of EARNINGS WITHHELD 2021-2026

Understanding the OF Earnings Withheld

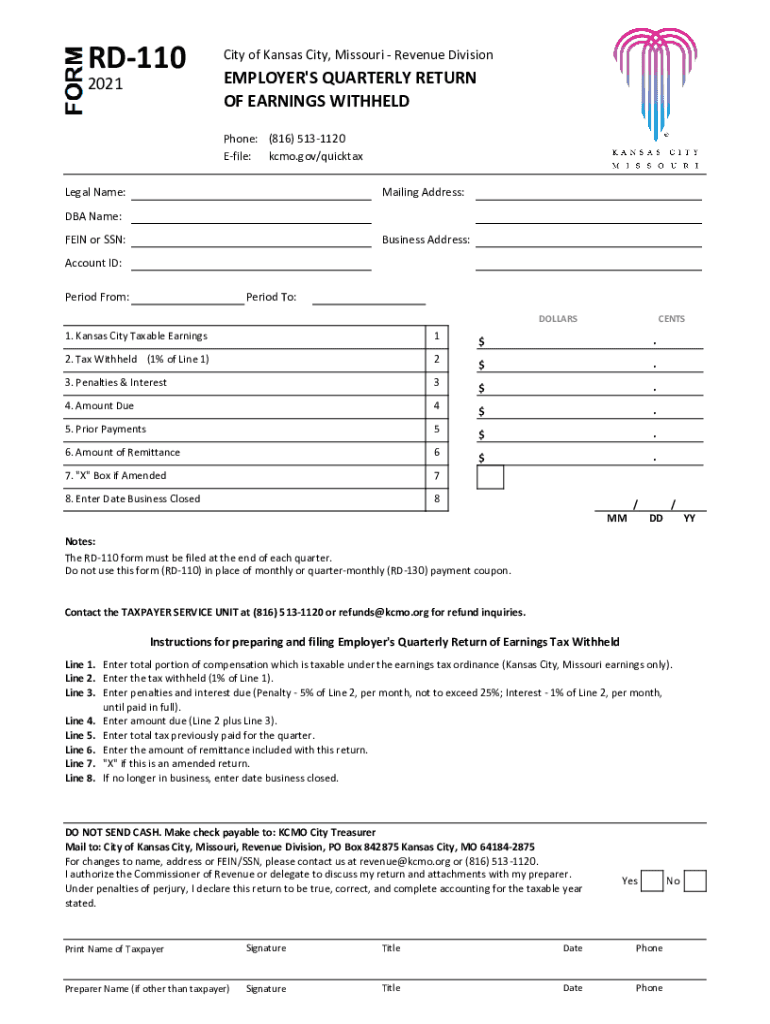

The OF Earnings Withheld, often referred to in the context of form RD110, is a crucial document for reporting income that has been withheld for tax purposes. This form is primarily used by employers and businesses to report amounts withheld from employees' earnings, ensuring compliance with federal and state tax regulations. Understanding the purpose of this form is essential for both employers and employees to maintain accurate tax records and avoid potential penalties.

Steps to Complete the OF Earnings Withheld

Completing the OF Earnings Withheld involves several key steps:

- Gather Necessary Information: Collect all relevant employee information, including names, Social Security numbers, and the amounts withheld.

- Fill Out the Form: Enter the required details accurately, ensuring that all figures reflect the correct amounts withheld from earnings.

- Review for Accuracy: Double-check all entries for errors to prevent issues during submission.

- Submit the Form: Follow the appropriate submission method as outlined in the guidelines, whether online, by mail, or in person.

Legal Use of the OF Earnings Withheld

The OF Earnings Withheld is legally mandated for businesses operating in the United States. Employers are required to report any amounts withheld from employee earnings to ensure compliance with tax laws. Failure to accurately complete and submit this form can result in penalties from tax authorities. It is crucial for employers to understand their obligations under the law to avoid legal complications.

Filing Deadlines and Important Dates

Timely filing of the OF Earnings Withheld is essential to avoid penalties. Typically, employers must submit this form by specific deadlines set by the IRS and state tax authorities. These deadlines may vary based on the type of business entity and the specific tax year. Employers should keep track of these dates to ensure compliance and avoid late fees.

Required Documents for Submission

When completing the OF Earnings Withheld, certain documents may be required to support the information provided. These may include:

- Employee W-2 forms, which detail annual wages and taxes withheld.

- Payroll records that reflect the amounts withheld during the reporting period.

- Any additional documentation requested by tax authorities.

Form Submission Methods

The OF Earnings Withheld can be submitted through various methods, depending on the preferences of the employer and the requirements of the tax authorities. Common submission methods include:

- Online Submission: Many states offer electronic filing options for convenience.

- Mail: Employers can send the completed form via postal service to the designated tax office.

- In-Person Submission: Some employers may choose to submit the form directly at local tax offices.

Quick guide on how to complete of earnings withheld

Easy Preparation of OF EARNINGS WITHHELD on Any Device

Digital document management has gained traction among both businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any holdups. Manage OF EARNINGS WITHHELD across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

Effortlessly Edit and eSign OF EARNINGS WITHHELD

- Obtain OF EARNINGS WITHHELD and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click the Done button to save your edits.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign OF EARNINGS WITHHELD to ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct of earnings withheld

Create this form in 5 minutes!

How to create an eSignature for the of earnings withheld

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the rd 110 feature in airSlate SignNow?

The rd 110 feature in airSlate SignNow allows users to efficiently manage document workflows. This feature ensures that all signing processes are streamlined and secure, making it easier for businesses to maintain compliance and improve productivity.

-

How does the pricing for rd 110 compare to other e-signature solutions?

The pricing for the rd 110 capabilities within airSlate SignNow is designed to be competitive and cost-effective. By offering various subscription tiers, businesses can choose a plan that best fits their needs without compromising on essential features.

-

Can I integrate rd 110 with other software applications?

Yes, airSlate SignNow supports a wide range of integrations with popular software applications. Users can easily connect the rd 110 capabilities to tools like CRM systems, project management apps, and cloud storage solutions for enhanced functionality.

-

What are the key benefits of using the rd 110 feature?

The primary benefits of the rd 110 feature include increased efficiency, improved security, and ease of use. With this feature, businesses can expedite document signing processes, reduce errors, and ensure that sensitive information is protected.

-

Is the rd 110 feature suitable for small businesses?

Absolutely! The rd 110 feature in airSlate SignNow is particularly advantageous for small businesses looking for scalable and affordable solutions. Its intuitive interface allows users to manage documents without extensive training or technical expertise.

-

How can I start using the rd 110 capabilities in airSlate SignNow?

To start using the rd 110 capabilities, simply sign up for an account on the airSlate SignNow website. Once registered, you can explore the dashboard and access various tools and features designed to streamline your document management process.

-

Are there any customer support options available for users of the rd 110 feature?

Yes, airSlate SignNow offers robust customer support options for users of the rd 110 feature. Customers can access tutorials, live chat, and phone support to address any questions or issues they may encounter while using the platform.

Get more for OF EARNINGS WITHHELD

- Real property income amp expense rpie nycgov form

- Certificate of estate tax payment and real property form

- Form rp 467919application for partial tax exemption for

- Tda withdraw al application nyc board of education form

- Instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1

- Applicable for the tax period june 1 2020 to august 31 2020 only form

- 2019 form ftb 3519 payment for automatic extension for individuals 2019 form ftb 3519 payment for automatic extension for

- Fillable online 540 es form 1 at bottom of page sutter tax fax

Find out other OF EARNINGS WITHHELD

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word