Form DTF 664 Tax Shelter Disclosure for Material Advisors Tax Year

What is the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

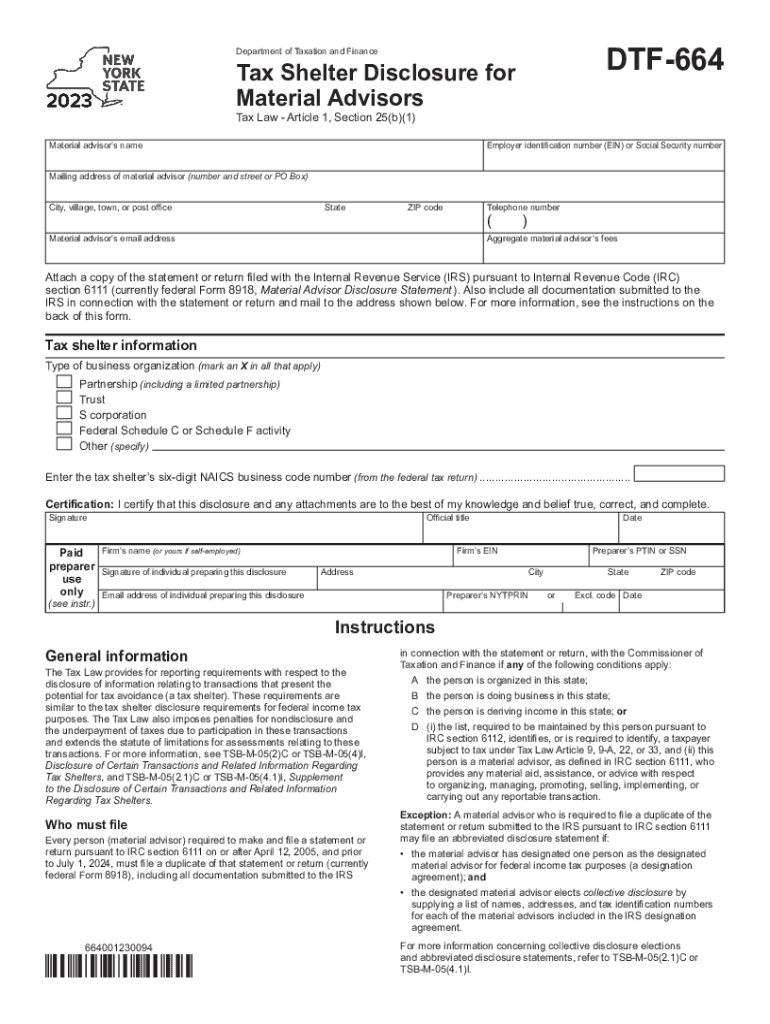

The Form DTF 664 is a tax disclosure document required by the New York State Department of Taxation and Finance. It is specifically designed for material advisors who provide advice regarding tax shelters. This form is essential for reporting information about tax shelter transactions and ensuring compliance with state tax laws. By submitting this form, material advisors disclose their involvement in tax shelters, which helps the state monitor and regulate these financial arrangements.

How to use the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

The Form DTF 664 is used by material advisors to report their participation in tax shelter transactions. To effectively use this form, advisors must accurately fill out all required sections, providing detailed information about the tax shelters involved. This includes identifying the type of shelter, the parties involved, and the specific tax benefits anticipated. Once completed, the form must be submitted to the appropriate state tax authority by the designated deadline to ensure compliance.

Steps to complete the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

Completing the Form DTF 664 involves several key steps:

- Gather necessary information about the tax shelter and participants.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the New York State Department of Taxation and Finance by the deadline.

Each step is crucial for ensuring that the disclosure is valid and meets legal requirements.

Key elements of the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

Key elements of the Form DTF 664 include:

- Identification of the material advisor: Name, address, and contact information.

- Description of the tax shelter: Details about the structure and purpose of the shelter.

- Disclosure of participants: Information about all parties involved in the tax shelter.

- Tax benefits: Explanation of the expected tax advantages associated with the shelter.

These elements ensure transparency and provide the state with necessary information for regulatory purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Form DTF 664 are critical for compliance. Material advisors must submit the form by the specified due date, which is typically aligned with the tax year in which the tax shelter transaction occurred. It is important to stay updated on any changes to deadlines, as failure to file on time can result in penalties or additional scrutiny from tax authorities.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form DTF 664 can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. It is essential for material advisors to understand these risks and ensure timely and accurate filing to avoid any negative consequences.

Quick guide on how to complete form dtf 664 tax shelter disclosure for material advisors tax year 708146953

Effortlessly Prepare Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Method to Alter and Electronically Sign Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year with Minimal Effort

- Locate Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or overlooked documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dtf 664 tax shelter disclosure for material advisors tax year 708146953

Create this form in 5 minutes!

How to create an eSignature for the form dtf 664 tax shelter disclosure for material advisors tax year 708146953

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

The Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year is a required document for material advisors to disclose certain tax shelter arrangements to the New York State Department of Taxation and Finance. This form helps ensure compliance with tax regulations and allows advisors to avoid penalties by providing necessary information related to tax shelters.

-

How can airSlate SignNow help with completing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

airSlate SignNow streamlines the process of completing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year by providing a secure platform for document creation and electronic signatures. With our intuitive interface, users can easily fill out the form, obtain necessary signatures, and ensure all details are accurate without the hassle of physical paperwork.

-

What is the pricing structure for using airSlate SignNow for the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

airSlate SignNow offers competitive pricing plans designed to fit various business needs when handling the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year. Whether you're a small business or a large enterprise, you can choose a plan that maximizes value while ensuring you have all the necessary features to efficiently manage your document workflows.

-

What features does airSlate SignNow offer for managing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

Our platform includes features such as customizable templates, automated reminders, and secure cloud storage specifically for the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year. These features enhance the user experience, helping you manage documents efficiently while ensuring compliance and security throughout the signing process.

-

Are there integrations available for airSlate SignNow when processing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

Yes, airSlate SignNow offers robust integrations with popular applications such as Google Drive, Salesforce, and Zapier, making it easier to manage the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year. These integrations enhance productivity by allowing you to access and store your documents seamlessly across multiple platforms.

-

Can I track the status of the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking capabilities that allow you to monitor the status of the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year in real-time. You can see when your document has been viewed, signed, and completed, ensuring a smooth and transparent workflow.

-

What benefits does airSlate SignNow offer for filing the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year?

Using airSlate SignNow to file the Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year provides numerous benefits, including increased efficiency, reduced human error, and enhanced security for your sensitive information. Our platform simplifies the entire process, allowing advisors to focus on their clients while ensuring compliance with tax regulations.

Get more for Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

- Authorization for release of health information formsingov

- Name and full address of applicant institution form

- Facility contact information change form

- Rehabilitation assessment form

- Certificate of medical necessity form for oxygen

- Hca midwest health system division provider information form provider information form

- Hospital admission checklist form

- Pre hospital dnr form

Find out other Form DTF 664 Tax Shelter Disclosure For Material Advisors Tax Year

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe