Request for Pre Dissolution Tax Abatement 2017

Understanding the Request For Pre Dissolution Tax Abatement

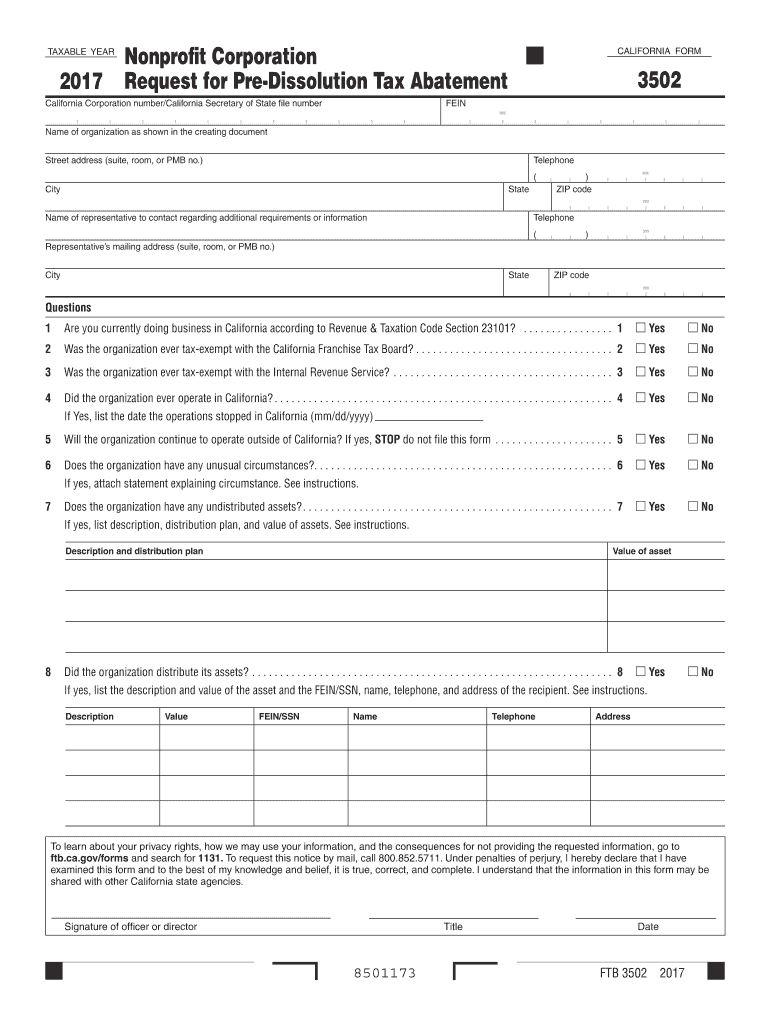

The Request For Pre Dissolution Tax Abatement is a formal application that allows businesses to seek tax relief before officially dissolving. This form is essential for companies looking to minimize their tax liabilities during the dissolution process. By filing this request, businesses can clarify their tax obligations and potentially reduce or eliminate certain taxes owed to state or local governments. Understanding the specific requirements and implications of this form is crucial for business owners to navigate the dissolution process smoothly.

Steps to Complete the Request For Pre Dissolution Tax Abatement

Completing the Request For Pre Dissolution Tax Abatement involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including tax returns and financial statements. Next, fill out the form with precise information, including the business's legal name, identification number, and the specific taxes for which relief is being requested. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the guidelines provided by the relevant tax authority, ensuring that all required documentation is attached.

Eligibility Criteria for the Request For Pre Dissolution Tax Abatement

Eligibility for the Request For Pre Dissolution Tax Abatement varies by state but generally includes specific criteria that businesses must meet. Typically, the business must be in the process of dissolution and have outstanding tax liabilities. Additionally, the business should demonstrate that it has made efforts to comply with tax obligations prior to filing the request. Understanding these criteria is vital for business owners to determine if they qualify for tax abatement and to ensure a successful application process.

Key Elements of the Request For Pre Dissolution Tax Abatement

The Request For Pre Dissolution Tax Abatement includes several key elements that are critical for its success. These elements typically consist of the business's identification details, a clear statement of the tax liabilities being addressed, and any supporting documentation that justifies the request for abatement. Additionally, the form may require a declaration of the business's financial status and any relevant correspondence with tax authorities. Each element must be completed accurately to prevent delays or rejections in processing the request.

Form Submission Methods for the Request For Pre Dissolution Tax Abatement

Submitting the Request For Pre Dissolution Tax Abatement can be done through various methods, depending on the requirements of the state or local tax authority. Common submission methods include online filing through the tax authority's website, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages, such as speed and confirmation of receipt, which can be important for tracking the status of the request.

Legal Use of the Request For Pre Dissolution Tax Abatement

The legal use of the Request For Pre Dissolution Tax Abatement is governed by specific regulations that vary by jurisdiction. It is essential for businesses to understand the legal framework surrounding this form, including compliance with state tax laws and any federal regulations that may apply. Proper legal use ensures that the request is valid and enforceable, protecting the business from potential penalties or disputes with tax authorities.

Quick guide on how to complete 2017 request for pre dissolution tax abatement

Effortlessly Prepare Request For Pre Dissolution Tax Abatement on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Request For Pre Dissolution Tax Abatement on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related activity today.

How to Modify and eSign Request For Pre Dissolution Tax Abatement with Ease

- Locate Request For Pre Dissolution Tax Abatement and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Request For Pre Dissolution Tax Abatement to ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 request for pre dissolution tax abatement

Create this form in 5 minutes!

How to create an eSignature for the 2017 request for pre dissolution tax abatement

How to make an eSignature for your 2017 Request For Pre Dissolution Tax Abatement in the online mode

How to make an electronic signature for the 2017 Request For Pre Dissolution Tax Abatement in Chrome

How to generate an electronic signature for signing the 2017 Request For Pre Dissolution Tax Abatement in Gmail

How to generate an eSignature for the 2017 Request For Pre Dissolution Tax Abatement straight from your smart phone

How to generate an eSignature for the 2017 Request For Pre Dissolution Tax Abatement on iOS devices

How to make an electronic signature for the 2017 Request For Pre Dissolution Tax Abatement on Android OS

People also ask

-

What is a Request For Pre Dissolution Tax Abatement?

A Request For Pre Dissolution Tax Abatement is a formal petition submitted by a business seeking relief from certain tax obligations before its dissolution. This process can help companies manage their tax liabilities strategically, ensuring compliance and minimizing costs.

-

How can airSlate SignNow assist with the Request For Pre Dissolution Tax Abatement process?

airSlate SignNow streamlines the Request For Pre Dissolution Tax Abatement process by allowing businesses to create, send, and eSign necessary documents quickly and securely. Our platform simplifies document management, ensuring that all submissions are timely and compliant with regulations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a variety of features to effectively manage tax documents, including customizable templates, an intuitive eSignature process, and secure document storage. These features are particularly useful when preparing a Request For Pre Dissolution Tax Abatement, making the process efficient and straightforward.

-

Is airSlate SignNow cost-effective for small businesses handling tax abatement requests?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With flexible pricing plans, users can efficiently handle their Request For Pre Dissolution Tax Abatement without incurring excessive costs, ensuring budget-friendly tax management.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow supports seamless integrations with various accounting and tax management software. This allows businesses to streamline their workflow when managing a Request For Pre Dissolution Tax Abatement and ensures all relevant data is easily accessible.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Request For Pre Dissolution Tax Abatement, offers numerous benefits such as enhanced security, faster processing times, and improved compliance. Our platform ensures that all documents are easily tracked and stored, reducing the risk of errors.

-

How does eSigning work for a Request For Pre Dissolution Tax Abatement?

eSigning a Request For Pre Dissolution Tax Abatement with airSlate SignNow is simple and efficient. Users can upload their documents, add signature fields, and send them to signers, who can then complete the signing process from anywhere, ensuring quick turnaround times.

Get more for Request For Pre Dissolution Tax Abatement

- Ada claim form cigna

- Southwestern christian college transcript request form

- Boon chapman reimbursement form

- Download individualized studies application buffalo state buffalostate form

- Cap and gown rental form 2010 fall buffalostate

- Stonybrook respirator certification form

- W 9 form example

- Fmla leave forms

Find out other Request For Pre Dissolution Tax Abatement

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement