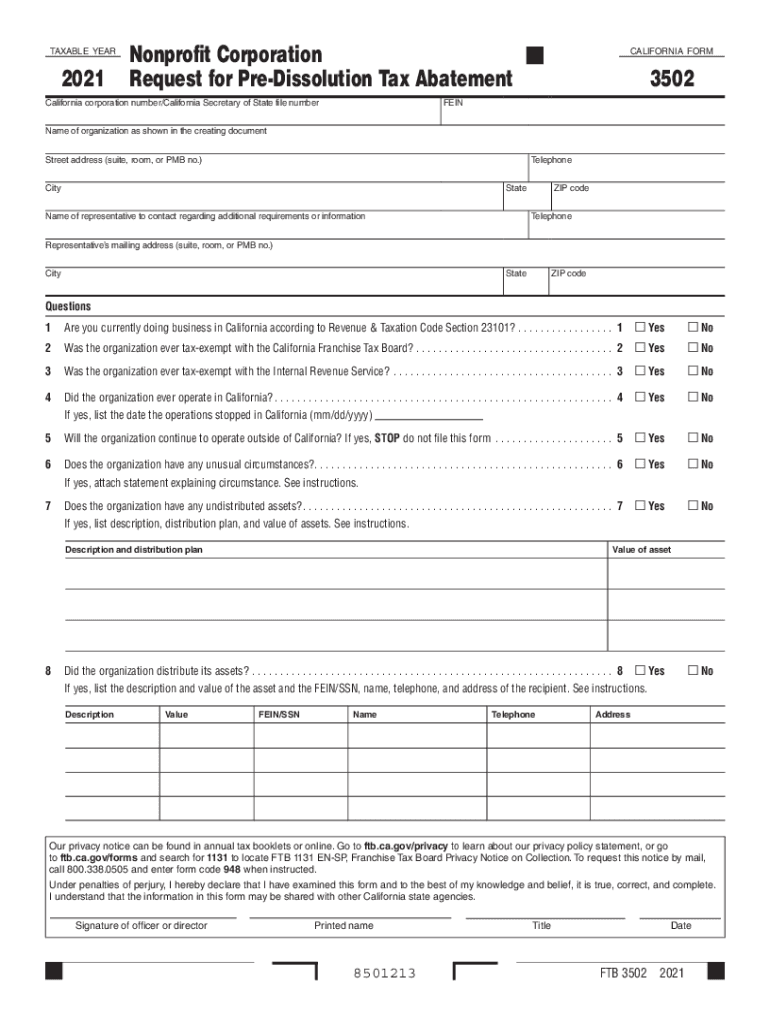

Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement 2021

What is the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

The Form 3502, also known as the Nonprofit Corporation Request for Pre Dissolution Tax Abatement, is a crucial document for nonprofit organizations in the United States that are planning to dissolve. This form allows nonprofits to request an abatement of any outstanding taxes before officially dissolving. By submitting this form, organizations can ensure that they settle their tax obligations, thereby avoiding potential penalties and liabilities. It is essential for nonprofits to understand the purpose and implications of this form to navigate the dissolution process smoothly.

Steps to Complete the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

Completing the Form 3502 involves several key steps to ensure accuracy and compliance. First, organizations should gather all necessary information, including their federal tax identification number and details about their financial status. Next, fill out the form with precise information regarding the nonprofit's activities and the reasons for dissolution. It is important to review the completed form for any errors or omissions. Once finalized, the form should be submitted to the appropriate state tax authority for processing. Organizations may also want to keep a copy of the submitted form for their records.

Eligibility Criteria for the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

To be eligible for filing the Form 3502, a nonprofit organization must meet specific criteria. The organization must be officially registered as a nonprofit in the state where it operates and must be in good standing with state tax authorities. Additionally, the nonprofit should have fulfilled all its tax obligations prior to submission. It is crucial for organizations to verify their eligibility to avoid delays in processing the request for tax abatement.

Required Documents for the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

When submitting the Form 3502, organizations must include several supporting documents to facilitate the review process. Required documents typically include:

- Proof of nonprofit status, such as the Articles of Incorporation.

- Financial statements demonstrating the organization's financial position.

- Any prior correspondence with tax authorities regarding tax obligations.

- Documentation of the decision to dissolve, such as meeting minutes.

Providing complete and accurate documentation is essential for a successful request for tax abatement.

Legal Use of the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

The legal use of the Form 3502 is governed by state laws regarding nonprofit dissolution and tax obligations. By submitting this form, organizations are formally requesting the state tax authority to consider their tax status before dissolution. Compliance with the legal requirements is necessary to ensure that the dissolution process is recognized and that the organization is not held liable for any outstanding taxes post-dissolution. Understanding the legal implications of the form can help nonprofits navigate their responsibilities effectively.

Form Submission Methods for the Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement

Organizations can submit the Form 3502 through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state tax authority's website.

- Mailing a hard copy of the completed form to the appropriate office.

- In-person submission at designated state tax offices.

It is important for organizations to verify the preferred submission method with their state tax authority to ensure proper processing of the request.

Quick guide on how to complete 2021 form 3502 nonprofit corporation request for pre dissolution tax abatement

Complete Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement without any hassle

- Locate Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tiresome form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 3502 nonprofit corporation request for pre dissolution tax abatement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 3502 nonprofit corporation request for pre dissolution tax abatement

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is form 3502?

Form 3502 is a crucial document used for reporting and compliance in various business transactions. With airSlate SignNow, you can easily create, send, and eSign your form 3502 securely and efficiently. Our platform streamlines the process, ensuring that all required signatures are captured.

-

How can airSlate SignNow benefit my business with form 3502?

Using airSlate SignNow for your form 3502 allows for a seamless eSigning experience, reducing paperwork and accelerating your workflow. The integrated solutions provide a cost-effective way to manage documents electronically, ensuring compliance and fast processing. Empower your team with the tools they need to handle form 3502 efficiently.

-

Is there a cost associated with using airSlate SignNow for form 3502?

Yes, airSlate SignNow offers competitive pricing plans tailored to suit various business needs while using form 3502. You can choose from different plans based on your usage and features required. Our cost-effective solutions make it easy to manage your document signing without breaking the bank.

-

What features does airSlate SignNow offer for form 3502?

airSlate SignNow provides a range of features for your form 3502, including customizable templates, automated workflows, and secure storage. These features simplify the process of preparing and signing documents, ensuring accuracy and efficiency. Additionally, our user-friendly interface makes it easy for anyone to create and manage form 3502.

-

Can I integrate airSlate SignNow with other applications when using form 3502?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when handling form 3502. You can connect with popular tools like Google Drive, Salesforce, and Dropbox, allowing for a more efficient document management process. This integration helps keep all your data organized and accessible.

-

How secure is my data when using airSlate SignNow for form 3502?

Security is a top priority at airSlate SignNow. When utilizing form 3502, we ensure that all your documents are encrypted and stored securely. Our platform adheres to industry standards and compliance regulations to protect your sensitive information throughout the signing process.

-

Can I track the status of my form 3502 once it is sent out?

Absolutely! With airSlate SignNow, you can easily track the status of your sent form 3502. Our platform provides real-time updates on who has viewed or signed the document, allowing you to stay informed and follow up when necessary. This feature enhances accountability and streamlines the signing process.

Get more for Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- Massachusetts affidavit 497309822 form

- Complex will with credit shelter marital trust for large estates massachusetts form

- Ma marital form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497309827 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497309829 form

- Marital joint debts form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497309831 form

Find out other Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document