Form 8857 Rev December Internal Revenue Service

What is the Form 8857 Rev December Internal Revenue Service

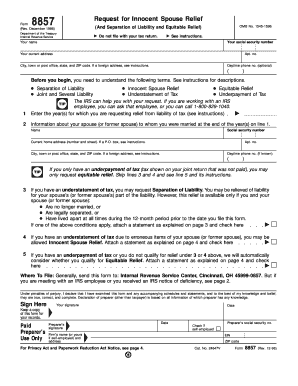

Form 8857, also known as the Request for Innocent Spouse Relief, is a tax form issued by the Internal Revenue Service (IRS). This form allows individuals to request relief from joint tax liability when they believe that their spouse or former spouse improperly reported income, claimed improper deductions, or failed to pay tax. The form is crucial for those who feel they should not be held responsible for tax debts incurred during a marriage.

How to use the Form 8857 Rev December Internal Revenue Service

To effectively use Form 8857, individuals must complete the form with accurate information regarding their tax situation. The form requires details about the tax year in question, the income reported, and any discrepancies that may have occurred. It is essential to provide supporting documentation that illustrates why the individual believes they qualify for relief. Once completed, the form should be submitted to the IRS for consideration.

Steps to complete the Form 8857 Rev December Internal Revenue Service

Completing Form 8857 involves several steps:

- Gather relevant financial documents, including tax returns and any correspondence with the IRS.

- Fill out personal information, including your name, address, and Social Security number.

- Indicate the tax years for which you seek relief and explain the circumstances that justify your request.

- Attach any supporting documents that substantiate your claim.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for relief under Form 8857, certain criteria must be met. Applicants must demonstrate that they were unaware of the tax issues caused by their spouse or former spouse. Additionally, they must show that it would be unfair to hold them liable for the tax debt. The IRS considers factors such as marital status, knowledge of the tax situation, and the potential for economic hardship when evaluating eligibility.

Required Documents

When submitting Form 8857, it is important to include specific documents to support your request. Required documents may include:

- Copies of tax returns for the years in question.

- Any notices received from the IRS regarding the tax liability.

- Proof of income and expenses that relate to the tax years.

- Documentation that demonstrates your lack of knowledge about the tax issues.

Form Submission Methods

Form 8857 can be submitted to the IRS through various methods. Individuals may choose to mail the completed form to the appropriate IRS address. Alternatively, some may opt to submit it in person at a local IRS office. It is important to check the IRS website for specific submission guidelines and any updates regarding electronic submission options, as these may change.

Quick guide on how to complete form 8857 rev december internal revenue service

Easily Prepare Form 8857 Rev December Internal Revenue Service on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 8857 Rev December Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Form 8857 Rev December Internal Revenue Service with Ease

- Obtain Form 8857 Rev December Internal Revenue Service and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes a few seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8857 Rev December Internal Revenue Service to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8857 rev december internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8857 Rev December Internal Revenue Service?

Form 8857 Rev December Internal Revenue Service is a form used by individuals seeking relief from joint tax liability. This form allows taxpayers to request equitable relief from joint responsibility for tax debts incurred during marriage. Understanding this form is crucial for anyone facing joint liability issues.

-

How can airSlate SignNow help with Form 8857 Rev December Internal Revenue Service?

airSlate SignNow provides a user-friendly platform to electronically sign and send Form 8857 Rev December Internal Revenue Service efficiently. Our solution streamlines the document process, allowing you to create, manage, and track your forms easily. This saves you time and ensures that your submission is accurate and timely.

-

What are the pricing options for using airSlate SignNow to process Form 8857 Rev December Internal Revenue Service?

airSlate SignNow offers various pricing options, ensuring that you can find a plan that suits your business needs when processing Form 8857 Rev December Internal Revenue Service. Our plans are competitively priced and include a range of features to help simplify your eSigning and document management tasks. Sign up today to explore our pricing options.

-

Are there any benefits to using airSlate SignNow for Form 8857 Rev December Internal Revenue Service?

Yes, using airSlate SignNow for Form 8857 Rev December Internal Revenue Service offers numerous benefits, including enhanced document security, quicker turnaround times, and the ability to access your forms from anywhere. Additionally, our platform is designed to ensure compliance with tax regulations and protect sensitive information throughout the electronic signing process.

-

What features does airSlate SignNow offer for managing Form 8857 Rev December Internal Revenue Service?

airSlate SignNow includes features such as drag-and-drop document uploads, customizable templates, and real-time tracking for Form 8857 Rev December Internal Revenue Service. You can also set reminders for signatures, manage workflow approvals, and collaborate with multiple signers seamlessly. These features simplify document management and help ensure that your forms are completed promptly.

-

Can airSlate SignNow integrate with other software for processing Form 8857 Rev December Internal Revenue Service?

Absolutely! airSlate SignNow integrates with a variety of other software tools, enabling you to streamline your processes when handling Form 8857 Rev December Internal Revenue Service. Whether you're using CRM systems, cloud storage apps, or accounting software, our integrations make it easy to share and manage your documents efficiently.

-

How does airSlate SignNow ensure security for Form 8857 Rev December Internal Revenue Service?

Security is a priority for airSlate SignNow when processing Form 8857 Rev December Internal Revenue Service. We utilize advanced encryption protocols and secure servers to protect your data. Additionally, our platform complies with legal regulations to ensure that all electronic signatures are valid and secure, safeguarding your sensitive information.

Get more for Form 8857 Rev December Internal Revenue Service

- North dakota medicaid individual provider application form

- Formsnorth dakota insurance department ndgov

- Fillable online notice of installation form t fax email

- Letterhead assistant commissioner form

- 51319 title vi non discrimination complaint form njgov

- This form is only to be used to request the reprint of licenses due to the loss of the original documents previously issued by

- New jersey general bill of sale form

- Stop vawa progress report form updated 91117

Find out other Form 8857 Rev December Internal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors