Schedules K 2 and K 3 Frequently Asked Questions Forms 1065, 1120S 2022

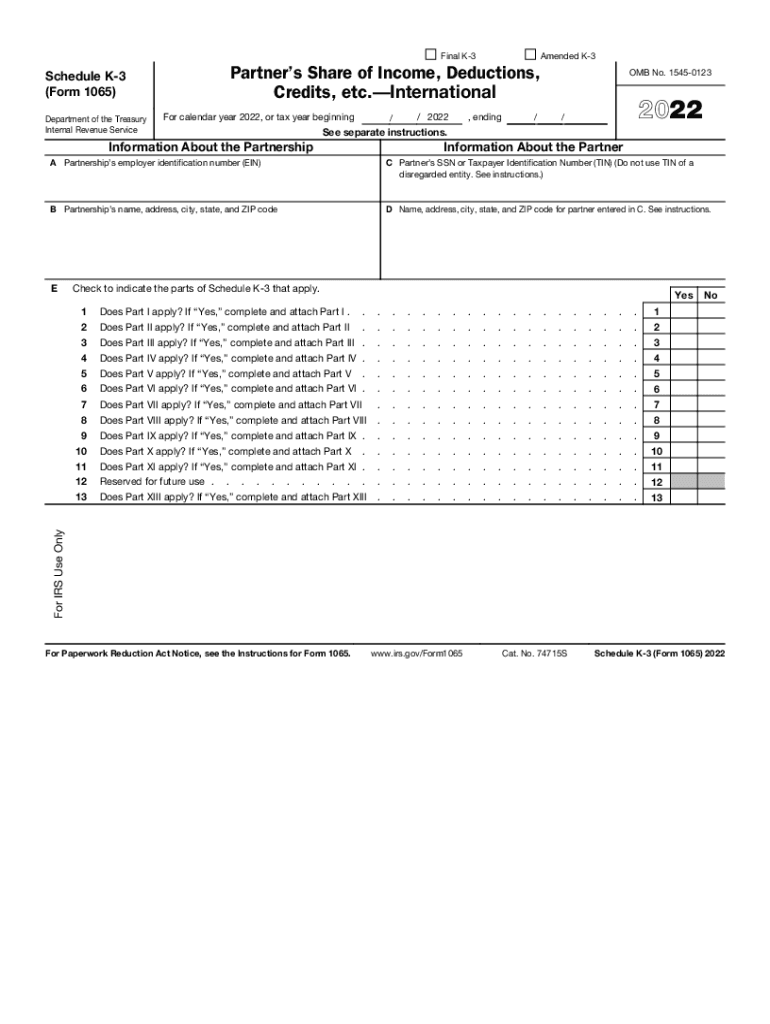

What is the IRS Schedule K-3?

The IRS Schedule K-3 is a tax form designed for partnerships and S corporations to report income, deductions, and credits to their partners and shareholders. It provides detailed information about each partner's or shareholder's share of the entity's income, deductions, and credits, which is essential for accurate tax reporting. This form complements the IRS Schedule K-2, which outlines the entity's overall tax information. Together, they ensure that all partners and shareholders receive the necessary details to complete their individual tax returns accurately.

Steps to Complete the IRS Schedule K-3

Completing the IRS Schedule K-3 involves several key steps to ensure accuracy and compliance. First, gather all relevant financial information from the partnership or S corporation, including income statements and expense reports. Next, accurately allocate income, deductions, and credits to each partner or shareholder based on their ownership percentage. It is crucial to ensure that the figures reported on Schedule K-3 align with those on the entity's tax return. Finally, review the form for any errors and submit it along with the entity's tax return to the IRS.

Filing Deadlines for the IRS Schedule K-3

The IRS Schedule K-3 must be filed along with the entity's tax return. For partnerships, the deadline is typically March 15, while S corporations must file by the same date. If additional time is needed, entities can apply for an extension, which generally allows for a six-month extension to file. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal Use of the IRS Schedule K-3

The IRS Schedule K-3 is legally binding and must be completed in accordance with IRS guidelines. It is important to ensure that all information reported is accurate and complete, as inaccuracies can lead to penalties or audits. The form must be provided to all partners and shareholders, as they rely on this information to report their income accurately on their personal tax returns. Compliance with eSignature laws can also enhance the legal standing of the document when submitted electronically.

Who Issues the IRS Schedule K-3?

The IRS Schedule K-3 is issued by the Internal Revenue Service (IRS) as part of the tax filing process for partnerships and S corporations. It is essential for entities to ensure that they are using the most current version of the form, as updates may occur annually. The IRS provides guidelines and instructions for completing the form, which should be followed closely to ensure compliance with federal tax regulations.

Examples of Using the IRS Schedule K-3

Entities such as partnerships and S corporations utilize the IRS Schedule K-3 to report income and deductions to their partners and shareholders. For instance, a partnership with three partners must allocate its total income and expenses among them based on their ownership percentages. Each partner will receive a copy of the Schedule K-3 detailing their respective shares, which they will then use to report their income on their individual tax returns. This process ensures transparency and compliance with tax laws.

Quick guide on how to complete schedules k 2 and k 3 frequently asked questions forms 1065 1120s

Effortlessly prepare Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S on any device

Digital document management has become widely accepted by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Handle Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S effortlessly

- Find Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S and ensure exceptional communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedules k 2 and k 3 frequently asked questions forms 1065 1120s

Create this form in 5 minutes!

People also ask

-

What is the schedule k 3 and how does it work?

The schedule k 3 is a tax form that is used to report income, deductions, and credits from partnerships and S corporations. It effectively provides detailed information that flows from the partnership or S corporation to the individual partners or shareholders, ensuring accurate tax reporting. Understanding how the schedule k 3 works can help businesses efficiently manage their tax obligations and reporting.

-

How can airSlate SignNow help with signing schedule k 3 documents?

airSlate SignNow offers an easy-to-use platform for electronically signing and managing schedule k 3 documents. Users can quickly upload their forms, gather signatures from necessary parties, and securely store completed documents. This streamline process enhances efficiency, ensuring that all parties can execute schedule k 3 documents with minimal hassle.

-

What are the pricing options for using airSlate SignNow for schedule k 3 documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of any size. With options ranging from monthly to annual subscriptions, you can choose a plan that best fits your organizational needs. The cost-effective nature of airSlate SignNow makes it an ideal solution for efficiently managing schedule k 3 filings without signNow financial strain.

-

What features does airSlate SignNow provide for handling tax documents like schedule k 3?

airSlate SignNow includes robust features such as customizable templates, bulk sending capabilities, and secure cloud storage for tax documents such as schedule k 3. Additionally, it provides real-time tracking of document status and notifications when documents are signed. These features ensure that managing your tax forms is both efficient and reliable.

-

Can airSlate SignNow integrate with accounting software for processing schedule k 3?

Yes, airSlate SignNow seamlessly integrates with various popular accounting software platforms, making it easier to handle schedule k 3 documents. By integrating your accounting tools, you can streamline your workflows and ensure accurate data transfer between systems. This enhances your ability to manage tax filings and maintain compliance.

-

What benefits does using airSlate SignNow offer for managing schedule k 3?

Using airSlate SignNow for managing schedule k 3 documents saves time and enhances productivity through its user-friendly interface and document automation features. The ability to eSign and track documents in real-time allows businesses to maintain organization and reduces the risk of errors. Overall, it simplifies the tax filing process, allowing you to focus on your core activities.

-

Is airSlate SignNow secure for handling sensitive information like schedule k 3?

Yes, airSlate SignNow prioritizes security and compliance by implementing advanced encryption measures for documents, including schedule k 3. The platform ensures that your sensitive information is stored securely and is only accessible to authorized users. This commitment to security provides peace of mind when managing important tax documents.

Get more for Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S

- Partial release of property from mortgage for corporation new jersey form

- Partial release of property from mortgage by individual holder new jersey form

- Nj discrimination form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy new jersey form

- Warranty deed for parents to child with reservation of life estate new jersey form

- Warranty deed for separate or joint property to joint tenancy new jersey form

- Warranty deed to separate property of one spouse to both spouses as joint tenants new jersey form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries new jersey form

Find out other Schedules K 2 And K 3 Frequently Asked Questions Forms 1065, 1120S

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later