Instructions for Form it 213 Claim for Empire State Child Credit Tax Year 2020

What is the Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year

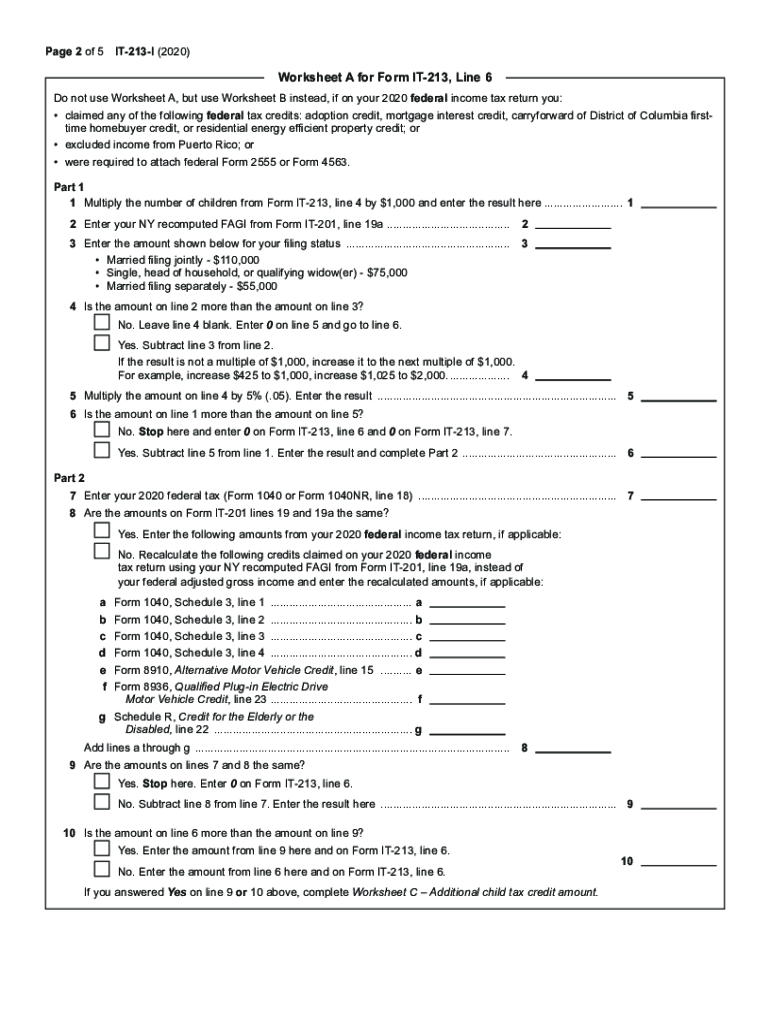

The Instructions For Form IT 213 provide essential guidance for taxpayers claiming the Empire State Child Credit in New York. This form is specifically designed for individuals who meet certain eligibility criteria and wish to receive a tax credit for dependent children. The Empire State Child Credit aims to alleviate some of the financial burdens associated with raising children, making it an important resource for qualifying families. Understanding the details of this form is crucial for ensuring compliance and maximizing potential benefits.

Steps to complete the Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year

Completing the Instructions For Form IT 213 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including Social Security numbers for dependents and income statements. Next, carefully read through the instructions to understand eligibility requirements and the specific information needed for the form. Fill out the form accurately, providing all required details about your dependents and income. Finally, review the completed form for any errors before submission.

Eligibility Criteria

To qualify for the Empire State Child Credit, taxpayers must meet specific eligibility criteria outlined in the Instructions For Form IT 213. Generally, the primary requirements include having a qualifying child under the age of 17 at the end of the tax year, meeting income thresholds, and being a resident of New York State. It is important to review these criteria carefully to determine if you are eligible to claim the credit, as this will directly impact your tax benefits.

Required Documents

When completing the Instructions For Form IT 213, certain documents are essential to support your claim for the Empire State Child Credit. These documents typically include:

- Social Security cards for each qualifying child

- Income statements, such as W-2 forms or 1099 forms

- Proof of residency in New York State

- Any previous tax returns that may be relevant

Having these documents on hand will facilitate a smoother and more efficient filing process.

Form Submission Methods

Submitting the Instructions For Form IT 213 can be done through various methods, allowing taxpayers flexibility in how they file their claims. You can submit the form online using approved e-filing services, which often provide a streamlined process. Alternatively, the form can be mailed to the appropriate tax authority address provided in the instructions. In-person submissions may also be possible at designated tax offices. Each method has its own processing times, so it's advisable to choose the one that best suits your needs.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when dealing with the Instructions For Form IT 213. Typically, the deadline for submitting this form aligns with the general tax filing deadline in the United States, which is usually April fifteenth. However, it is important to check for any updates or changes to this deadline each tax year, as extensions or specific circumstances may affect the timeline. Timely submission ensures that you receive any eligible credits without unnecessary delays.

Quick guide on how to complete instructions for form it 213 claim for empire state child credit tax year 2020

Effortlessly Prepare Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year with Ease

- Locate Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 213 claim for empire state child credit tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 213 claim for empire state child credit tax year 2020

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What are the key features of airSlate SignNow related to it 213 instructions?

airSlate SignNow offers a range of features designed to streamline document signing based on it 213 instructions. You can easily create, send, and manage eSignatures while ensuring secure storage of your documents. The platform also allows for customizable workflows that cater directly to the it 213 instructions for maximum efficiency.

-

How does airSlate SignNow enhance compliance with it 213 instructions?

By using airSlate SignNow, you can ensure that your document signing processes are compliant with it 213 instructions. The platform provides secure signing options, audit trails, and compliance features to meet regulatory requirements. This makes it easier for businesses to adhere to standards and maintain legal validity.

-

Is there a trial period available for airSlate SignNow to explore it 213 instructions?

Yes, airSlate SignNow offers a free trial period where you can explore all the features, including those tailored to it 213 instructions. This allows you to test the platform, see how it functions in real-world scenarios, and determine if it's the right solution for your business needs. Make the most out of the trial to understand ease of use and efficiency.

-

What pricing plans are available for airSlate SignNow in relation to it 213 instructions?

airSlate SignNow provides several pricing plans that cater to businesses of all sizes needing support for it 213 instructions. Each plan includes essential features and additional options for higher tier subscriptions. This flexibility allows you to choose a plan that fits your budget while still meeting your document signing needs effectively.

-

Can airSlate SignNow integrate with other tools for handling it 213 instructions?

Absolutely! airSlate SignNow supports various integrations with popular tools and software that help streamline the processes related to it 213 instructions. You can connect with CRM systems, cloud storage solutions, and project management tools to create a cohesive workflow for document management and signing.

-

What benefits does airSlate SignNow provide for businesses focusing on it 213 instructions?

The primary benefits of using airSlate SignNow for businesses that follow it 213 instructions include increased efficiency, greater compliance, and reduced costs of printing and mailing documents. With the ability to send and sign documents electronically, you save time and resources while also benefiting from enhanced security and tracking.

-

How user-friendly is airSlate SignNow for implementing it 213 instructions?

airSlate SignNow is designed to be user-friendly, making it easy for anyone to implement it 213 instructions without needing extensive technical knowledge. The intuitive interface guides you through the process of creating, sending, and signing documents, ensuring a smooth experience for all users. Training resources are also available to assist if needed.

Get more for Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year

Find out other Instructions For Form IT 213 Claim For Empire State Child Credit Tax Year

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy