Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement 2024-2026

Understanding the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

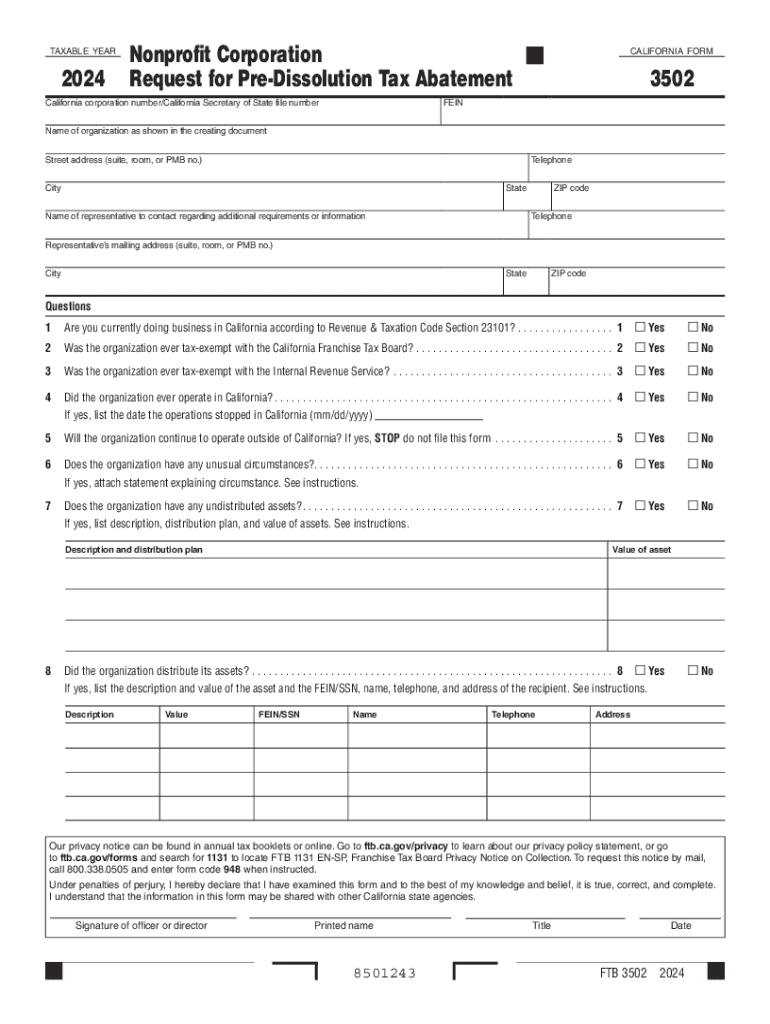

The Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement is a crucial document for nonprofit organizations in the United States that are considering dissolution. This form allows nonprofits to request a tax abatement before they officially dissolve, helping to alleviate any outstanding tax liabilities. By filing this form, organizations can ensure compliance with state and federal tax regulations, potentially reducing financial burdens during the dissolution process.

Steps to Complete the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Completing the Form 3502 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about your nonprofit, including its legal name, address, and tax identification number. Next, provide details regarding the reason for dissolution and any outstanding tax obligations. It is essential to review the form thoroughly for completeness and accuracy before submission. Finally, ensure that all required signatures are obtained, as this is critical for the form's validity.

Eligibility Criteria for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

To be eligible for the Form 3502, your nonprofit must meet specific criteria. The organization should be registered as a nonprofit corporation in the United States and must be in the process of dissolution. Additionally, the nonprofit should have outstanding tax obligations that it seeks to address through this form. It is important to verify that your organization complies with all state and federal regulations before proceeding with the application.

Required Documents for Filing the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

When filing the Form 3502, certain documents are required to support your request. These typically include the nonprofit's articles of incorporation, a copy of the board resolution approving the dissolution, and any relevant tax documents that detail outstanding liabilities. Providing comprehensive documentation helps facilitate the review process and increases the likelihood of a favorable outcome.

Form Submission Methods for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

The Form 3502 can be submitted through various methods, depending on the regulations of your state. Common submission methods include online filing through state tax authority websites, mailing a physical copy to the appropriate department, or delivering the form in person. It is advisable to check the specific submission guidelines for your state to ensure compliance and timely processing.

Legal Use of the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

The legal use of the Form 3502 is critical for nonprofits seeking to dissolve while managing tax responsibilities. This form serves as an official request to the state tax authority for a pre-dissolution tax abatement, protecting the organization from potential penalties or liabilities that could arise during the dissolution process. Proper completion and submission of this form ensure that the nonprofit adheres to legal requirements, safeguarding its interests and those of its stakeholders.

Create this form in 5 minutes or less

Find and fill out the correct form 3502 nonprofit corporation request for pre dissolution tax abatement 772018433

Create this form in 5 minutes!

How to create an eSignature for the form 3502 nonprofit corporation request for pre dissolution tax abatement 772018433

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

The Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement is a document that nonprofit organizations must submit to request tax abatement before dissolving. This form helps ensure that the organization meets all tax obligations and can facilitate a smoother dissolution process.

-

How can airSlate SignNow assist with the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

airSlate SignNow provides an easy-to-use platform for nonprofits to complete and eSign the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. Our solution streamlines the document management process, ensuring that all necessary signatures are obtained quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of nonprofits. Our cost-effective solution allows organizations to manage their Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement without breaking the bank, with options for monthly or annual subscriptions.

-

Are there any features specifically designed for nonprofits using the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

Yes, airSlate SignNow includes features tailored for nonprofits, such as customizable templates for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement, automated reminders for signers, and secure cloud storage for all documents. These features enhance efficiency and compliance for nonprofit organizations.

-

What benefits does airSlate SignNow provide for completing the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

Using airSlate SignNow for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. Our platform ensures that your documents are handled with care and that all necessary steps are followed.

-

Can airSlate SignNow integrate with other tools for managing the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement alongside your existing workflows. This integration capability enhances productivity and ensures a smooth document management experience.

-

Is there customer support available for assistance with the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. Our knowledgeable team is available to provide guidance and ensure a positive experience with our platform.

Get more for Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Find out other Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online