Form 3502 Nonprofit Corporation Request for Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request for Pre Dissol 2020

What is the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

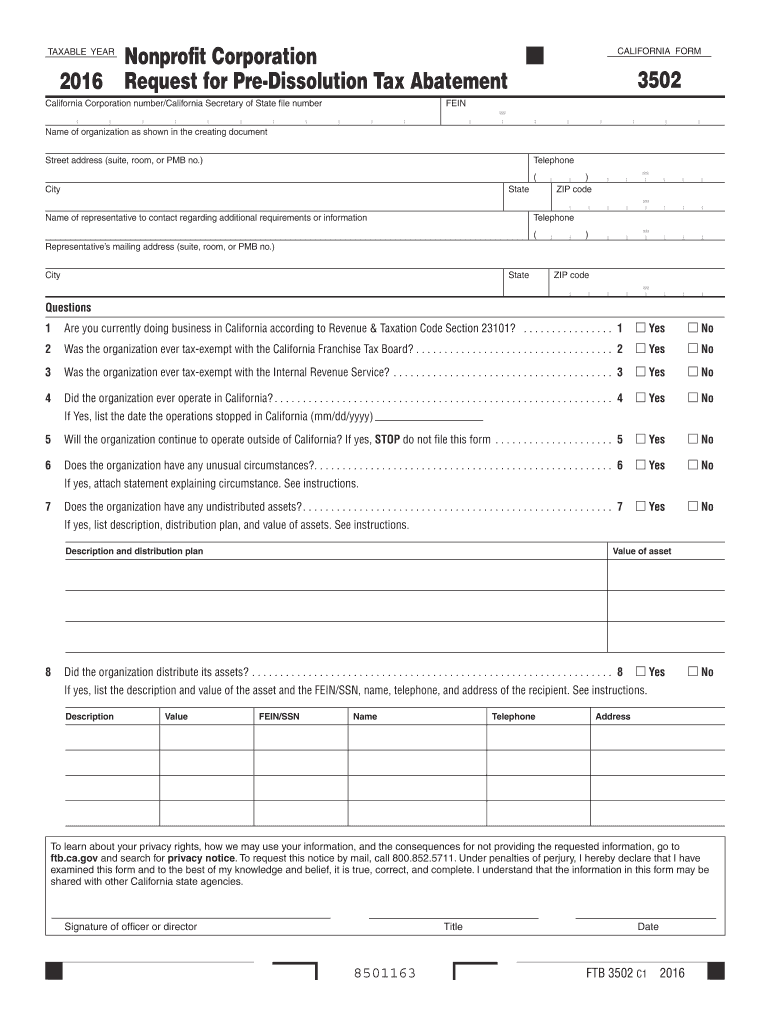

The Form 3502 is a specific document used by nonprofit corporations in California to request a pre-dissolution tax abatement. This form is essential for organizations planning to dissolve, as it allows them to seek relief from certain tax obligations before officially ceasing operations. By submitting this form, nonprofits can ensure compliance with state regulations while managing their financial responsibilities effectively.

How to use the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Using the Form 3502 involves several steps to ensure proper completion and submission. First, organizations should gather all necessary information, including their tax identification number and details about their dissolution process. Once the form is filled out accurately, it can be submitted electronically or via mail to the appropriate state agency. It is crucial to follow the specific instructions provided with the form to avoid delays or complications.

Steps to complete the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Completing the Form 3502 requires attention to detail. Here are the key steps:

- Review the form instructions carefully to understand the requirements.

- Fill in the organization’s legal name and address as registered with the state.

- Provide the tax identification number and any relevant financial information.

- Detail the reasons for dissolution and any outstanding tax obligations.

- Sign and date the form, ensuring that all information is accurate before submission.

Legal use of the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

The legal use of Form 3502 is governed by California state law. Nonprofit organizations must ensure that they meet all eligibility criteria for tax abatement prior to dissolution. This includes providing accurate information and adhering to filing deadlines. Failure to comply with legal requirements may result in penalties or denial of the tax abatement request, affecting the organization’s ability to dissolve smoothly.

Key elements of the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement

Key elements of the Form 3502 include:

- The legal name and address of the nonprofit corporation.

- The tax identification number.

- A detailed explanation of the reasons for dissolution.

- Information regarding any outstanding taxes or obligations.

- Signatures from authorized representatives of the organization.

Eligibility Criteria

To be eligible for the pre-dissolution tax abatement, the nonprofit corporation must meet specific criteria set by the state. These typically include being in good standing with the California Secretary of State, having no outstanding tax liabilities, and providing a valid reason for dissolution. Organizations should review these criteria carefully to ensure they qualify before submitting the form.

Quick guide on how to complete 2016 form 3502 nonprofit corporation request for pre dissolution tax abatement 2016 form 3502 nonprofit corporation request for

Easily Prepare Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electrically Sign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol Effortlessly

- Find Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that aim.

- Craft your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 3502 nonprofit corporation request for pre dissolution tax abatement 2016 form 3502 nonprofit corporation request for

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 3502 nonprofit corporation request for pre dissolution tax abatement 2016 form 3502 nonprofit corporation request for

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

The Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement is a specific document required by the FTB in California for nonprofit organizations seeking to dissolve and abate taxes prior to dissolution. This form helps ensure that your nonprofit complies with state tax regulations while transitioning out of operation. Filing this form correctly is crucial for a smooth dissolution process.

-

How do I complete the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

To complete the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement, gather all necessary financial documents and details about your nonprofit's operations. The form requires information on assets, liabilities, and reasons for dissolution. Ensure accuracy to avoid delays in processing your request.

-

What are the benefits of using airSlate SignNow for the Form 3502 submission?

Using airSlate SignNow for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement submission allows for easy document management and eSigning features. This platform streamlines the submission process, ensuring your form is filled out and signed digitally with ease. Additionally, you can access templates to simplify filling out the form.

-

Is there a cost associated with airSlate SignNow for filing the Form 3502?

Yes, there are various pricing plans for airSlate SignNow, designed to fit different organizational needs. Basic features are offered at a competitive rate, while more advanced options include additional functionalities that can assist in the preparation of the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. Review the pricing page to find the best plan for your organization.

-

How long does it take to process the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement?

The processing time for the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement can vary depending on the FTB's workload. Generally, the processing may take anywhere from a few weeks to a couple of months. It is advisable to submit the form as early as possible to avoid delays in the dissolution process.

-

Can I track the status of my Form 3502 submission through airSlate SignNow?

Yes, airSlate SignNow provides features that allow you to track the status of your document submissions, including the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. This functionality ensures you can confirm the receipt and progress of your request, giving you peace of mind throughout the process.

-

Does airSlate SignNow integrate with accounting software for nonprofits?

Yes, airSlate SignNow offers integrations with various accounting software that are commonly used by nonprofits. This integration simplifies the process of gathering the necessary financial data required for filling out the Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement. You can seamlessly import relevant information to ensure accuracy and compliance.

Get more for Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol

Find out other Form 3502 Nonprofit Corporation Request For Pre Dissolution Tax Abatement Form 3502 Nonprofit Corporation Request For Pre Dissol

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF