Magnetic Media Reporting Ohio Department of Taxation Ohiogov Tax Ohio 2015

Understanding the Magnetic Media Reporting for Ohio Department of Taxation

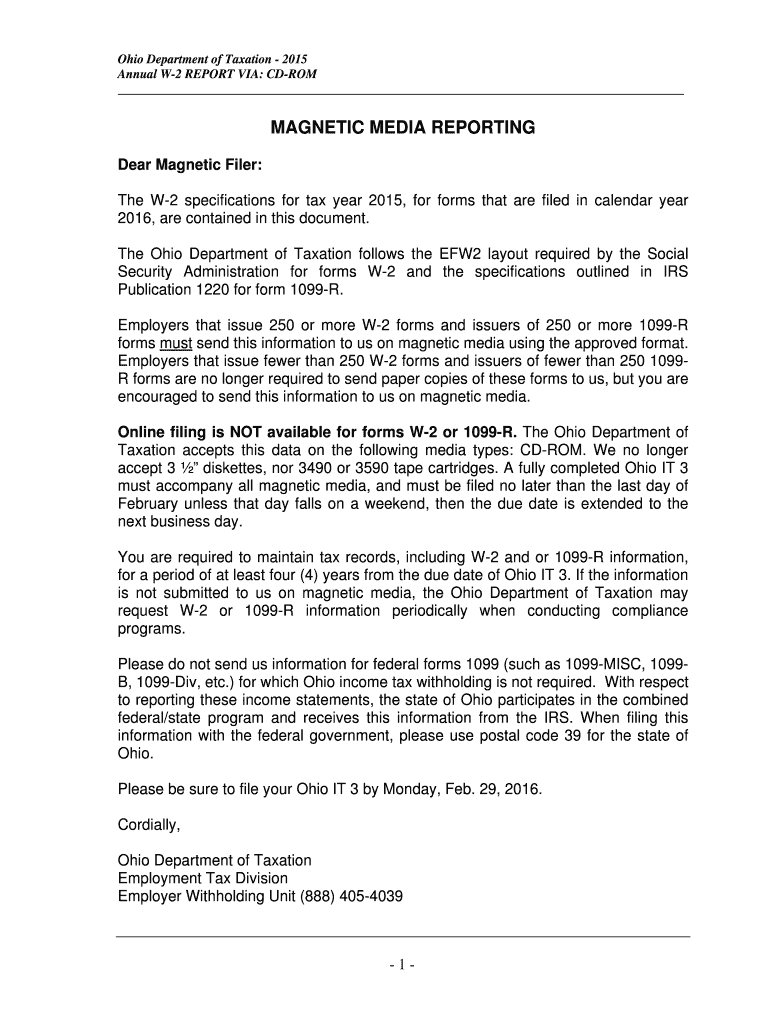

The Magnetic Media Reporting form is a crucial document for taxpayers in Ohio, specifically designed for electronic filing of tax information. This form allows businesses and individuals to report various tax-related data in a digital format, ensuring compliance with state regulations. The Ohio Department of Taxation mandates the use of this form to facilitate efficient processing and accurate record-keeping of tax submissions. By utilizing magnetic media reporting, taxpayers can streamline their filing process and reduce the likelihood of errors that may occur with traditional paper forms.

Steps to Complete the Magnetic Media Reporting Form

Completing the Magnetic Media Reporting form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information and documentation relevant to your tax situation. Next, access the electronic version of the form through the Ohio Department of Taxation's official website. Carefully fill in the required fields, ensuring that all data is accurate and complete. Once the form is filled out, review it for any errors or omissions. After confirming that all information is correct, you can proceed to eSign the document using a secure eSignature solution like signNow, which enhances the security and validity of your submission.

Legal Use of the Magnetic Media Reporting Form

The Magnetic Media Reporting form is recognized as a legally binding document when completed and submitted according to the guidelines set forth by the Ohio Department of Taxation. It is essential to adhere to the specific requirements outlined in the form, as failure to do so may result in penalties or delays in processing. The form must be signed electronically or manually, depending on the submission method chosen. Utilizing a compliant eSignature solution ensures that your electronic signature meets legal standards and provides an audit trail for verification purposes.

Filing Deadlines for Magnetic Media Reporting

Timely submission of the Magnetic Media Reporting form is critical to avoid penalties and ensure compliance with Ohio tax laws. The filing deadlines are typically aligned with the annual tax filing dates set by the Ohio Department of Taxation. It is advisable to check the official website for specific dates each tax year, as they may vary. Marking these deadlines on your calendar can help ensure that you complete your reporting on time and avoid any late fees or complications with your tax status.

Form Submission Methods for Magnetic Media Reporting

Taxpayers have several options for submitting the Magnetic Media Reporting form. The preferred method is electronic submission, which can be done through the Ohio Department of Taxation's online portal. This method not only speeds up the processing time but also allows for immediate confirmation of receipt. Alternatively, taxpayers may choose to submit the form via mail or in person at designated tax offices. Regardless of the submission method, it is important to keep a copy of the submitted form for your records.

Key Elements of the Magnetic Media Reporting Form

The Magnetic Media Reporting form includes several key elements that must be accurately completed. These elements typically encompass taxpayer identification information, financial data relevant to the reporting period, and any applicable deductions or credits. It is essential to provide precise information in each section to ensure compliance and avoid potential audits. Additionally, understanding the specific requirements for each field can help streamline the completion process and enhance the overall accuracy of your submission.

Quick guide on how to complete magnetic media reporting ohio department of taxation ohiogov tax ohio

Your assistance manual on how to prepare your Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio

If you’re wondering how to construct and send your Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio, here are some brief guidelines on how to streamline your tax submission process.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that allows you to modify, generate, and finalize your income tax files effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to edit details as necessary. Enhance your tax management with advanced PDF editing, electronic signing, and user-friendly sharing.

Follow the instructions below to finalize your Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio in no time:

- Create your account and start working on PDFs in moments.

- Utilize our directory to locate any IRS tax form; navigate through versions and schedules.

- Click Get form to open your Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio in our editor.

- Complete the required fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and amend any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper filing can increase return errors and delay refunds. Of course, before e-filing your taxes, refer to the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct magnetic media reporting ohio department of taxation ohiogov tax ohio

Create this form in 5 minutes!

How to create an eSignature for the magnetic media reporting ohio department of taxation ohiogov tax ohio

How to make an electronic signature for the Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio online

How to make an eSignature for your Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio in Google Chrome

How to generate an electronic signature for signing the Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio in Gmail

How to create an electronic signature for the Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio from your smartphone

How to make an electronic signature for the Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio on iOS

How to generate an electronic signature for the Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio on Android

People also ask

-

What is Magnetic Media Reporting for the Ohio Department of Taxation?

Magnetic Media Reporting is a required process for businesses in Ohio to submit their tax data electronically to the Ohio Department of Taxation. This helps streamline tax filing and ensures compliance with Ohiogov regulations. By using Magnetic Media Reporting, businesses can avoid penalties associated with inaccurate submissions or late filings.

-

How does airSlate SignNow support Magnetic Media Reporting for Ohio taxes?

airSlate SignNow provides an easy-to-use platform that allows businesses to eSign and send documents related to Magnetic Media Reporting for the Ohio Department of Taxation. Our solution simplifies the submission process, reducing the time spent on paperwork. With compliance features integrated, you can ensure your submissions meet Ohiogov standards.

-

What features does airSlate SignNow offer for Magnetic Media Reporting?

With airSlate SignNow, you can automate the eSigning process, track document status, and securely manage your data. Our platform is designed to help you efficiently handle documents for Magnetic Media Reporting, including templates tailored to Ohio Department of Taxation requirements. We also offer analytics to monitor your submissions.

-

Is airSlate SignNow cost-effective for businesses filing Magnetic Media Reporting in Ohio?

Yes, airSlate SignNow is a cost-effective solution for managing your Magnetic Media Reporting needs with the Ohio Department of Taxation. We provide various pricing plans that fit businesses of all sizes, ensuring you only pay for the features you need. Our service minimizes manual processes, saving you both time and money.

-

Can airSlate SignNow integrate with existing accounting software for Magnetic Media Reporting?

Absolutely! airSlate SignNow supports integrations with popular accounting and tax software that can enhance your Magnetic Media Reporting experience. This ensures that your financial data is seamlessly accessible, which simplifies the submission process to the Ohio Department of Taxation. Check our integrations section for a list of compatible software.

-

What are the benefits of using airSlate SignNow for Magnetic Media Reporting?

Using airSlate SignNow for Magnetic Media Reporting ensures that your tax submissions to the Ohio Department of Taxation are efficient and legally compliant. Our platform simplifies document management and encourages faster turnaround times. Additionally, you gain access to user-friendly features that enhance your overall tax filing experience.

-

How secure is airSlate SignNow for handling tax documents for Ohio?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure access controls to protect your documents related to Magnetic Media Reporting for the Ohio Department of Taxation. You can trust that your sensitive tax information is safe when using our services.

Get more for Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio

- Qwertee returns form

- Ethiopian insurance corporation pdf form

- Direct deposit agreement form smokey bones jobs

- Wellsense fitness reimbursement form

- Cameron cougar gear pre order form

- Electric service application pepco form

- Restricted stock purchase agreement template form

- Restricted stock award agreement template form

Find out other Magnetic Media Reporting Ohio Department Of Taxation Ohiogov Tax Ohio

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer