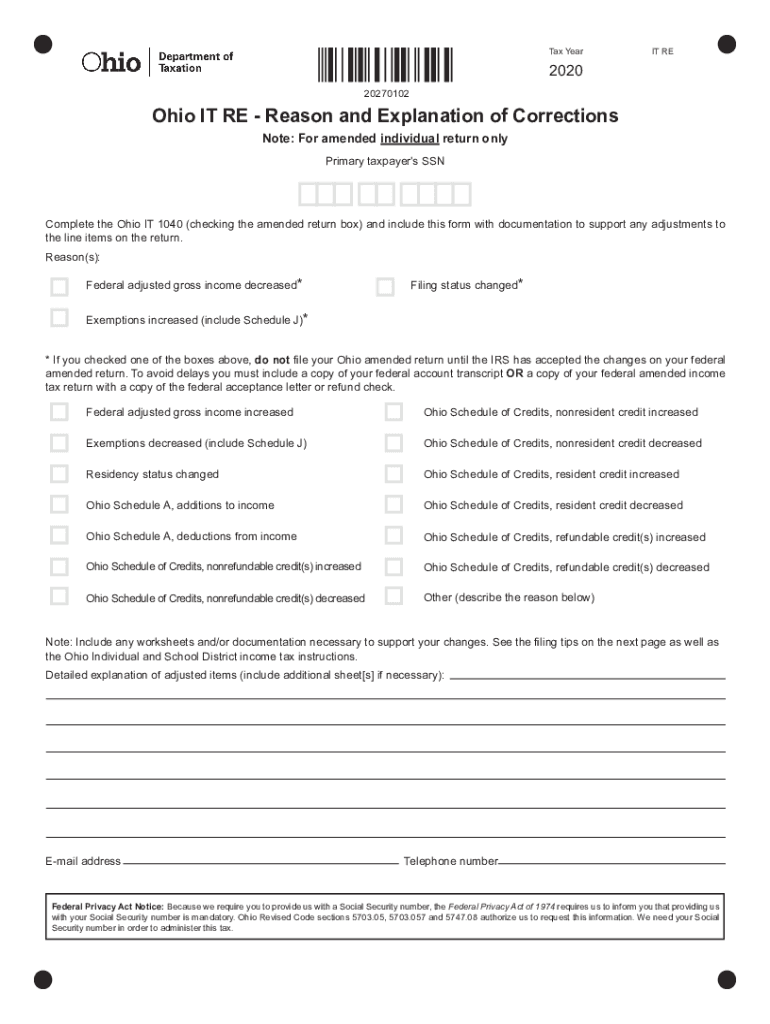

NO RETURNS Ohio Department of Taxation 2020

Understanding the Ohio Department of Taxation's NO RETURNS Form

The NO RETURNS form is a specific document issued by the Ohio Department of Taxation. It is designed for individuals or entities that do not have a tax liability in Ohio for a given tax year. This form allows taxpayers to formally declare that they are not required to file a return, which can help avoid penalties for non-filing.

Steps to Complete the NO RETURNS Form

Completing the NO RETURNS form involves several straightforward steps:

- Gather necessary information, including your name, address, and Social Security number or Employer Identification Number (EIN).

- Indicate the tax year for which you are filing the NO RETURNS form.

- Provide any additional information required by the Ohio Department of Taxation, such as income details or reasons for not filing.

- Review the form for accuracy and completeness before submission.

Legal Use of the NO RETURNS Form

The NO RETURNS form serves a legal purpose by officially notifying the Ohio Department of Taxation that you do not have a tax obligation for the specified year. This declaration can protect you from potential penalties associated with failing to file a return. It is important to ensure that all information provided is accurate to maintain compliance with state tax laws.

Required Documents for Submission

When submitting the NO RETURNS form, you may need to include certain supporting documents, such as:

- Proof of income or lack thereof for the tax year in question.

- Any relevant correspondence from the Ohio Department of Taxation.

- Identification documents, if applicable.

Filing Deadlines for the NO RETURNS Form

It is crucial to be aware of the filing deadlines for the NO RETURNS form to avoid penalties. Typically, the form should be submitted by the same deadline as regular tax returns. For most taxpayers, this means filing by April 15 of the following year. However, if you are unable to meet this deadline, it is advisable to check for any extensions or specific guidelines from the Ohio Department of Taxation.

Form Submission Methods

The NO RETURNS form can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission through the Ohio Department of Taxation's website.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person delivery at designated tax offices across Ohio.

Quick guide on how to complete no returns ohio department of taxation

Prepare NO RETURNS Ohio Department Of Taxation effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Handle NO RETURNS Ohio Department Of Taxation on any device using airSlate SignNow’s applications for Android or iOS and enhance any document-based workflow today.

How to adjust and eSign NO RETURNS Ohio Department Of Taxation with ease

- Obtain NO RETURNS Ohio Department Of Taxation and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers.

- Craft your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign NO RETURNS Ohio Department Of Taxation and ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct no returns ohio department of taxation

Create this form in 5 minutes!

How to create an eSignature for the no returns ohio department of taxation

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the primary function of airSlate SignNow's 'form it re' feature?

The 'form it re' feature allows users to create, send, and eSign documents seamlessly. By leveraging this functionality, businesses can streamline their document processes and ensure that all necessary forms are efficiently filled and signed.

-

How does 'form it re' improve the efficiency of document management?

'form it re' simplifies the document management workflow by automating signature collection and reducing time spent on manual processes. Users can easily track the status of their documents, ensuring nothing gets lost in the shuffle.

-

What pricing plans are available for using airSlate SignNow's 'form it re' feature?

airSlate SignNow offers various pricing plans that include access to the 'form it re' feature. Depending on your business needs, you can choose a plan that best fits your budget and required functionalities.

-

Are there any integrations available with the 'form it re' feature?

Yes, the 'form it re' feature integrates with several popular applications, enhancing its versatility. Users can connect with tools they already use, facilitating a smoother workflow and improving overall productivity.

-

What are the benefits of using the 'form it re' feature for small businesses?

For small businesses, the 'form it re' feature offers cost-effective solutions for document signing and management. It not only saves time but also reduces operational costs associated with paper-based processes.

-

Can I customize documents created with the 'form it re' feature?

Absolutely! The 'form it re' feature allows users to customize documents to fit their branding and specific requirements. This flexibility helps maintain brand consistency and addresses individual client needs.

-

Is technical support available for the 'form it re' users?

Yes, airSlate SignNow provides dedicated technical support for all users of the 'form it re' feature. Whether you encounter a technical issue or need assistance, support is readily available to ensure a seamless experience.

Get more for NO RETURNS Ohio Department Of Taxation

Find out other NO RETURNS Ohio Department Of Taxation

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document