Instructions for Form it 213, Claim for Empire State Child 2023-2026

Understanding the Instructions for Form IT-213

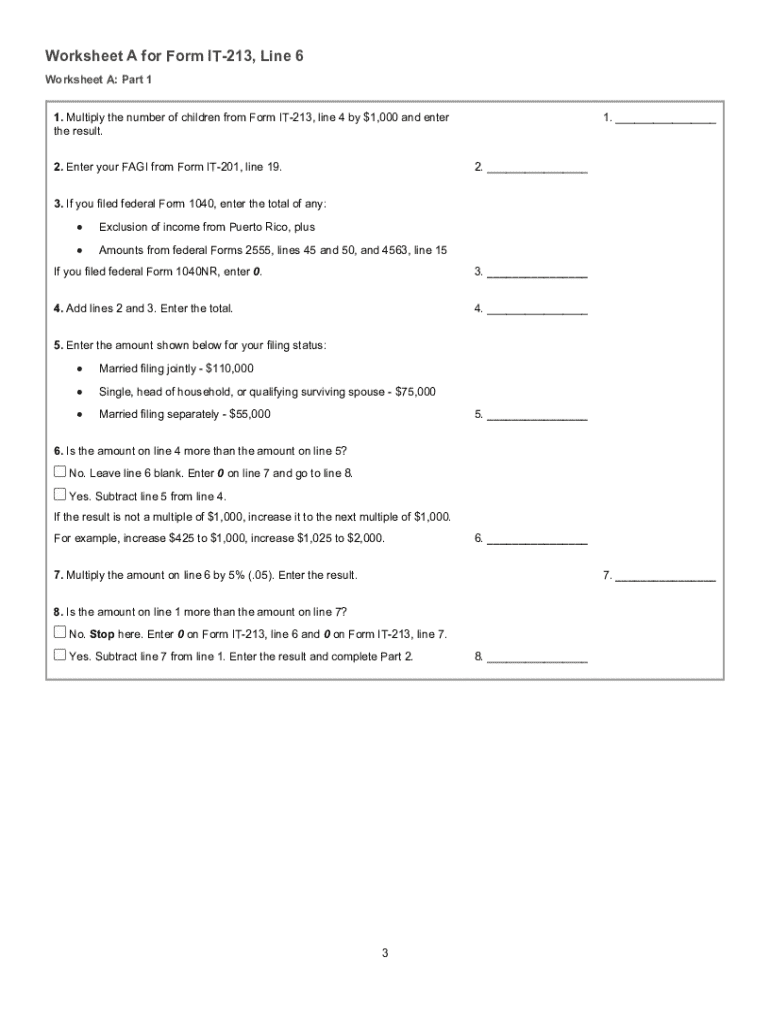

The Instructions for Form IT-213, also known as the Claim for Empire State Child Credit, provide essential guidance for taxpayers in New York who wish to claim this credit. This form is designed to help eligible families receive financial assistance for their dependent children. The instructions outline the eligibility criteria, necessary documentation, and specific steps required to complete the form accurately.

Steps to Complete Form IT-213

Completing Form IT-213 involves several key steps to ensure accuracy and compliance. First, gather all required information, including Social Security numbers for both the taxpayer and dependents. Next, carefully read through the instructions to understand the eligibility requirements and the calculations needed for the credit. Fill out the form by entering the necessary details, ensuring that all figures are accurate. Finally, review the completed form for errors before submission.

Eligibility Criteria for Form IT-213

To qualify for the Empire State Child Credit using Form IT-213, taxpayers must meet specific eligibility criteria. This includes having a qualifying child under the age of 17 at the end of the tax year. The taxpayer must also have a valid Social Security number and meet certain income thresholds. It is important to review the detailed eligibility requirements outlined in the form instructions to ensure compliance.

Required Documents for Form IT-213

When filing Form IT-213, certain documents are necessary to support the claim for the Empire State Child Credit. Taxpayers should prepare copies of their federal tax return, proof of income, and documentation confirming the relationship to the qualifying child. This may include birth certificates or adoption papers. Ensuring all required documents are submitted can help avoid delays in processing the claim.

Form Submission Methods for IT-213

Taxpayers can submit Form IT-213 through various methods. The form can be filed electronically using approved tax software, which may streamline the process and reduce errors. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate state tax office. In-person submissions are also possible at designated tax offices, providing another option for those who prefer direct interaction.

Filing Deadlines for Form IT-213

It is crucial to be aware of the filing deadlines associated with Form IT-213 to ensure timely submission. Generally, the form must be filed by the same deadline as the federal tax return, which is typically April 15. However, if taxpayers file for an extension on their federal return, they may also extend the deadline for Form IT-213. Staying informed about these dates helps prevent penalties and ensures eligibility for the credit.

Quick guide on how to complete instructions for form it 213 claim for empire state child

Complete Instructions For Form IT 213, Claim For Empire State Child effortlessly on any gadget

Web-based document management has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Instructions For Form IT 213, Claim For Empire State Child across any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to edit and electronically sign Instructions For Form IT 213, Claim For Empire State Child with ease

- Locate Instructions For Form IT 213, Claim For Empire State Child and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a standard wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Instructions For Form IT 213, Claim For Empire State Child and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form it 213 claim for empire state child

Create this form in 5 minutes!

How to create an eSignature for the instructions for form it 213 claim for empire state child

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny 213 state form, and why is it important?

The ny 213 state form is a specific document required for various administrative tasks in New York. It is crucial for ensuring compliance with state regulations and facilitating smoother business operations. Understanding this form can help prevent errors and delays in processing official documents.

-

How can I complete the ny 213 state form using airSlate SignNow?

You can easily complete the ny 213 state form with airSlate SignNow's intuitive platform. Simply upload the form, fill in the required fields, and utilize our eSignature feature for a seamless signing experience. This automation saves you time and effort, ensuring your documents are processed quickly.

-

What are the pricing options for using airSlate SignNow to manage the ny 213 state form?

airSlate SignNow offers several pricing plans to accommodate different business needs when handling the ny 213 state form. Our competitive pricing ensures that you have access to essential features without breaking the bank. Check our website for detailed pricing tiers and find the best option for your organization.

-

What features does airSlate SignNow offer for the ny 213 state form?

airSlate SignNow provides a range of features specifically designed for managing the ny 213 state form, including document templates, eSignatures, and secure cloud storage. These features enhance your efficiency and improve collaboration among team members. Additionally, our audit trails ensure compliance and security.

-

Can I integrate airSlate SignNow with other applications for handling the ny 213 state form?

Yes, airSlate SignNow allows you to integrate seamlessly with various applications, enhancing your workflow for the ny 213 state form. Popular integrations include Google Drive, Dropbox, and CRM tools, which streamline your document management process. This connectivity improves productivity and ensures all data is synchronized across platforms.

-

Is airSlate SignNow suitable for small businesses needing to handle the ny 213 state form?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including small businesses that require efficient handling of the ny 213 state form. Our user-friendly interface and affordable pricing make it accessible for many users. Plus, the ability to automate processes can lead to signNow time savings.

-

What are the benefits of using airSlate SignNow for the ny 213 state form compared to traditional methods?

Using airSlate SignNow for the ny 213 state form offers numerous benefits over traditional methods. You can expect faster processing times, reduced paper usage, and enhanced security with eSignatures. Furthermore, our platform simplifies collaboration, ensuring all stakeholders can access and sign documents easily.

Get more for Instructions For Form IT 213, Claim For Empire State Child

- Model release form doc

- City of fort smith project concern utility assistance form

- Equipo plan personal en una pgina ppup form

- Ps kenya education through listening etl manual pskenya form

- Customer ddr form b 550 setup p1

- Richmond public schools field trip request within 50 miles form

- Paws for action worksheet form

- Debt equity swap agreement template form

Find out other Instructions For Form IT 213, Claim For Empire State Child

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now