Form Ct 399 2023-2026

What is the Form CT-399

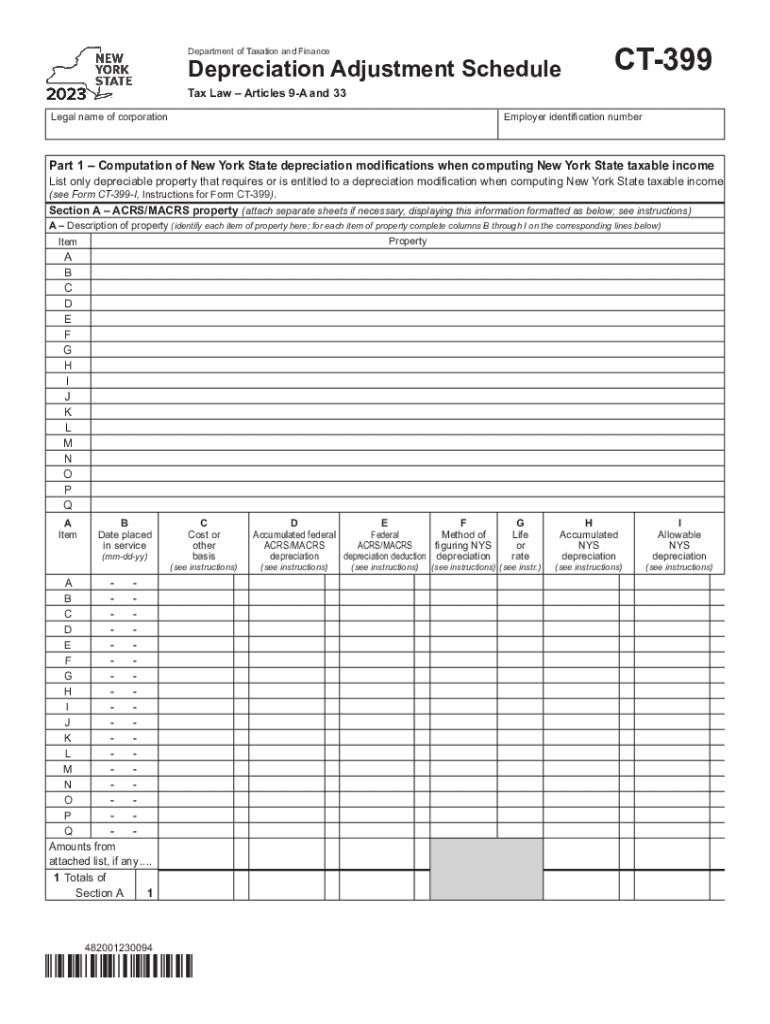

The Form CT-399 is a tax adjustment schedule used in New York State for reporting certain tax adjustments. This form is specifically designed for individuals and businesses to report depreciation adjustments and other related tax changes. It is essential for ensuring accurate tax filings and compliance with state tax regulations.

How to Use the Form CT-399

Using the Form CT-399 involves several steps to ensure accurate reporting. First, gather all necessary financial documents that pertain to depreciation and tax adjustments. Next, fill out the form by providing the required information, including your tax identification number and details of the adjustments being reported. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to Complete the Form CT-399

Completing the Form CT-399 requires careful attention to detail. Start by downloading the form from the New York State Department of Taxation and Finance website. Follow these steps:

- Enter your personal or business information at the top of the form.

- Detail the depreciation adjustments in the designated sections.

- Calculate any tax owed or refunds due based on the adjustments.

- Sign and date the form to certify its accuracy.

Ensure that all calculations are double-checked to avoid errors that could lead to penalties.

Key Elements of the Form CT-399

The Form CT-399 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Taxpayer Information: This includes your name, address, and tax identification number.

- Adjustment Details: Specific sections for detailing the nature of the adjustments being reported.

- Signature: A section for the taxpayer's signature, affirming the accuracy of the information provided.

Understanding these elements helps ensure that the form is filled out correctly and submitted in compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT-399 are typically aligned with the general tax filing deadlines in New York State. It is essential to submit the form by the due date to avoid penalties. Generally, the deadline is the same as the due date for your income tax return, which is usually April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year.

Who Issues the Form CT-399

The Form CT-399 is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides the necessary forms and instructions for taxpayers to accurately report their tax adjustments and other relevant information.

Legal Use of the Form CT-399

The legal use of the Form CT-399 is crucial for maintaining compliance with New York State tax laws. This form must be used by taxpayers who need to report adjustments related to depreciation and other tax-related changes. Failing to use the form correctly can result in penalties, interest, and potential audits by tax authorities.

Quick guide on how to complete form ct 399

Effortlessly prepare Form Ct 399 on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form Ct 399 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign Form Ct 399 without hassle

- Obtain Form Ct 399 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred delivery method for your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form Ct 399 while ensuring outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 399

Create this form in 5 minutes!

How to create an eSignature for the form ct 399

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure of airSlate SignNow, particularly for plans starting at 399?

airSlate SignNow offers flexible pricing plans, with options that start at 399. This pricing model is designed to accommodate businesses of varying sizes, ensuring that you only pay for the features you need. With these plans, you can access a comprehensive suite of tools to streamline your document signing processes.

-

What key features are included in the 399 pricing plan of airSlate SignNow?

The 399 pricing plan includes essential features such as unlimited eSigning, template creation, and advanced document tracking. These features make it easier to manage your documents efficiently and boost productivity in your organization. Users can signNowly benefit from the included tools that enhance their eSigning experience.

-

How can airSlate SignNow help improve my business’s workflow for just 399?

By using airSlate SignNow for just 399, businesses can automate their document workflows, simplifying the signing process. This efficiency reduces turnaround time for important documents, enabling quicker decision-making. The overall productivity boost from streamlined workflows can lead to better business outcomes.

-

Are there any integrations available with airSlate SignNow at the 399 pricing level?

Yes, airSlate SignNow offers robust integrations with popular platforms at the 399 pricing level. This includes integrations with CRM systems, cloud storage solutions, and other business software that help create a seamless workflow. These integrations enhance functionality, making it easier to manage your documents and boost organizational efficiency.

-

What benefits does airSlate SignNow provide to its users for 399?

With the 399 pricing plan, users benefit from a user-friendly eSigning platform that enhances collaboration and speeds up document handling. The solution provides a reliable, secure way to obtain signatures, which is essential for business operations. Additionally, the customer support available with this plan ensures you can quickly resolve any issues.

-

Is airSlate SignNow suitable for small businesses if I choose the 399 plan?

Absolutely! The 399 plan of airSlate SignNow is tailored to meet the needs of small businesses by providing affordable yet powerful document signing capabilities. This allows smaller teams to operate efficiently without breaking the bank. The intuitive interface also helps minimize training time, making it accessible for everyone in your organization.

-

Can I upgrade my airSlate SignNow plan if I start with the 399 option?

Yes, airSlate SignNow allows users to easily upgrade their plans from 399 as their business grows or needs change. This flexibility means you can adapt your eSigning solution to better fit expanding operational requirements without hassle. Upgrading ensures you can access additional features and capabilities to support your business needs.

Get more for Form Ct 399

- Nm 4 h foundation scholarship application new mexico state aces nmsu form

- Dental expired license 1 3 years activation application doh wa form

- Virginia beach police physical ability medical waiver form 2013

- Section 35 form

- Naukeag form

- Omega psi phi form 9a

- Absentee ballot nevada fillable form

- Death certificate ohio form

Find out other Form Ct 399

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement