FormMOPTC2023 Property Tax Credit Claiming in BLAC 2023

Understanding the Missouri Property Tax Credit Form 2024

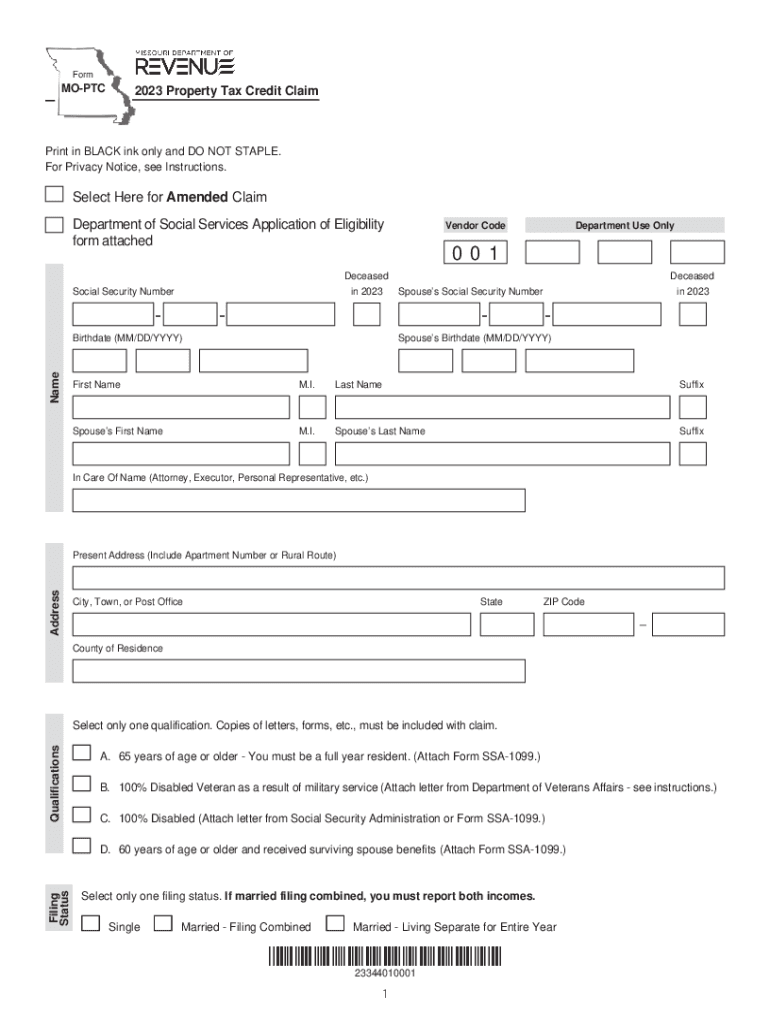

The Missouri Property Tax Credit Form 2024, commonly referred to as the MO PTC form 2024, is a crucial document for residents seeking to claim property tax credits. This form is specifically designed for individuals who qualify based on their income, age, and property ownership status. The credit aims to alleviate the financial burden of property taxes for eligible homeowners and renters in Missouri. Understanding the specifics of this form is essential for maximizing potential tax benefits.

Eligibility Criteria for the MO PTC Form 2024

To qualify for the Missouri Property Tax Credit, applicants must meet certain criteria. Generally, eligibility includes:

- Being a resident of Missouri.

- Meeting income limits set by the state.

- Being at least sixty-five years old, or being a disabled individual.

- Owning or renting a home in Missouri.

It is important for applicants to review these criteria carefully to ensure they meet all requirements before submitting the form.

Steps to Complete the MO PTC Form 2024

Filling out the MO PTC form 2024 involves several key steps:

- Gather necessary documentation, including proof of income and property ownership or rental agreements.

- Download the form from the official state website or obtain a physical copy from local tax offices.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form via the designated method, whether online, by mail, or in person.

Following these steps can help streamline the application process and reduce the likelihood of delays.

Form Submission Methods

The MO PTC form 2024 can be submitted through various methods, accommodating different preferences:

- Online: Eligible applicants can fill out and submit the form through the Missouri Department of Revenue's online portal.

- Mail: Completed forms can be mailed to the appropriate local tax office for processing.

- In-Person: Applicants may also choose to submit the form in person at their local tax office.

Choosing the right submission method can enhance the efficiency of the application process.

Required Documents for the MO PTC Form 2024

When applying for the Missouri Property Tax Credit, several documents are necessary to support your claim:

- Proof of income, such as tax returns or pay stubs.

- Documentation showing property ownership or rental agreements.

- Identification verifying age or disability status, if applicable.

Having these documents ready can facilitate a smoother application experience and ensure compliance with state requirements.

Important Filing Deadlines

Timeliness is crucial when submitting the MO PTC form 2024. Key deadlines include:

- The deadline for filing the form is typically set for April fifteenth of the following year.

- Extensions may be available under certain circumstances, but it is advisable to file as early as possible.

Being aware of these deadlines can help applicants avoid penalties and ensure they receive their credits promptly.

Quick guide on how to complete formmoptc2023 property tax credit claiming in blac

Complete FormMOPTC2023 Property Tax Credit Claiming In BLAC seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FormMOPTC2023 Property Tax Credit Claiming In BLAC on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign FormMOPTC2023 Property Tax Credit Claiming In BLAC with ease

- Find FormMOPTC2023 Property Tax Credit Claiming In BLAC and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign FormMOPTC2023 Property Tax Credit Claiming In BLAC while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct formmoptc2023 property tax credit claiming in blac

Create this form in 5 minutes!

How to create an eSignature for the formmoptc2023 property tax credit claiming in blac

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo ptc form 2024, and why is it important?

The mo ptc form 2024 is a necessary document for businesses and individuals involved in tax reporting in Missouri. It ensures compliance with state regulations and helps streamline the filing process, making it crucial for accurate tax management.

-

How can airSlate SignNow help me complete the mo ptc form 2024?

AirSlate SignNow provides a user-friendly platform that allows users to easily fill out and eSign the mo ptc form 2024. With our tools, you can complete your forms quickly and securely, ensuring you meet deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the mo ptc form 2024?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs when completing the mo ptc form 2024. Our cost-effective solutions are designed to provide great value and facilitate your document management process.

-

What features does airSlate SignNow offer for the mo ptc form 2024?

AirSlate SignNow offers robust features for completing the mo ptc form 2024, including eSigning, document templates, and cloud storage. These tools are designed to enhance the efficiency of your document workflows and ensure secure transactions.

-

Are there any integrations available with airSlate SignNow for the mo ptc form 2024?

Absolutely, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the mo ptc form 2024. This means you can easily connect with your existing tools for a streamlined workflow.

-

Can I track the status of my mo ptc form 2024 with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your mo ptc form 2024. You will receive notifications when documents are viewed or signed, ensuring you stay updated throughout the process.

-

How secure is airSlate SignNow for handling the mo ptc form 2024?

Security is a priority at airSlate SignNow, especially when handling sensitive documents like the mo ptc form 2024. We implement robust encryption methods and secure data storage protocols to protect your information.

Get more for FormMOPTC2023 Property Tax Credit Claiming In BLAC

Find out other FormMOPTC2023 Property Tax Credit Claiming In BLAC

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile