Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 2024-2026

Understanding the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

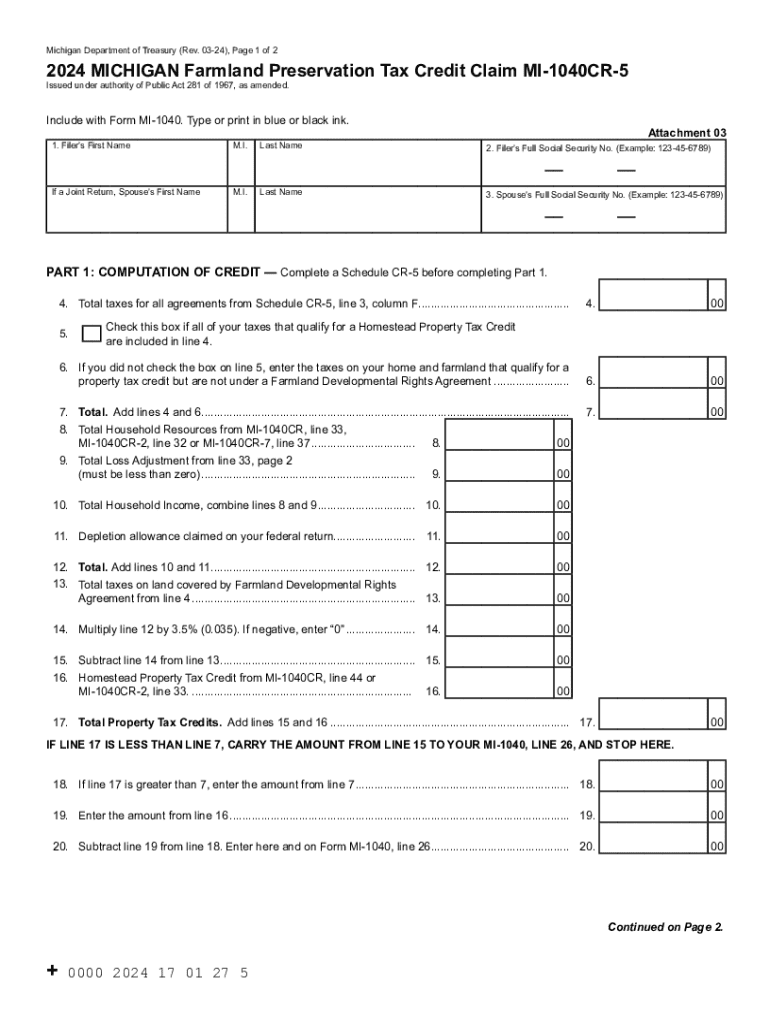

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax form designed for property owners who wish to claim a tax credit for preserving farmland in Michigan. This program aims to encourage the preservation of agricultural land by providing financial incentives to landowners who maintain their properties for agricultural use. The credit is available to individuals and entities that meet specific eligibility criteria, including ownership of qualified farmland and adherence to local zoning regulations.

Steps to Complete the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

Completing the MI 1040CR 5 form requires careful attention to detail. Begin by gathering all necessary documentation, including proof of farmland ownership and any relevant zoning information. Follow these steps:

- Fill out your personal information at the top of the form.

- Provide details about the farmland, including its location and size.

- Calculate the credit amount based on the assessed value of the property.

- Attach any required supporting documents, such as the farmland preservation agreement.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

To qualify for the tax credit, applicants must meet specific eligibility requirements. These include:

- Ownership of farmland that is enrolled in the Farmland and Open Space Preservation Act.

- Compliance with local zoning laws that support agricultural use.

- Maintaining the land for agricultural purposes for a minimum duration, as specified by state regulations.

Required Documents for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

When filing the MI 1040CR 5, certain documents are essential to support your claim. These typically include:

- A copy of the farmland preservation agreement.

- Proof of ownership, such as a deed or tax bill.

- Documentation demonstrating compliance with local zoning requirements.

Form Submission Methods for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

The MI 1040CR 5 form can be submitted through various methods, providing flexibility for applicants. Options include:

- Online submission via the Michigan Department of Treasury's website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated state offices, if applicable.

Filing Deadlines for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

It is crucial to be aware of the filing deadlines associated with the MI 1040CR 5 form. Typically, the deadline aligns with the annual tax filing date, which is April fifteenth. However, it is advisable to check for any specific extensions or changes that may apply in a given tax year.

Create this form in 5 minutes or less

Find and fill out the correct michigan farmland preservation tax credit claim mi 1040cr 5 771949413

Create this form in 5 minutes!

How to create an eSignature for the michigan farmland preservation tax credit claim mi 1040cr 5 771949413

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

The Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 is a tax credit available to eligible landowners who preserve farmland in Michigan. This credit helps reduce the tax burden for those who maintain agricultural land, encouraging sustainable farming practices and land conservation.

-

How can airSlate SignNow assist with the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

airSlate SignNow provides an efficient platform for eSigning and managing documents related to the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. With our easy-to-use interface, you can quickly prepare, send, and sign necessary forms, ensuring a smooth application process.

-

What are the eligibility requirements for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

To qualify for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, landowners must meet specific criteria, including having land enrolled in the Farmland and Open Space Preservation Act. Additionally, the land must be actively used for agricultural purposes to be eligible for the tax credit.

-

Is there a fee associated with filing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

While there is no direct fee for filing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5, there may be costs associated with preparing the necessary documentation. Using airSlate SignNow can help minimize these costs by streamlining the document preparation and eSigning process.

-

What features does airSlate SignNow offer for managing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. These tools simplify the process, ensuring that all necessary documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

Yes, airSlate SignNow can be integrated with various software applications to enhance your workflow for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5. This integration allows for seamless data transfer and improved efficiency in managing your tax credit claims.

-

What are the benefits of using airSlate SignNow for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5?

Using airSlate SignNow for the Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5 offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently, allowing you to focus on your farming operations.

Get more for Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- Notice of mechanics lien supplier to owner individual form

- Texas deed without warranty legal form nolo

- Opinion case no23422 state of west virginia ex rel marie m form

- Notice of mechanics lien supplier to owner corporation form

- Results from participation in an equestrian activity pursuant to west virginia code 20 44 2001 form

- Tenant may not assign this lease or sublet any part of the property form

- And insure its validity and enforceability including but not limited to execution of ucc 1 form

- This waiver and release does not cover any retention or labor services or form

Find out other Michigan Farmland Preservation Tax Credit Claim MI 1040CR 5

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT