Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 2022

Understanding the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

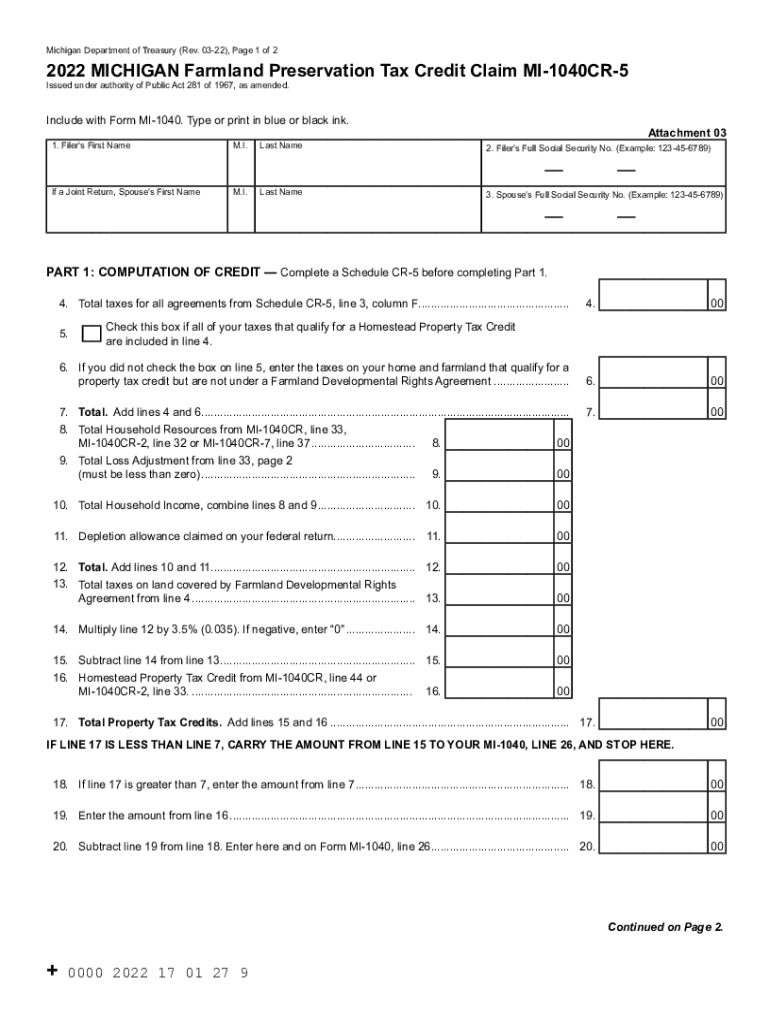

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax form designed for property owners who wish to claim a credit for preserving farmland in Michigan. This credit incentivizes landowners to maintain agricultural land, supporting the state's agricultural economy and environmental sustainability. By completing this form, eligible taxpayers can reduce their tax liability, thereby encouraging the preservation of farmland for future generations.

Steps to Complete the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

Completing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 involves several key steps:

- Gather necessary documentation, including proof of farmland preservation and any applicable assessments.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

- Submit the form either electronically or by mail, following the specified submission guidelines.

Eligibility Criteria for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

To qualify for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, applicants must meet specific eligibility criteria. These typically include:

- The property must be enrolled in the Farmland and Open Space Preservation Program.

- The land must be actively used for agricultural purposes.

- Applicants must provide documentation proving the preservation status of the farmland.

Meeting these criteria ensures that the tax credit is awarded to those genuinely contributing to farmland preservation efforts.

Required Documents for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

When filing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, certain documents are required to substantiate the claim. These may include:

- Proof of enrollment in the Farmland and Open Space Preservation Program.

- Documentation of agricultural use, such as farm income statements.

- Any correspondence from the state regarding land preservation status.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with the requirements.

Form Submission Methods for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 can be submitted through various methods. Taxpayers have the option to:

- File electronically using approved e-filing software.

- Mail the completed form to the designated state tax office.

- Deliver the form in person at local tax offices, if available.

Choosing the right submission method can enhance the efficiency of the filing process and ensure timely processing of the claim.

Legal Use of the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

The legal framework surrounding the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 ensures that the form is recognized as a valid tax document. Compliance with state tax laws and regulations is essential for the credit to be honored. Properly executed eSignatures, when applicable, meet legal standards, making the digital submission of this form secure and legitimate.

Quick guide on how to complete 2022 michigan farmland preservation tax credit claim mi 1040cr 5 2022 michigan farmland preservation tax credit claim mi 1040cr

Complete Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent green alternative to conventional printed and signed papers, allowing you to easily find the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 with ease

- Find Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize crucial sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document administration needs with just a few clicks from any device you prefer. Modify and eSign Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 michigan farmland preservation tax credit claim mi 1040cr 5 2022 michigan farmland preservation tax credit claim mi 1040cr

Create this form in 5 minutes!

How to create an eSignature for the 2022 michigan farmland preservation tax credit claim mi 1040cr 5 2022 michigan farmland preservation tax credit claim mi 1040cr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax credit form that allows property owners to claim benefits for maintaining land designated for agricultural use. It helps promote farmland preservation and comes with specific eligibility requirements outlined by the state of Michigan. Understanding this form can signNowly aid in maximizing your tax benefits.

-

How do I qualify for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

To qualify for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, you must have land in an agricultural production area, be enrolled in the Farmland and Open Space Preservation Program, and meet other eligibility criteria provided by the Michigan Department of Agriculture. It's essential to verify your land's status and compliance to successfully claim this tax credit.

-

What benefits does the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 offer?

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 offers signNow financial benefits by reducing your state tax liability, which allows you to reinvest back into your farmland or support local farming initiatives. This credit is aimed at sustaining Michigan's agricultural heritage and preserving valuable farmland for future generations.

-

How can airSlate SignNow help with my Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

AirSlate SignNow provides an easy-to-use platform for signing and managing documents, which can simplify the submission of your Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. With integrated templates and eSign functionalities, you can ensure your documents are prepared accurately and filed in a timely manner.

-

Are there any costs associated with filing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

While filing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 itself does not incur a fee, you may have costs associated with preparing the claim, such as hiring tax professionals or software solutions like airSlate SignNow. Utilizing affordable and efficient platforms can help you minimize these expenses while ensuring compliance.

-

Can I eSign my Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 documents?

Yes, you can eSign your Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 documents using airSlate SignNow. The platform allows you to securely sign and send your documents electronically, which streamlines the process and ensures your claims are processed faster.

-

What documents do I need to submit along with the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

When submitting the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, you typically need to provide proof of your land's eligibility, previous tax returns, and any supporting documentation from the Michigan Department of Agriculture. Ensuring you have complete and accurate documentation will facilitate a smoother submission process.

Get more for Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- Tn limited corporation form

- Tn warranty deed 497326660 form

- Tennessee minors form

- Tennessee real estate residential property disclosure form tennessee

- Claim mineral form

- Order on complaint for abandoned mineral interest tennessee form

- Tn husband wife form

- Quitclaim deed limited liability company to an individual tennessee form

Find out other Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast