Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 2023

What is the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

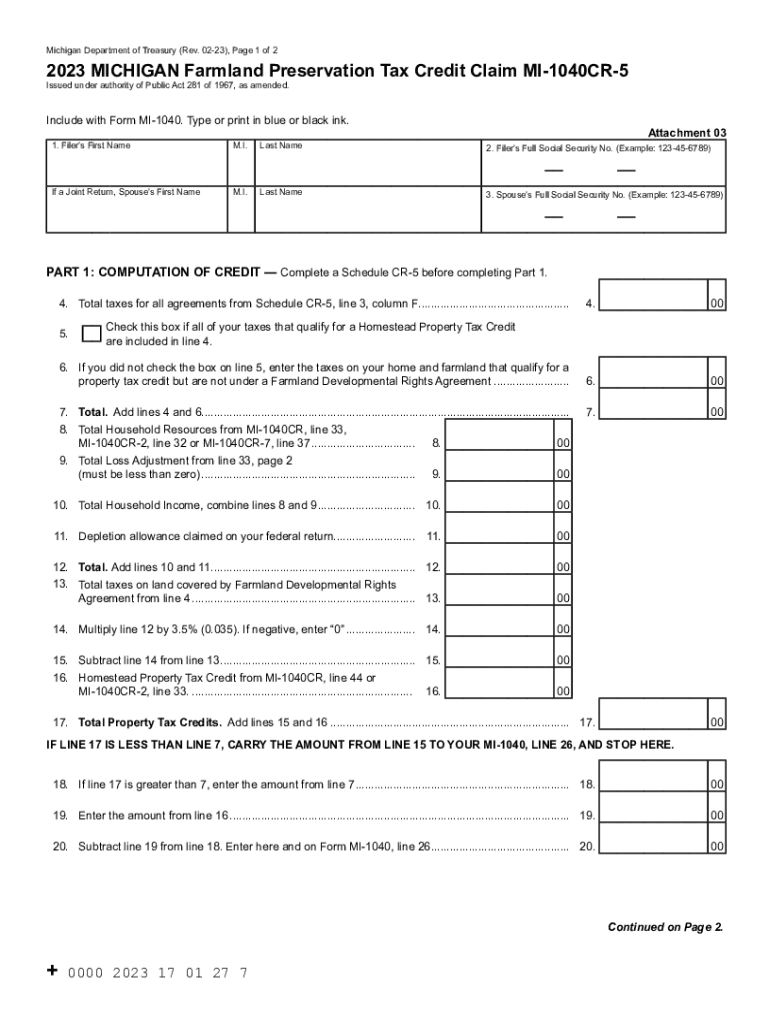

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax form designed for property owners in Michigan who wish to claim a tax credit for preserving farmland. This credit is available to individuals who have entered into a qualified farmland preservation agreement, contributing to the conservation of agricultural land. The program aims to encourage the protection of farmland from development, ensuring that it remains available for agricultural use.

Eligibility Criteria for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

To qualify for the Michigan Farmland Preservation Tax Credit, applicants must meet specific eligibility criteria. Property owners must have a valid farmland preservation agreement in place, which has been approved by the Michigan Department of Agriculture and Rural Development. Additionally, the property must be actively used for agricultural purposes, and the owner must not have received any other tax credits for the same property during the tax year.

Steps to Complete the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

Completing the Michigan Farmland Preservation Tax Credit Claim involves several key steps:

- Gather necessary documentation, including proof of the farmland preservation agreement and any relevant tax records.

- Obtain the MI 1040CR 5 form from the Michigan Department of Treasury or authorized sources.

- Fill out the form accurately, providing all requested information about the property and the preservation agreement.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy and ensure all required signatures are included.

- Submit the form along with your state tax return by the designated deadline.

Required Documents for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

When filing the MI 1040CR 5, applicants must include certain documents to support their claim. Required documents typically include:

- A copy of the farmland preservation agreement.

- Proof of property ownership, such as a deed or tax bill.

- Any additional documentation that verifies the agricultural use of the property.

Form Submission Methods for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

The MI 1040CR 5 form can be submitted through various methods. Taxpayers have the option to file online, mail the completed form to the Michigan Department of Treasury, or deliver it in person at designated offices. Each method has its own guidelines and deadlines, so it is essential to choose the most convenient and timely option for submission.

Filing Deadlines for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

Filing deadlines for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 typically align with the state income tax return deadlines. Taxpayers should ensure that their claims are submitted by the due date for their state tax returns to avoid penalties. It is advisable to check for any updates or changes to deadlines annually, as they may vary.

Quick guide on how to complete michigan farmland preservation tax credit claim mi 1040cr 5

Finish Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 smoothly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to alter and electronically sign Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 effortlessly

- Find Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan farmland preservation tax credit claim mi 1040cr 5

Create this form in 5 minutes!

How to create an eSignature for the michigan farmland preservation tax credit claim mi 1040cr 5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax credit available to property owners who preserve farmland in accordance with Michigan law. This program aims to encourage the conservation of agricultural land. To claim this credit, you must complete the MI 1040CR 5 form, detailing the preserved land and its benefits.

-

How can airSlate SignNow help with the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

airSlate SignNow simplifies the process of preparing and submitting your Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. With our eSigning capabilities, you can easily gather signatures from required parties, ensuring that your claim is processed more efficiently. This means less time spent on paperwork and more focus on your farmland.

-

Is there a cost associated with using airSlate SignNow for my tax credit claim?

Yes, using airSlate SignNow involves a subscription fee, which is designed to be cost-effective for businesses and individuals alike. The pricing is transparent, and you can choose a plan that fits your needs while ensuring you can efficiently manage documents, including the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. You may find that the time saved justifies the investment.

-

What features does airSlate SignNow offer for managing the MI 1040CR 5 form?

airSlate SignNow provides features like customizable templates, eSignature collection, and document tracking, which are especially beneficial for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. These tools help streamline the documentation process, ensuring you don't miss critical steps in your claim. Additionally, easily share documents with relevant parties for faster processing.

-

Are there any benefits to using airSlate SignNow for tax credit claims?

Using airSlate SignNow for your Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 offers numerous benefits, including enhanced security and easy access to all your documents. The platform ensures that all signed documents are safely stored and easily retrievable, reducing the hassle of managing paper files. Plus, it helps speed up claim processing, giving you peace of mind.

-

Can I integrate airSlate SignNow with other tools when filing my MI 1040CR 5?

Absolutely! airSlate SignNow offers integration options with various business tools, making it easy to incorporate into your existing workflow. Whether you're using accounting software or document management systems, you can efficiently work on your Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 without disruptions.

-

Are there any limitations I should be aware of when using airSlate SignNow for my claim?

While airSlate SignNow is highly efficient, it’s important to be aware that certain limitations may pertain to document size and number of signatures based on your selected plan. For the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, ensure that you have all necessary information and signatures before submitting. Familiarizing yourself with these details can help you avoid any processing delays.

Get more for Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- Veterinary certificate of health form

- Infection prevention plan operator template government of form

- Declaration form confidential this form is used to submitting a complaint

- Motor vehicle bill of sale infrastructure form

- Sheet metal worker ita bc form

- Form 6 annual report

- Ita work based training hours report form

- Isp1811 form

Find out other Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney