Form 6252 Installment Sale Income What it Is, How it Works

What is Form 6252 Installment Sale Income?

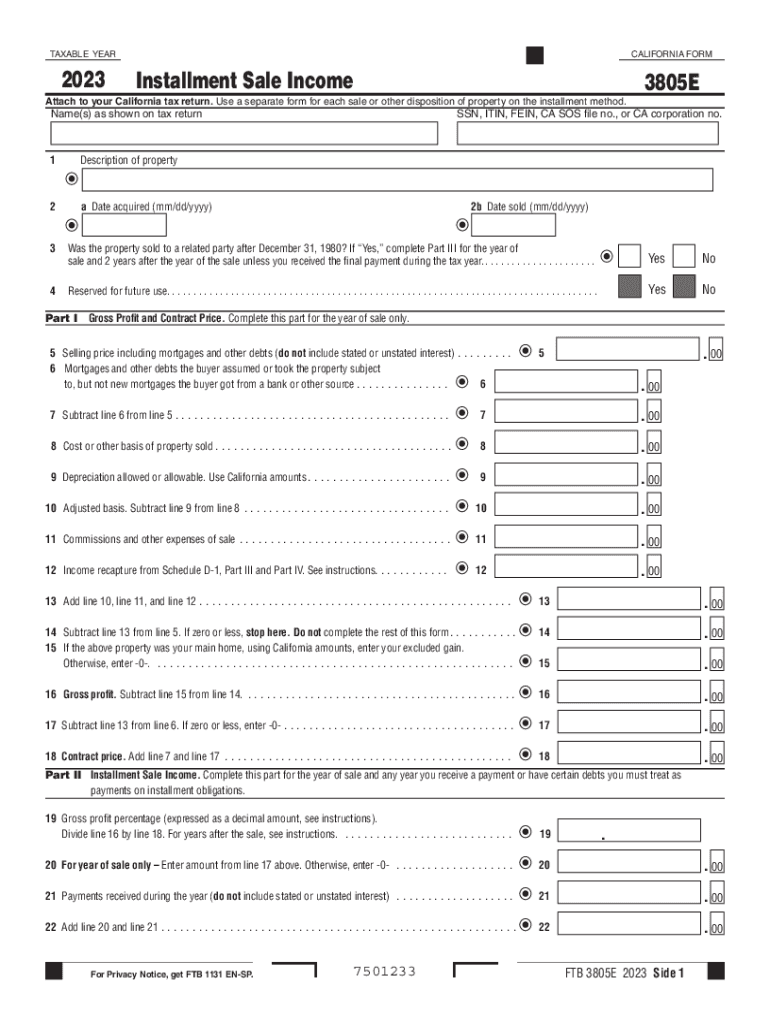

Form 6252 is used to report income from an installment sale, which occurs when a seller allows the buyer to make payments over time rather than paying the full purchase price upfront. This form is essential for taxpayers who sell property and receive payments in installments, as it helps determine the taxable portion of each payment received. The income reported on Form 6252 is typically derived from the sale of real estate, personal property, or business assets.

How to Use Form 6252

To use Form 6252 effectively, you must first gather all relevant information regarding the sale, including the total selling price, the amount of cash received at the time of sale, and the adjusted basis of the property sold. Once you have this information, you can fill out the form, which includes sections for reporting the sale details, calculating the gross profit, and determining the income to report for the tax year. It is crucial to keep accurate records of all payments received and any expenses related to the sale.

Steps to Complete Form 6252

Completing Form 6252 involves several key steps:

- Start by entering your name, address, and taxpayer identification number at the top of the form.

- Provide details about the property sold, including its description and the date of sale.

- Calculate the total selling price and the adjusted basis of the property to determine the gross profit.

- Report any payments received during the tax year and calculate the taxable income for that year based on the gross profit percentage.

- Sign and date the form before submitting it with your tax return.

IRS Guidelines for Form 6252

The Internal Revenue Service (IRS) provides specific guidelines for using Form 6252. These guidelines outline eligibility criteria, reporting requirements, and deadlines for submission. It is important to refer to the latest IRS instructions for Form 6252 to ensure compliance with tax laws and regulations. The IRS also emphasizes the need for accurate reporting to avoid potential penalties for non-compliance.

Filing Deadlines for Form 6252

Form 6252 must be filed with your annual tax return, which is typically due on April fifteenth of each year. If you need additional time to prepare your return, you may file for an extension, but it is important to note that any taxes owed are still due by the original deadline. Keeping track of these deadlines helps avoid late fees and ensures you remain compliant with tax obligations.

Required Documents for Form 6252

When completing Form 6252, it is essential to have specific documents on hand, including:

- Sales contract or agreement detailing the terms of the installment sale.

- Records of payments received and any interest charged on the installment payments.

- Documentation of the property's adjusted basis, including purchase price and any improvements made.

Having these documents readily available will facilitate accurate reporting and help you avoid errors when filing your taxes.

Quick guide on how to complete form 6252 installment sale income what it is how it works

Complete Form 6252 Installment Sale Income What It Is, How It Works effortlessly on any device

Online document management has surged in popularity among organizations and individuals alike. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, since you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Form 6252 Installment Sale Income What It Is, How It Works on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign Form 6252 Installment Sale Income What It Is, How It Works with ease

- Obtain Form 6252 Installment Sale Income What It Is, How It Works and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 6252 Installment Sale Income What It Is, How It Works and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6252 installment sale income what it is how it works

Create this form in 5 minutes!

How to create an eSignature for the form 6252 installment sale income what it is how it works

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6252 Installment Sale Income?

Form 6252 Installment Sale Income is a tax form used to report income received from an installment sale. This form helps you understand how installment sales work and ensures proper tax reporting. By using Form 6252, you can track income over the years as payments are received, making it essential for sellers engaging in such sales.

-

How does Form 6252 Installment Sale Income work in practice?

The process of using Form 6252 Installment Sale Income involves reporting the total sale price and payments received for an asset over time. Each year, you report the portion of the gain or income that corresponds to payments received that year. This allows sellers to manage their tax obligations effectively while benefiting from installment sale agreements.

-

What are the benefits of using Form 6252 for businesses?

Using Form 6252 Installment Sale Income provides several advantages, including deferred tax liabilities and increased cash flow. This method allows businesses to report income gradually as payments are collected, reducing immediate tax burdens. Additionally, it can enhance financial planning and investment strategies for businesses engaged in installment sales.

-

Are there costs associated with filing Form 6252 Installment Sale Income?

Filing Form 6252 Installment Sale Income has minimal direct costs, as it is generally a straightforward process. However, businesses may incur costs related to tax software or professional tax assistance to ensure compliance and accuracy. Understanding the financial implications of installment sales can further optimize your tax strategy.

-

What features does airSlate SignNow offer to assist with Form 6252?

airSlate SignNow provides a range of features that streamline document management, particularly useful for those needing to file Form 6252 Installment Sale Income. With eSignature capabilities, secure document storage, and user-friendly templates, businesses can efficiently prepare and finalize their installment sale agreements. This comprehensive solution simplifies compliance with necessary tax filings.

-

Can airSlate SignNow integrate with accounting software for Form 6252?

Yes, airSlate SignNow integrates seamlessly with various accounting software to handle Form 6252 Installment Sale Income. By streamlining the flow of information between platforms, businesses can ensure accurate reporting and maintain organized records. This integration simplifies the process of managing installment sale transactions and enhances overall financial accuracy.

-

How can I ensure compliance while using Form 6252 Installment Sale Income?

To ensure compliance with Form 6252 Installment Sale Income, it is vital to maintain accurate records of all transactions and payments. Regularly consulting with a tax professional can help clarify any complexities related to installment sales. By leveraging airSlate SignNow’s document management features, you can keep all pertinent documentation organized and accessible for review.

Get more for Form 6252 Installment Sale Income What It Is, How It Works

- Individual vehicle mileage and fuel report idaho state tax form

- Btro form

- Individual vehicle mileage and fuel report always dmv virginia form

- International fuel tax agreement ifta virginia form

- Virginia ifta tax forms printable

- Vdot c 25 form

- General complaint virginia department of motor vehicles form

- General complaint form

Find out other Form 6252 Installment Sale Income What It Is, How It Works

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy