PRINTCLEARForm G4 Rev 021519STATE of GEORGIA 2014

What is the Georgia G-4 Form?

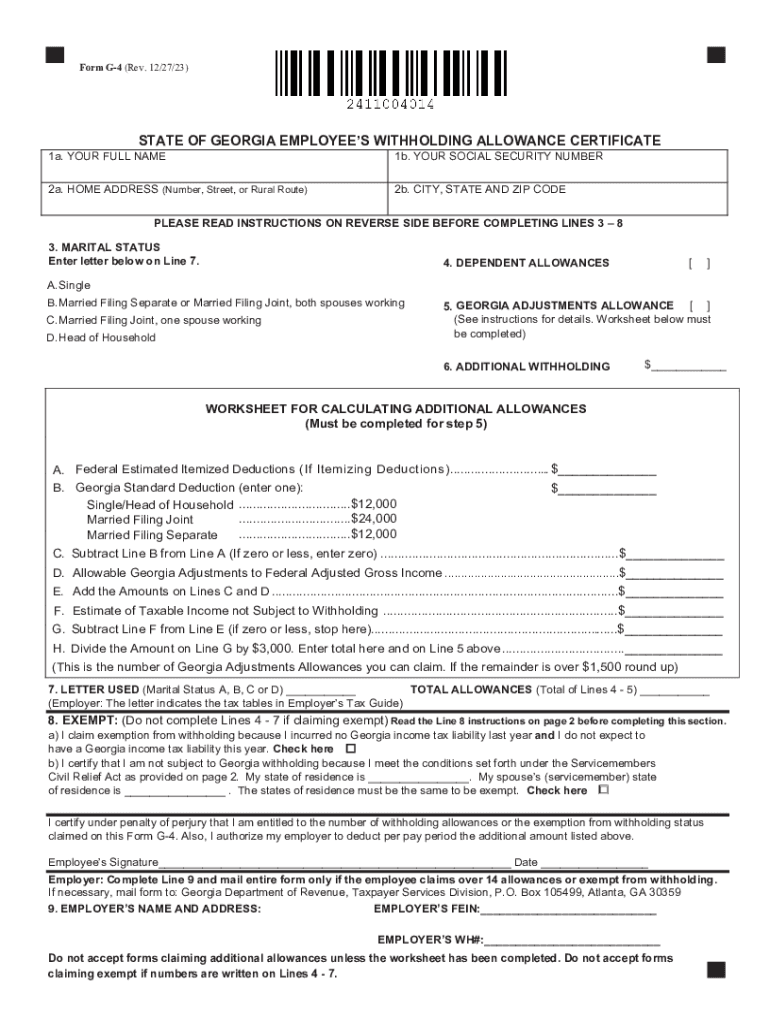

The Georgia G-4 form, officially known as the State of Georgia Employee's Withholding Allowance Certificate, is a crucial document for employees in Georgia. It is used to determine the amount of state income tax to withhold from an employee's paycheck. By accurately completing the G-4 form, employees can ensure that the correct amount of taxes is withheld based on their personal financial situation, including allowances for dependents and other factors.

Steps to Complete the Georgia G-4 Form

Filling out the Georgia G-4 form involves several straightforward steps:

- Begin by providing your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Specify the number of allowances you are claiming. This number affects how much tax is withheld.

- If applicable, include any additional withholding amounts you wish to have deducted from your paycheck.

- Sign and date the form to validate it.

Once completed, submit the form to your employer, who will use it to adjust your state tax withholding accordingly.

Key Elements of the Georgia G-4 Form

The Georgia G-4 form contains several key components that are essential for accurate tax withholding:

- Personal Information: Essential details such as your name, address, and Social Security number.

- Filing Status: Options include single, married, or head of household, which influence the tax calculations.

- Allowances: The number of allowances claimed directly affects the amount withheld from your paycheck.

- Additional Withholding: An option for those who wish to have more tax withheld than the standard calculation.

Legal Use of the Georgia G-4 Form

The Georgia G-4 form is legally required for employees in Georgia to ensure proper tax withholding. Employers must maintain this form on file for each employee, as it serves as documentation for the state tax authorities. Accurate completion of the form helps prevent under-withholding or over-withholding of state taxes, which can lead to penalties or unexpected tax bills.

Filing Deadlines / Important Dates

It is important to submit the Georgia G-4 form to your employer as soon as you begin employment or whenever your tax situation changes. Regular updates may be necessary, especially after significant life events such as marriage, divorce, or the birth of a child. Keeping your G-4 form current ensures that your tax withholding aligns with your financial circumstances.

Examples of Using the Georgia G-4 Form

Consider a few scenarios where the Georgia G-4 form is utilized:

- An employee who recently got married may want to adjust their withholding allowances on the G-4 to reflect their new filing status.

- A parent claiming dependents can increase their allowances to reduce their tax burden.

- Individuals with multiple jobs may need to fill out a G-4 for each employer to ensure proper withholding across all sources of income.

Quick guide on how to complete printclearform g4 rev 021519state of georgia

Complete PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as a suitable eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA without hassle

- Find PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from a device of your preference. Adjust and eSign PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printclearform g4 rev 021519state of georgia

Create this form in 5 minutes!

How to create an eSignature for the printclearform g4 rev 021519state of georgia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form g 4 example and how is it used?

A form g 4 example refers to a specific document format that allows businesses to efficiently collect, manage, and sign important documents. This form can streamline the process of obtaining signatures and help maintain compliance with legal requirements.

-

How can airSlate SignNow help with form g 4 example?

AirSlate SignNow offers a user-friendly platform for creating and managing form g 4 examples, ensuring seamless eSigning. With its intuitive interface, users can easily customize these forms to fit their needs and enhance document workflow.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow provides various pricing plans to cater to different business needs, including options suitable for smaller teams and large enterprises. Each plan offers unique features that enhance the ease of use for creating form g 4 examples and other documents.

-

What features does airSlate SignNow offer for form g 4 example?

The platform includes features such as document templates, eSignature capabilities, and real-time collaboration tools, making it perfect for handling form g 4 examples. These features help streamline the signing process and improve overall efficiency.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with numerous applications, allowing users to enhance their workflow with form g 4 examples. Popular integrations include CRM systems, cloud storage solutions, and other productivity tools, making document management more convenient.

-

What benefits does using airSlate SignNow provide for form g 4 example?

Using airSlate SignNow for form g 4 examples offers several benefits, including faster document turnaround times, improved accuracy, and enhanced security. These advantages help businesses operate more efficiently and maintain a competitive edge.

-

Is airSlate SignNow suitable for small businesses using form g 4 example?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, including small businesses. It provides an affordable yet powerful solution to manage form g 4 examples, ensuring simplicity and ease of use without compromising functionality.

Get more for PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA

- Docketing statement form

- Co parenting forms

- Fill in blank failure to appear notice san bernardino form

- Other justice court locations salt lake county form

- Satisfaction of judgment 5766848 form

- Navigating the court system utah state bar form

- Banking affidavit form

- Georgia non disclosure agreement nda template form

Find out other PRINTCLEARForm G4 Rev 021519STATE OF GEORGIA

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form