Georgia State Income Tax Rates, Who Pays 2008

Understanding Georgia State Income Tax Rates

The Georgia state income tax is a progressive tax system, meaning that tax rates increase as income levels rise. For the tax year 2023, the rates range from one percent to five and a half percent, depending on the taxpayer's income bracket. Individuals earning less than a certain threshold may pay a lower rate, while higher earners contribute at the maximum rate. This structure is designed to ensure that those with greater financial resources contribute a fair share to state revenue.

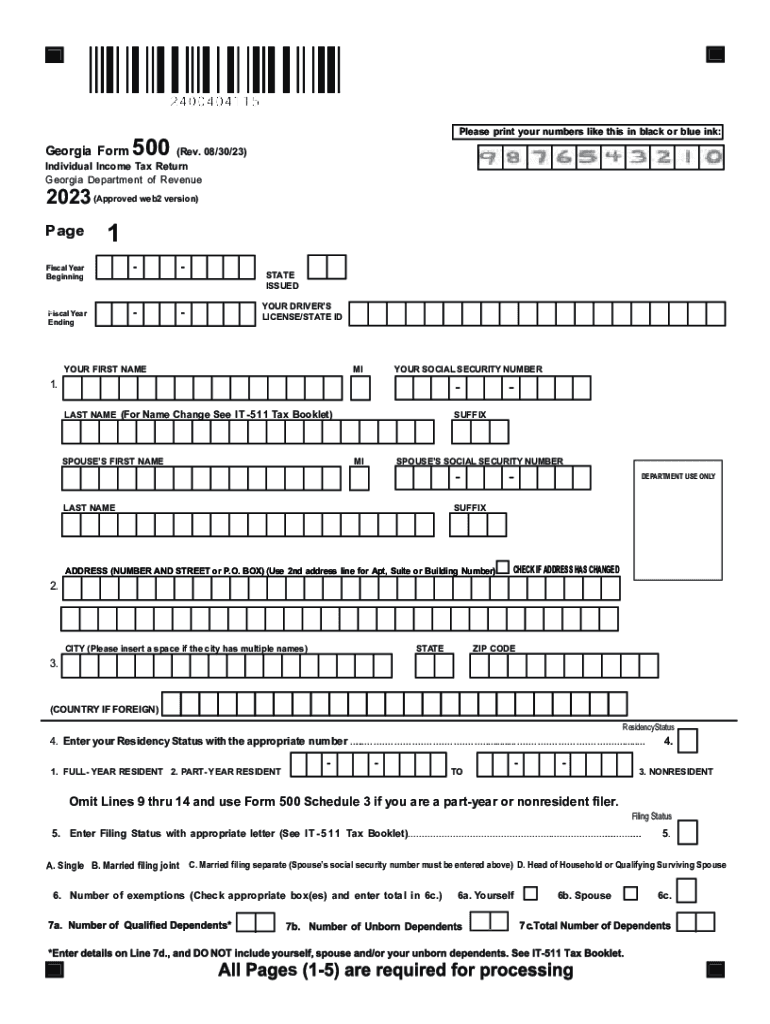

Steps to Complete the Georgia Form 500

Completing the Georgia Form 500 involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099 forms, and any other income statements. Next, calculate your total income by adding all sources of income together. After determining your total income, apply any deductions you may qualify for, such as standard or itemized deductions. Once you have your taxable income, use the Georgia tax tables to find your tax liability. Finally, fill out the Georgia Form 500 accurately and ensure all sections are complete before submission.

Required Documents for Filing Georgia Form 500

When preparing to file Georgia Form 500, it is essential to collect specific documents to ensure accuracy. Required documents typically include:

- W-2 forms from all employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Having these documents on hand will streamline the filing process and help avoid errors.

Filing Deadlines for Georgia Form 500

The deadline for filing Georgia Form 500 is typically April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of this deadline to avoid penalties and interest on any unpaid taxes. Taxpayers can also request an extension if they need additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods for Georgia Form 500

Georgia Form 500 can be submitted through several methods, providing flexibility for taxpayers. The available submission options include:

- Online filing through the Georgia Department of Revenue's e-filing system

- Mailing a paper copy of the completed form to the appropriate address

- In-person submission at designated Georgia Department of Revenue offices

Each method has its advantages, and taxpayers should choose the one that best fits their needs and circumstances.

Penalties for Non-Compliance with Georgia Form 500

Failure to comply with the requirements of Georgia Form 500 can result in significant penalties. Common penalties include:

- Late filing penalties, which can amount to five percent of the unpaid tax for each month the return is late

- Interest on unpaid taxes, which accrues from the original due date until the tax is paid

- Potential legal action for serious cases of tax evasion

Understanding these penalties can help taxpayers remain compliant and avoid unnecessary financial burdens.

Quick guide on how to complete georgia state income tax rates who pays

Complete Georgia State Income Tax Rates, Who Pays effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Handle Georgia State Income Tax Rates, Who Pays on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Georgia State Income Tax Rates, Who Pays with ease

- Find Georgia State Income Tax Rates, Who Pays and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for such purposes by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Georgia State Income Tax Rates, Who Pays and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct georgia state income tax rates who pays

Create this form in 5 minutes!

How to create an eSignature for the georgia state income tax rates who pays

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia Form 500?

The Georgia Form 500 is a crucial tax form used by residents in Georgia to report their state income tax. It is essential for ensuring compliance with Georgia tax regulations while calculating your tax obligations. Understanding how to accurately fill out the Georgia Form 500 can help prevent errors and potential penalties.

-

How can airSlate SignNow help with Georgia Form 500?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send the Georgia Form 500 securely. With our solution, you can streamline your document management process, ensuring that tax forms like the Georgia Form 500 are signed and submitted quickly and without hassle.

-

Is there a cost associated with using airSlate SignNow for Georgia Form 500?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs, providing cost-effective solutions for handling documents like the Georgia Form 500. By choosing the right plan, businesses can enjoy seamless eSigning and document management without breaking the bank.

-

What features does airSlate SignNow offer for the Georgia Form 500?

airSlate SignNow includes features like document templates, easy eSigning, and real-time tracking for the Georgia Form 500. These features not only enhance efficiency but also provide assurance that your documents are securely managed and compliant with state regulations.

-

Can I store and manage my Georgia Form 500 documents with airSlate SignNow?

Absolutely! airSlate SignNow allows you to store and manage your Georgia Form 500 documents in a secure online environment. This centralized storage ensures that your important tax forms are accessible whenever you need them, making compliance management easier.

-

Is airSlate SignNow suitable for businesses of all sizes when handling Georgia Form 500?

Yes, airSlate SignNow is designed to benefit businesses of all sizes, whether you are a small startup or a large corporation. Our platform provides scalable solutions that make managing the Georgia Form 500 and other documents efficient, regardless of your business volume.

-

What integrations does airSlate SignNow offer for the Georgia Form 500?

airSlate SignNow integrates seamlessly with various applications and systems, making it easier to manage the Georgia Form 500 alongside your existing workflows. With these integrations, you can automate processes and ensure that your document handling remains effortless and efficient.

Get more for Georgia State Income Tax Rates, Who Pays

- Gepf self service app download form

- Landlord s notice to terminate early cause government of form

- Pptc 463 b use if the applicant is a foster parent or an adoptive parent form

- Canadian citizenship checklist form

- Pay action request form 446 5e 388852336

- Form for applying for the treasury solicitors consent to administrative restoration bvc14

- Srg1119a aeroplanesapplication for issue of a single form

- Apprenticeship forms application registration ampamp moreita

Find out other Georgia State Income Tax Rates, Who Pays

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple