IRS Form 1065 Explained Partnership Tax Filing Guide 2024-2026

Understanding the Schedule K-3 Form

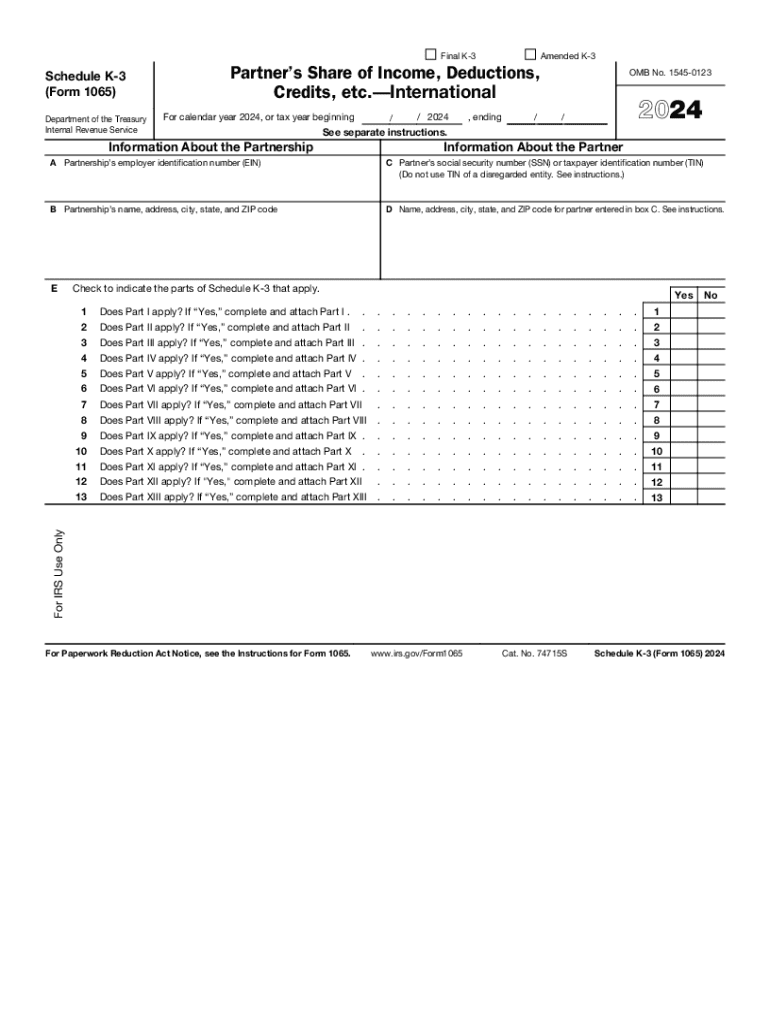

The Schedule K-3 is an essential tax form used by partnerships to report income, deductions, and credits to their partners. It provides detailed information about each partner's share of the partnership's income, which is crucial for individual tax filings. The IRS introduced this form to enhance transparency and ensure that partners receive accurate information for their tax returns. The K-3 is typically filed alongside Form 1065, which is the partnership tax return.

Steps to Complete the Schedule K-3 Form

Completing the Schedule K-3 involves several key steps:

- Gather all necessary financial information related to the partnership's income, deductions, and credits.

- Fill out the partnership's income and loss details on Form 1065, as these figures will feed into the K-3.

- Complete the K-3 by detailing each partner's share of the partnership's items, ensuring accuracy in reporting.

- Review the completed form for any errors or omissions before submission.

- Distribute copies of the K-3 to each partner for their records and tax filings.

Filing Deadlines for the Schedule K-3

The Schedule K-3 must be filed by the partnership's tax return deadline, which is typically March 15 for calendar year partnerships. If the partnership applies for an extension, the K-3 must be submitted by the extended due date. It is important for partnerships to adhere to these deadlines to avoid penalties and ensure that partners receive their K-3s in a timely manner for their own tax filings.

Required Documents for Schedule K-3 Filing

To accurately complete the Schedule K-3, partnerships should prepare the following documents:

- Form 1065, which provides the overall financial picture of the partnership.

- Financial statements, including profit and loss statements and balance sheets.

- Records of each partner's contributions, distributions, and share of liabilities.

- Any supporting documentation related to deductions and credits that will be reported on the K-3.

IRS Guidelines for Schedule K-3

The IRS provides specific guidelines for completing and filing the Schedule K-3. Partnerships must ensure that they accurately report each partner's share of income, deductions, and credits as outlined in the IRS instructions. It is essential to follow these guidelines closely to avoid discrepancies and potential audits. The IRS also emphasizes the importance of providing partners with timely and accurate information to facilitate their own tax compliance.

Penalties for Non-Compliance with Schedule K-3

Failure to file the Schedule K-3 or inaccuracies in reporting can result in penalties for the partnership. The IRS may impose fines for late filing, which can accumulate over time. Additionally, if partners do not receive their K-3s, they may face challenges in accurately reporting their income on their individual tax returns, potentially leading to further penalties. It is crucial for partnerships to ensure compliance with all filing requirements to avoid these issues.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1065 explained partnership tax filing guide

Create this form in 5 minutes!

How to create an eSignature for the irs form 1065 explained partnership tax filing guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-3 and why is it important?

A Schedule K-3 is a tax form used to report income, deductions, and credits for partnerships and S corporations. It is important because it provides detailed information to partners and shareholders about their share of the entity's income, which is essential for accurate tax reporting.

-

How can airSlate SignNow help with Schedule K-3 documentation?

airSlate SignNow simplifies the process of preparing and signing Schedule K-3 documents. With our easy-to-use platform, you can quickly send, eSign, and manage your tax documents securely, ensuring compliance and efficiency in your tax reporting.

-

What features does airSlate SignNow offer for managing Schedule K-3 forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Schedule K-3 forms. These tools help streamline the workflow, reduce errors, and ensure that all necessary signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for handling Schedule K-3 forms?

Yes, airSlate SignNow is a cost-effective solution for managing Schedule K-3 forms. Our pricing plans are designed to fit various business needs, allowing you to save time and money while ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other accounting software for Schedule K-3?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your Schedule K-3 forms alongside your financial data. This integration enhances efficiency and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Schedule K-3?

Using airSlate SignNow for Schedule K-3 offers numerous benefits, including enhanced security, faster turnaround times, and improved collaboration among stakeholders. Our platform ensures that your tax documents are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of Schedule K-3 documents?

airSlate SignNow prioritizes the security of your Schedule K-3 documents by employing advanced encryption and secure cloud storage. This ensures that your sensitive tax information is protected from unauthorized access and data bsignNowes.

Get more for IRS Form 1065 Explained Partnership Tax Filing Guide

- Phases of matter worksheet answers pdf form

- Panchayat license application form

- 24 hour report nc form 29228929

- Waybill template word form

- Form 40sp online

- Birth certificate child name inclusion form

- Instructions for completing the authorization agreement for eft form

- Tournament name 32 player single elimination tournament form

Find out other IRS Form 1065 Explained Partnership Tax Filing Guide

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple