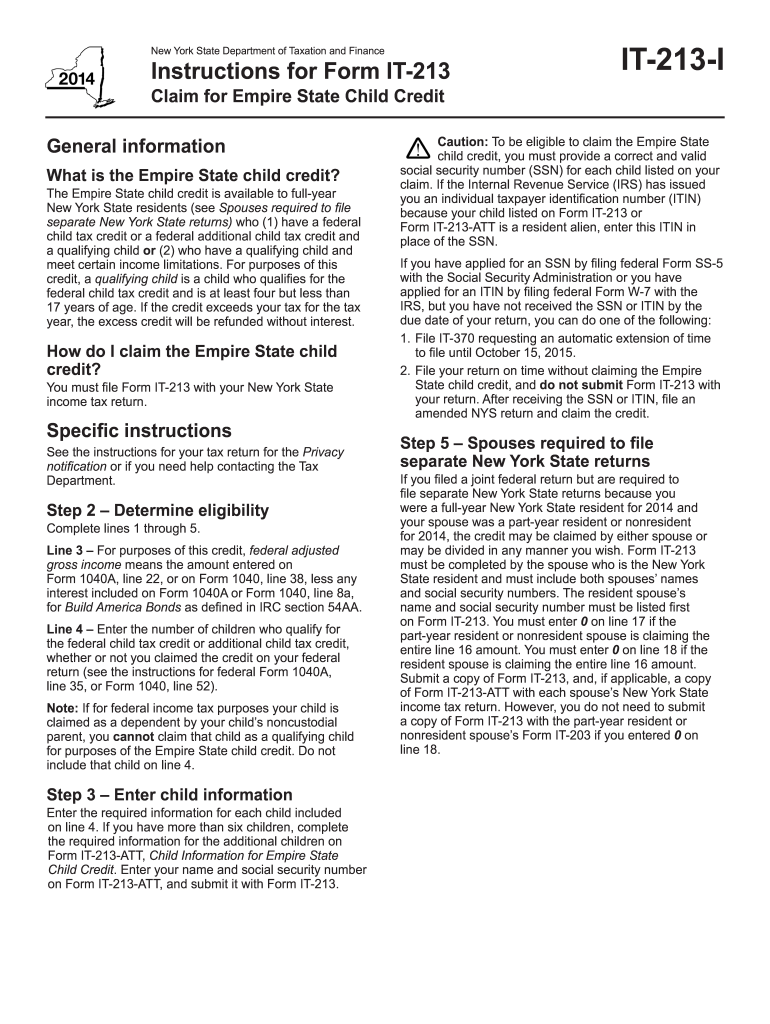

it 213 Instructions Form 2014

What is the It 213 Instructions Form

The It 213 Instructions Form is a tax-related document used in the United States to provide specific guidance on completing a particular tax return. This form is essential for taxpayers to accurately report their income, deductions, and credits to the Internal Revenue Service (IRS). By following the instructions outlined in this form, individuals can ensure compliance with federal tax laws and avoid potential penalties.

How to use the It 213 Instructions Form

Using the It 213 Instructions Form involves several straightforward steps. First, download the form from a reliable source, ensuring it is the most current version. Next, carefully read through the instructions provided in the form to understand the requirements for completing your tax return. Fill out the necessary fields with accurate information, and refer back to the instructions as needed. Once completed, ensure that you sign and date the form before submitting it to the IRS.

Steps to complete the It 213 Instructions Form

Completing the It 213 Instructions Form requires attention to detail. Here are the steps to follow:

- Download the form from an official source.

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documents, such as W-2s or 1099s.

- Fill out the form accurately, ensuring all information is correct.

- Review the completed form for any errors or omissions.

- Sign and date the form before submission.

- Submit the form according to the guidelines provided, whether online or by mail.

Legal use of the It 213 Instructions Form

The It 213 Instructions Form is legally recognized as a valid document for tax reporting purposes. When completed accurately and submitted on time, it helps taxpayers comply with federal tax regulations. It is important to ensure that all information provided is truthful and complete to avoid legal repercussions, such as fines or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the It 213 Instructions Form are crucial for taxpayers to adhere to in order to avoid penalties. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to filing deadlines each tax year.

Form Submission Methods (Online / Mail / In-Person)

The It 213 Instructions Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can file electronically using IRS-approved software, which often streamlines the process.

- Mail: The completed form can be printed and sent to the appropriate IRS address, as specified in the instructions.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or authorized tax preparation locations.

Quick guide on how to complete it 213 instructions 2014 form

Your assistance manual on how to prepare your It 213 Instructions Form

If you’re interested in understanding how to generate and transmit your It 213 Instructions Form, here are a few concise recommendations on how to simplify tax submission.

To start, you just need to sign up for your airSlate SignNow account to change how you manage documentation online. airSlate SignNow is an extremely user-friendly and robust document tool that enables you to modify, generate, and complete your income tax forms effortlessly. With its editor, you can transition between text, check boxes, and electronic signatures and return to update details as needed. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your It 213 Instructions Form in a matter of minutes:

- Create your profile and start working on PDFs quickly.

- Utilize our directory to locate any IRS tax document; sift through variations and schedules.

- Click Get form to access your It 213 Instructions Form in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if required).

- Review your document and amend any errors.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting by mail can lead to return errors and delay refunds. Before e-filing your taxes, remember to check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 213 instructions 2014 form

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 213 instructions 2014 form

How to generate an electronic signature for the It 213 Instructions 2014 Form in the online mode

How to generate an electronic signature for your It 213 Instructions 2014 Form in Chrome

How to create an electronic signature for signing the It 213 Instructions 2014 Form in Gmail

How to make an eSignature for the It 213 Instructions 2014 Form straight from your smart phone

How to create an eSignature for the It 213 Instructions 2014 Form on iOS devices

How to generate an eSignature for the It 213 Instructions 2014 Form on Android devices

People also ask

-

What is the It 213 Instructions Form and how can airSlate SignNow help?

The It 213 Instructions Form is a crucial document for specific tax filings. With airSlate SignNow, you can easily prepare, send, and eSign the It 213 Instructions Form, streamlining your tax documentation process and ensuring compliance.

-

How much does airSlate SignNow cost for using the It 213 Instructions Form?

airSlate SignNow offers flexible pricing plans that cater to different business needs. By subscribing, you gain access to features that simplify the management of the It 213 Instructions Form, all at a competitive cost.

-

What features does airSlate SignNow provide for the It 213 Instructions Form?

airSlate SignNow includes features such as document templates, real-time tracking, and automated reminders for the It 213 Instructions Form. These tools enhance efficiency and ensure that your documents are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications when handling the It 213 Instructions Form?

Yes, airSlate SignNow offers seamless integrations with numerous applications, making it easy to manage the It 213 Instructions Form alongside your existing workflows. This ensures a cohesive experience across all your business tools.

-

What are the benefits of using airSlate SignNow for the It 213 Instructions Form?

Using airSlate SignNow for the It 213 Instructions Form brings numerous benefits, including enhanced accuracy, reduced processing time, and improved collaboration. This user-friendly platform allows you to focus more on your core business operations.

-

Is airSlate SignNow secure for managing the It 213 Instructions Form?

Absolutely! airSlate SignNow employs advanced security measures, ensuring that your It 213 Instructions Form and all related documents are protected. Your data is encrypted and stored securely, providing peace of mind.

-

How can I get started with airSlate SignNow for the It 213 Instructions Form?

Getting started with airSlate SignNow is straightforward. Simply sign up for an account, explore the templates available for the It 213 Instructions Form, and begin creating and sending your documents in just a few clicks.

Get more for It 213 Instructions Form

- Okdhslive form

- Hankook warranty claim form pdf

- Carefirst reimbursement form

- Write trace amp say the numbers 11 20 form

- Independent work behavior checklist form

- Swimming pool rules and regulations v20120519 cleaneddocx campusvillage form

- Gie dental lab work authorization form

- Officer and director nomination formif you

Find out other It 213 Instructions Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors