Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement 2022

Understanding the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

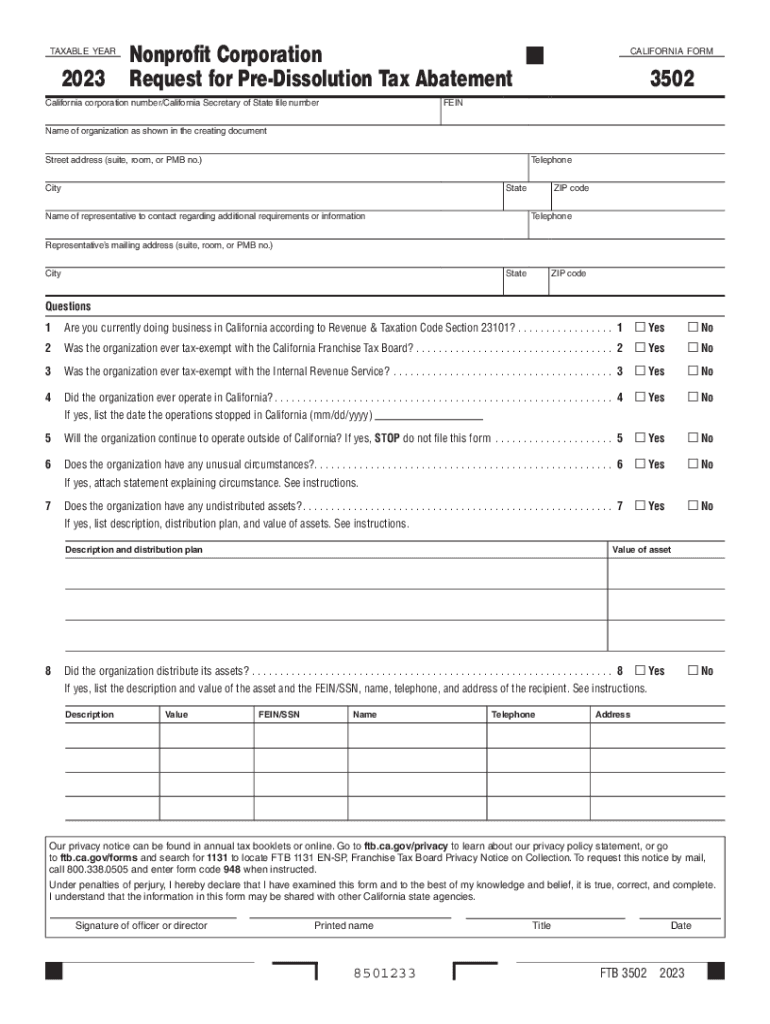

The Form 3502 is a critical document for nonprofit corporations seeking to request a pre-dissolution tax abatement. This form allows organizations to apply for a waiver of certain tax obligations before officially dissolving their operations. Understanding the purpose of this form is essential for nonprofits to ensure compliance with state tax regulations and avoid potential penalties.

Nonprofit organizations may find themselves in a position where dissolution is necessary due to various reasons, including financial difficulties or changes in mission. By submitting Form 3502, these organizations can request relief from tax liabilities that might otherwise accrue during the dissolution process, allowing for a smoother transition and closure.

Steps to Complete the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Completing the Form 3502 requires careful attention to detail. The following steps outline the process:

- Gather Required Information: Collect all necessary documentation, including the organization’s tax identification number, financial statements, and any relevant correspondence with tax authorities.

- Fill Out the Form: Carefully complete each section of the form, ensuring that all information is accurate and up to date. Double-check for any errors or omissions.

- Attach Supporting Documents: Include any required attachments that support your request for tax abatement, such as proof of financial hardship or dissolution plans.

- Review the Form: Before submission, review the entire form to ensure completeness and accuracy. This step is crucial to avoid delays in processing.

- Submit the Form: Follow the submission guidelines provided with the form, whether submitting online, by mail, or in person.

Legal Use of the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

The legal use of Form 3502 is essential for nonprofits aiming to comply with state tax laws during the dissolution process. This form serves as an official request to the state tax authority for an abatement of taxes that may be due at the time of dissolution.

Filing this form correctly helps organizations avoid unnecessary tax liabilities and potential legal repercussions. It is advisable for nonprofits to consult with legal or tax professionals to ensure that all legal requirements are met and that the form is used appropriately within the context of their specific situation.

Required Documents for Form 3502 Submission

When submitting Form 3502, certain documents are typically required to support the application. These may include:

- Financial statements that demonstrate the organization’s financial status.

- Proof of the decision to dissolve, such as meeting minutes or board resolutions.

- Any correspondence with tax authorities regarding the organization’s status or tax obligations.

Providing complete and accurate documentation is crucial for the successful processing of the form and to ensure compliance with state regulations.

Filing Deadlines and Important Dates for Form 3502

Understanding the filing deadlines for Form 3502 is vital for nonprofit organizations. Typically, the form must be submitted before the official dissolution date to ensure that any tax liabilities are addressed appropriately. Missing deadlines can result in penalties or complications in the dissolution process.

Nonprofits should stay informed about specific state requirements and deadlines, as these can vary. It is advisable to check with the relevant state tax authority to confirm the exact timelines applicable to the Form 3502 submission.

Quick guide on how to complete form 3502 nonprofit corporation request for pre dissolution tax abatement

Effortlessly Prepare Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement on Any Gadget

The popularity of online document organization has surged among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely retain it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without interruptions. Manage Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related workflow today.

How to Alter and Electronically Sign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement with Ease

- Find Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize the relevant sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3502 nonprofit corporation request for pre dissolution tax abatement

Create this form in 5 minutes!

How to create an eSignature for the form 3502 nonprofit corporation request for pre dissolution tax abatement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SBA Form 3502, and who needs to fill it out?

The SBA Form 3502 is a document required by the Small Business Administration for certain loan programs. It’s essential for businesses seeking financial assistance through SBA loans to complete this form accurately. airSlate SignNow helps streamline the process of filling out the SBA Form 3502, making it accessible for all business owners.

-

How can airSlate SignNow facilitate filling out the SBA Form 3502?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the SBA Form 3502. With features like templates and collaborative editing, businesses can ensure all necessary information is provided without hassle. This efficiency helps to speed up loan processing times signNowly.

-

Is there a cost associated with using airSlate SignNow for the SBA Form 3502?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses using the SBA Form 3502. These plans are designed to be cost-effective without compromising on essential features. Check our website for current pricing and find a plan that suits your business requirements.

-

What are the key features of airSlate SignNow relevant to the SBA Form 3502?

Key features of airSlate SignNow include customizable templates, in-app collaboration, and secure eSignature capabilities. These features make it easy to manage and complete the SBA Form 3502 efficiently, ensuring compliance and accuracy. The platform is user-friendly, allowing businesses to focus on their core activities.

-

Can I store and manage multiple versions of the SBA Form 3502 with airSlate SignNow?

Absolutely! airSlate SignNow allows users to store and manage multiple versions of the SBA Form 3502. You can easily track changes, maintain version control, and ensure that you always access the most up-to-date documents. This feature is particularly useful for collaborative projects.

-

Does airSlate SignNow integrate with other software for SBA Form 3502 management?

Yes, airSlate SignNow offers integrations with various productivity tools and platforms, enhancing your workflow when managing the SBA Form 3502. Whether you're using CRM systems or cloud storage solutions, you can simplify the document management process. Explore our integrations to find the best options for your business.

-

What are the benefits of using airSlate SignNow for the SBA Form 3502 compared to traditional methods?

Using airSlate SignNow for the SBA Form 3502 provides numerous benefits over traditional methods, including increased efficiency and reduced errors. The digital platform allows for faster document processing and approvals, helping businesses meet deadlines. Furthermore, it contributes to a paperless environment, aligning with modern business practices.

Get more for Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Find out other Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple