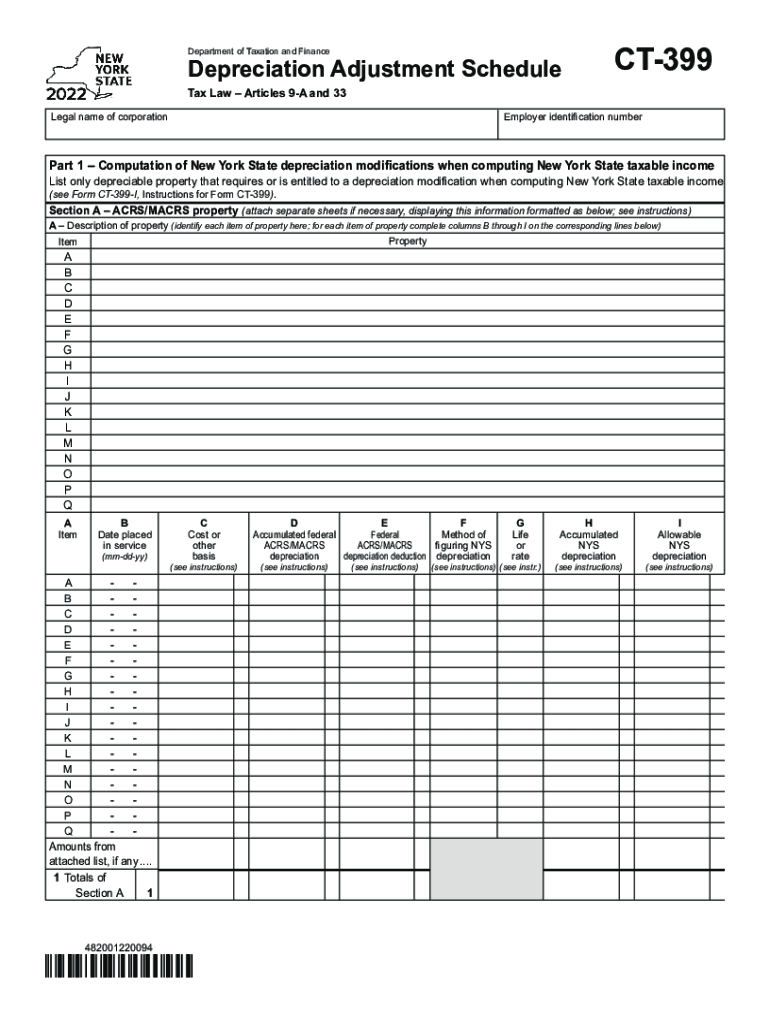

Form CT 399 Depreciation Adjustment Schedule Tax Year 2022

What is the Form CT 399 Depreciation Adjustment Schedule?

The Form CT 399, also known as the Depreciation Adjustment Schedule, is a tax form used by businesses in Connecticut to report depreciation adjustments for tax purposes. This form is essential for calculating the correct amount of depreciation that can be claimed on a tax return. It is particularly relevant for businesses that have made changes to their fixed assets, such as purchases or sales, which can affect their depreciation calculations. Understanding how to accurately fill out this form is crucial for compliance with state tax laws.

Steps to Complete the Form CT 399

Completing the Form CT 399 involves several key steps:

- Gather necessary financial documents, including previous tax returns and asset purchase records.

- Identify the assets for which you need to adjust depreciation, including their original cost and the date of acquisition.

- Calculate the depreciation adjustment based on the asset's useful life and any changes made during the tax year.

- Fill out the form accurately, ensuring all calculations align with the guidelines provided by the Connecticut Department of Revenue Services.

- Review the completed form for accuracy before submission to avoid penalties.

Legal Use of the Form CT 399

The Form CT 399 is legally required for businesses in Connecticut that need to report depreciation adjustments. Properly completing this form ensures compliance with state tax regulations. Failure to submit the form or inaccuracies in reporting can result in penalties or audits. It is important to understand the legal implications of the information provided on this form, as it can affect overall tax liability.

Filing Deadlines for the Form CT 399

Timely submission of the Form CT 399 is critical to avoid late fees and penalties. The filing deadline typically aligns with the business's tax return due date. For most businesses, this is the fifteenth day of the fourth month following the close of the tax year. If additional time is needed, businesses may apply for an extension, but it is essential to ensure that the form is submitted by the extended deadline to maintain compliance.

Required Documents for the Form CT 399

To complete the Form CT 399, several documents are typically required:

- Previous year’s tax returns.

- Records of asset purchases, including invoices and contracts.

- Documentation of any asset disposals or adjustments made during the tax year.

- Depreciation schedules for each asset affected.

Examples of Using the Form CT 399

Businesses may encounter various scenarios requiring the use of the Form CT 399. For instance, if a company purchases new equipment that qualifies for depreciation, it must report this adjustment on the form. Similarly, if an asset is sold or disposed of, the business needs to adjust its depreciation accordingly and report this change. Each example highlights the importance of accurately tracking and reporting depreciation to ensure compliance and optimize tax benefits.

Quick guide on how to complete form ct 399 depreciation adjustment schedule tax year 2022

Complete Form CT 399 Depreciation Adjustment Schedule Tax Year effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly and efficiently. Handle Form CT 399 Depreciation Adjustment Schedule Tax Year on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Form CT 399 Depreciation Adjustment Schedule Tax Year with ease

- Obtain Form CT 399 Depreciation Adjustment Schedule Tax Year and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your form.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form CT 399 Depreciation Adjustment Schedule Tax Year to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 399 depreciation adjustment schedule tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form ct 399 depreciation adjustment schedule tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 399?

airSlate SignNow is an intuitive eSigning and document management solution designed to streamline the signing process. For just 399, you can access powerful features that cater to the needs of businesses looking to enhance their workflows.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans starting at 399 per user, ensuring that businesses of all sizes can find a solution that fits their budget. This cost-effective option includes essential features that enhance productivity and efficiency.

-

What features does the 399 plan include?

The 399 plan includes advanced eSigning capabilities, templates, real-time notifications, and secure storage for your documents. These features make it easier for businesses to manage contracts and agreements efficiently.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow easily integrates with popular applications, allowing you to streamline your workflows more effectively. This compatibility enhances functionality, making the 399 plan even more valuable for your business.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow simplifies the document signing process, saving time and reducing errors. With a starting price of 399, businesses benefit from increased efficiency and a user-friendly interface that makes eSigning easy.

-

Is airSlate SignNow secure for signing important documents?

Absolutely! airSlate SignNow prioritizes document security and complies with global regulations to protect your sensitive information. At 399, you get a reliable eSigning solution that keeps your data safe while enhancing workflow efficiency.

-

How can airSlate SignNow improve my team's productivity?

airSlate SignNow enhances team productivity by providing a streamlined process for document preparation, signing, and storage. For just 399, your team can access tools that reduce turnaround time and help get contracts signed faster.

Get more for Form CT 399 Depreciation Adjustment Schedule Tax Year

- Power of attorney forms package rhode island

- Revocation of statutory equivalent of living will or declaration rhode island form

- Revised uniform anatomical gift act donation rhode island

- Employment hiring process package rhode island form

- Revocation of anatomical gift donation rhode island form

- Employment or job termination package rhode island form

- Newly widowed individuals package rhode island form

- Employment interview package rhode island form

Find out other Form CT 399 Depreciation Adjustment Schedule Tax Year

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation