IRS Introduces a Domestic Filing Exception to Schedules K 2023

Understanding the IRS Schedule K-3

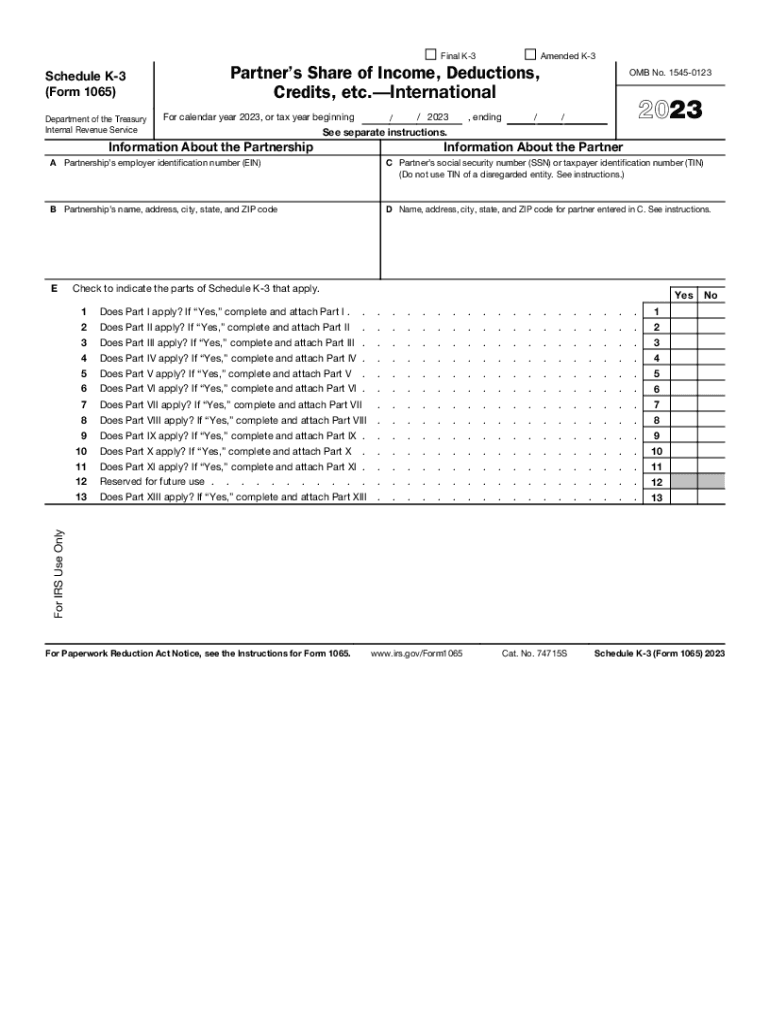

The IRS Schedule K-3 is a tax form designed for partnerships and S corporations to report income, deductions, and credits to their partners and shareholders. This form is essential for ensuring that all income is accurately reported to the IRS, particularly for entities that have international activities or foreign partners. The K-3 form provides detailed information about each partner's share of the entity's income, which is crucial for their individual tax returns.

Key Elements of the Schedule K-3

Several important components make up the Schedule K-3. These include:

- Partner's Share of Income: This section outlines the specific amounts of income allocated to each partner.

- Deductions and Credits: Partners can see their share of deductions and credits that may affect their tax liability.

- Foreign Transactions: If applicable, this section details any foreign income or taxes paid, which is vital for partners with international dealings.

Filing Deadlines for Schedule K-3

Timely filing of the Schedule K-3 is crucial to avoid penalties. Generally, the deadline for partnerships to file their tax returns, including the K-3, is March 15 of each year. If the partnership applies for an extension, the deadline may be extended to September 15. However, partners should receive their K-3 in a timely manner to prepare their own tax returns by the April 15 deadline.

Obtaining the Schedule K-3 Form

To obtain the Schedule K-3 form, partnerships and S corporations must download it directly from the IRS website. The form is available in PDF format, which can be filled out electronically or printed for manual completion. It is essential to ensure that the latest version of the form is used to comply with current IRS regulations.

Submission Methods for Schedule K-3

Partners can submit their completed Schedule K-3 forms through various methods. The IRS accepts electronic submissions via e-filing for partnerships that meet specific criteria. Alternatively, the form can be mailed to the IRS at the address specified in the form instructions. In-person submissions are generally not accepted for this form.

Penalties for Non-Compliance with Schedule K-3

Failure to file the Schedule K-3 or inaccuracies can result in significant penalties. The IRS may impose fines for late filing or for providing incorrect information. It is important for partnerships to ensure that the K-3 is completed accurately and submitted on time to avoid these financial repercussions.

Quick guide on how to complete irs introduces a domestic filing exception to schedules k

Complete IRS Introduces A Domestic Filing Exception To Schedules K effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage IRS Introduces A Domestic Filing Exception To Schedules K on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign IRS Introduces A Domestic Filing Exception To Schedules K with ease

- Find IRS Introduces A Domestic Filing Exception To Schedules K and click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign IRS Introduces A Domestic Filing Exception To Schedules K to ensure excellent communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs introduces a domestic filing exception to schedules k

Create this form in 5 minutes!

How to create an eSignature for the irs introduces a domestic filing exception to schedules k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K 3 and how does it work?

A Schedule K 3 is a tax document used to report partners' shares of income, deductions, and credits from partnerships. This form provides information relevant to the partners' tax situations, ensuring compliance with IRS regulations. Understanding how to fill out and interpret a Schedule K 3 is essential for accurate tax reporting.

-

How can airSlate SignNow help streamline the Schedule K 3 preparation process?

AirSlate SignNow simplifies the preparation of Schedule K 3 by allowing users to easily create, edit, and send documents for eSigning. With its user-friendly interface, businesses can ensure that all necessary signatures are collected promptly, reducing the overall turnaround time. This efficiency benefits both accountants and their clients by minimizing errors and enhancing communication.

-

What are the costs associated with using airSlate SignNow for Schedule K 3 management?

The pricing for using airSlate SignNow is competitive and varies based on the features chosen. Users can select from several plans that cater to individual or business needs, which can include document storage and advanced eSigning tools. Investing in SignNow can ultimately save businesses time and money when managing important documents like the Schedule K 3.

-

Are there any integration options available for Schedule K 3 software?

AirSlate SignNow offers various integration options with popular accounting and tax preparation software designed for managing Schedule K 3 documents. Integrating SignNow with these tools can streamline your workflow, allowing for seamless data transfer and handling of documents. This provides a central hub for managing your tax documents efficiently.

-

What security measures does airSlate SignNow implement for Schedule K 3 documents?

AirSlate SignNow prioritizes the security of your Schedule K 3 documents with advanced encryption and authentication protocols. This ensures that sensitive tax information remains confidential and protected from unauthorized access. Users can confidently send and store their Schedule K 3 documents, knowing that their data is safe.

-

Can airSlate SignNow facilitate collaboration when preparing a Schedule K 3?

Absolutely! AirSlate SignNow allows multiple users to collaborate on a Schedule K 3 document in real-time, making it easy to gather input from partners or accountants. This feature enhances transparency and ensures that all relevant information is included before finalizing the document. Enhanced collaboration leads to more accurate and timely submissions.

-

Is airSlate SignNow suitable for businesses of all sizes handling Schedule K 3?

Yes, airSlate SignNow is tailored to meet the needs of businesses of all sizes, whether you are a small firm or a large corporation navigating multiple Schedule K 3 documents. Its scalable solutions accommodate the varying demands of users, allowing signNow flexibility in managing eSignatures and document workflows. Every business can benefit from optimizing their Schedule K 3 processes.

Get more for IRS Introduces A Domestic Filing Exception To Schedules K

Find out other IRS Introduces A Domestic Filing Exception To Schedules K

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile