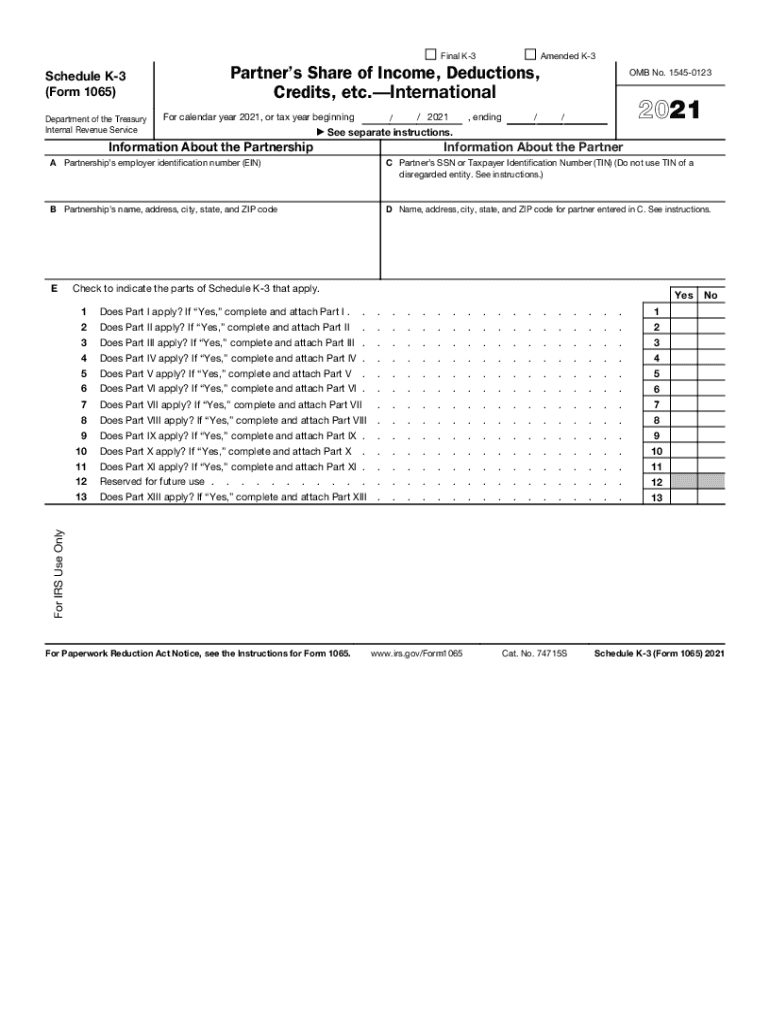

Schedule K 3 2021

What is the Schedule K-3

The Schedule K-3 is a tax form used by partnerships and S corporations to report income, deductions, and credits to their partners or shareholders. This form is part of the IRS Form 1065 and Form 1120-S series and is essential for providing detailed information on international activities, foreign transactions, and other essential tax details. The Schedule K-3 helps ensure that each partner or shareholder accurately reports their share of the entity's income on their individual tax returns, facilitating compliance with U.S. tax laws.

How to use the Schedule K-3

Using the Schedule K-3 involves several steps. First, partnerships and S corporations must complete the form accurately, detailing each partner's or shareholder's share of income, deductions, and credits. Once completed, the form should be distributed to all partners or shareholders, who will then use the information provided to fill out their respective tax returns. It is crucial for recipients to review the information carefully, as it directly affects their tax liabilities. Additionally, ensuring that the Schedule K-3 is filed alongside the appropriate tax returns is essential for compliance.

Steps to complete the Schedule K-3

Completing the Schedule K-3 requires attention to detail and a clear understanding of the entity's financial activities. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and balance sheets.

- Identify each partner's or shareholder's share of income, deductions, and credits.

- Fill out the form accurately, ensuring all figures are correct and reflect the entity's financial activities.

- Review the completed form for accuracy and completeness.

- Distribute the Schedule K-3 to all partners or shareholders in a timely manner.

Legal use of the Schedule K-3

The Schedule K-3 is legally binding when completed and submitted according to IRS guidelines. This means that all information reported must be accurate and reflect the true financial activities of the partnership or S corporation. Failure to comply with IRS regulations regarding the Schedule K-3 can result in penalties and legal repercussions for both the entity and its partners or shareholders. Therefore, it is vital to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K-3 align with the deadlines for Form 1065 and Form 1120-S. Generally, partnerships must file their returns by March 15, while S corporations have the same deadline. Extensions may be available but must be requested timely. It is essential to stay informed about any changes to these deadlines to avoid penalties and ensure compliance with tax regulations.

Who Issues the Form

The Schedule K-3 is issued by the IRS and is part of the tax return filing process for partnerships and S corporations. It is essential for these entities to prepare and distribute the form to their partners or shareholders as part of their annual tax reporting obligations. The IRS provides guidelines and instructions for completing the form, ensuring that it meets all legal requirements.

Quick guide on how to complete schedule k 3

Manage Schedule K 3 seamlessly on any gadget

Digital document organization has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to access the correct format and securely store it online. airSlate SignNow offers all the resources you require to develop, modify, and electronically sign your papers swiftly and without hold-ups. Manage Schedule K 3 on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Schedule K 3 effortlessly

- Locate Schedule K 3 and click Obtain Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important portions of the documents or black out sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click the Finish button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate creating new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Schedule K 3 and guarantee excellent communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 3

Create this form in 5 minutes!

People also ask

-

What is a Schedule K-3?

A Schedule K-3 is a tax form used to report the income, deductions, and credits of partnerships or S corporations to their shareholders. It provides details about the entity's foreign transactions and international tax compliance, offering a clear breakdown of income attributed to each partner. Understanding how to properly fill out a Schedule K-3 can help ensure accurate reporting and compliance with tax obligations.

-

How does airSlate SignNow facilitate the scheduling of a Schedule K-3?

airSlate SignNow allows users to streamline the scheduling and signing process for a Schedule K-3. With an intuitive interface, businesses can quickly upload, prepare, and send documents for eSignature. This not only reduces the time spent on paperwork but also ensures that all parties can easily access and sign the Schedule K-3 digitally, enhancing efficiency.

-

What are the pricing options for using airSlate SignNow for Schedule K-3 forms?

airSlate SignNow offers various pricing plans to cater to different business needs when managing Schedule K-3 forms. Users can choose from monthly or annual subscriptions, which provide options for additional features as required. Regular promotional discounts can also be found, making it a cost-effective solution for handling legal and tax documents.

-

Can I integrate airSlate SignNow with other accounting software for my Schedule K-3?

Yes, airSlate SignNow easily integrates with popular accounting and tax software to manage your Schedule K-3 efficiently. This ensures that all data flows seamlessly between applications, allowing for better tracking and reporting of tax compliance. Integrations can enhance productivity by pre-filling forms and automating workflow processes.

-

What features does airSlate SignNow provide for Schedule K-3 management?

airSlate SignNow offers several robust features for managing Schedule K-3, including customizable templates, secure eSignature capabilities, and automated tracking of document statuses. Users can set reminders to ensure timely submissions, and the platform provides compliance checks to minimize errors. These features streamline the document workflow, making it simple to manage your Schedule K-3.

-

Is airSlate SignNow secure for handling Schedule K-3 documents?

Absolutely, airSlate SignNow prioritizes security when managing Schedule K-3 documents. The platform is equipped with advanced encryption technology and complies with industry standards to protect sensitive information. Users can rest assured that their eSigned documents are secure and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for Schedule K-3 forms?

Using airSlate SignNow for Schedule K-3 forms provides numerous benefits, including time savings and increased accuracy in document preparation. The user-friendly interface simplifies the eSignature process, ensuring that all parties can quickly review and sign forms. Moreover, the digital nature of airSlate SignNow reduces paper waste and storage needs, contributing to a more eco-friendly approach.

Get more for Schedule K 3

Find out other Schedule K 3

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now