Form MO 1040A Individual Income Tax Return SingleMarried One Income 2023-2026

Overview of the MO 1040A Individual Income Tax Return

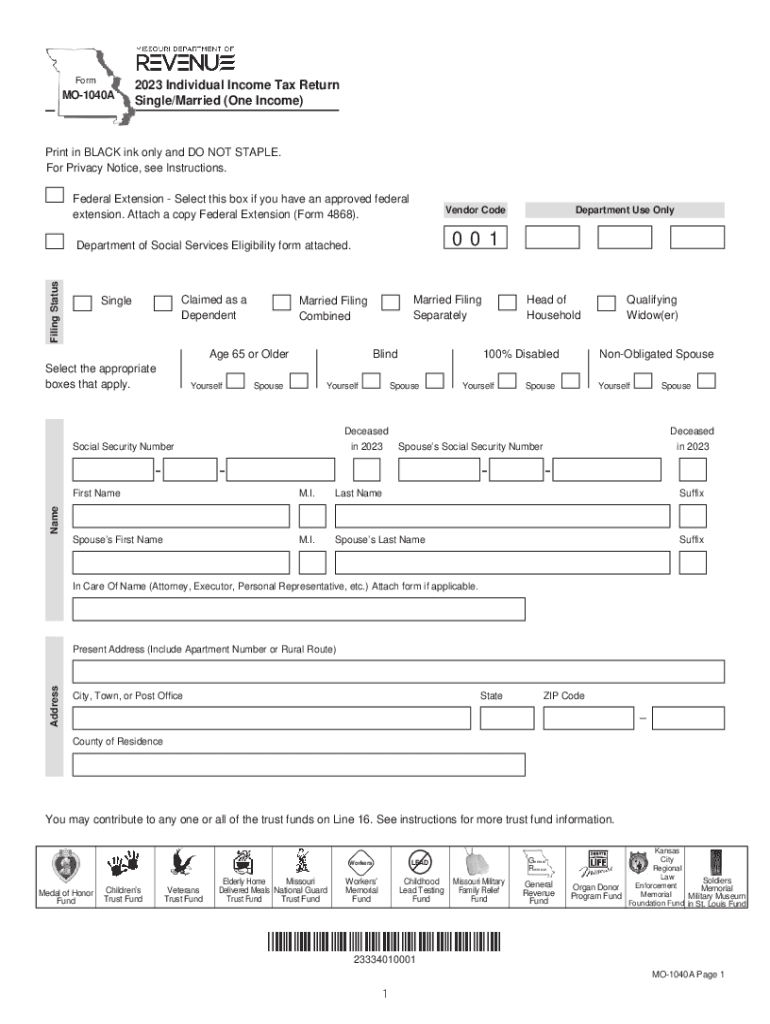

The MO 1040A is a form used by residents of Missouri to file their individual income tax returns. This form is specifically designed for taxpayers who meet certain criteria, including those filing as single or married with one income. It simplifies the filing process for individuals who do not itemize deductions and instead opt for the standard deduction. Understanding this form is essential for ensuring compliance with state tax laws and maximizing potential refunds.

Steps to Complete the MO 1040A Individual Income Tax Return

Completing the MO 1040A involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report income by entering total wages, salaries, and other income sources on the appropriate lines.

- Calculate your Missouri adjusted gross income by applying any relevant deductions.

- Determine your tax liability using the tax tables provided in the form instructions.

- Claim any tax credits for which you are eligible, ensuring you follow the specific guidelines for each credit.

- Sign and date the form before submission.

How to Obtain the MO 1040A Individual Income Tax Return

The MO 1040A form can be obtained through several methods:

- Visit the Missouri Department of Revenue's official website to download a printable version of the form.

- Request a physical copy by contacting the Missouri Department of Revenue directly.

- Access tax preparation software that includes the MO 1040A form for electronic filing.

Filing Deadlines for the MO 1040A Individual Income Tax Return

It is important to be aware of the filing deadlines to avoid penalties. For most taxpayers, the deadline to file the 2018 MO tax return is April 15, 2019. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may apply, allowing additional time for filing without incurring penalties.

Required Documents for the MO 1040A Individual Income Tax Return

Before completing the MO 1040A, gather the following documents:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any additional income, such as freelance work or interest.

- Records of any deductions or credits you plan to claim, including receipts and statements.

- Previous year’s tax return for reference, if applicable.

Penalties for Non-Compliance with the MO 1040A Filing Requirements

Failing to file the MO 1040A by the deadline can result in penalties and interest on any unpaid taxes. The Missouri Department of Revenue may impose a late filing penalty, which is typically a percentage of the unpaid tax amount. Additionally, interest accrues on any outstanding balance from the original due date until the tax is paid in full. It is crucial to file on time to avoid these financial repercussions.

Quick guide on how to complete form mo 1040a individual income tax return singlemarried one income

Easy Preparation of Form MO 1040A Individual Income Tax Return SingleMarried One Income on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any holdups. Handle Form MO 1040A Individual Income Tax Return SingleMarried One Income on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

Effortlessly Edit and eSign Form MO 1040A Individual Income Tax Return SingleMarried One Income

- Obtain Form MO 1040A Individual Income Tax Return SingleMarried One Income and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure confidential information using tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether through email, SMS, invite link, or download to your computer.

Say goodbye to lost or mislaid documents, tedious form hunting, and errors that necessitate reprinting form copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Form MO 1040A Individual Income Tax Return SingleMarried One Income and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1040a individual income tax return singlemarried one income

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040a individual income tax return singlemarried one income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2018 MO tax return?

A 2018 MO tax return is the official document used to report your income and calculate your tax owed to the state of Missouri for the year 2018. It is essential for ensuring compliance with state tax laws. Filing this return helps you claim refunds and credits you may be eligible for.

-

How can airSlate SignNow help with my 2018 MO tax return?

AirSlate SignNow streamlines the process of preparing and signing your 2018 MO tax return by allowing you to create, send, and eSign documents securely. This eliminates the need for printing and mailing physical documents, saving you time and making your tax filing experience much more efficient.

-

What features does airSlate SignNow offer for tax document management?

AirSlate SignNow offers several features specifically tailored for managing tax documents, including customizable templates, real-time tracking of signed documents, and secure cloud storage. These features ensure that you can quickly and easily handle your 2018 MO tax return and other related documents, all in one place.

-

Is airSlate SignNow affordable for filing a 2018 MO tax return?

Yes, airSlate SignNow provides a cost-effective solution for individuals and businesses alike. With flexible pricing plans, you can find a subscription that fits your budget while still providing all the necessary tools to efficiently manage your 2018 MO tax return.

-

Can I integrate airSlate SignNow with other tax software?

Absolutely! AirSlate SignNow integrates seamlessly with popular tax software and applications, allowing you to import and export your 2018 MO tax return data with ease. This connectivity helps you maintain a smooth workflow between document management and tax preparation.

-

What are the benefits of using airSlate SignNow for my 2018 MO tax return?

Using airSlate SignNow for your 2018 MO tax return offers numerous benefits, such as improved efficiency and enhanced security. The platform simplifies document collaboration, ensuring you can sign and send your tax return quickly while keeping sensitive information protected.

-

How does airSlate SignNow ensure the security of my 2018 MO tax return?

AirSlate SignNow employs advanced security measures, including encryption and multi-factor authentication, to safeguard your documents. This ensures that your 2018 MO tax return and related information remain confidential and protected against unauthorized access.

Get more for Form MO 1040A Individual Income Tax Return SingleMarried One Income

- Sps 305 licenses certifications and registrations code petition dsps wi form

- Wisconsin fish dealer license form

- Wv f 1 form

- M00324491 form

- Rent certificate form

- Instruction to transfer an existing isa to an isa with form

- Isa manager transfer bformb lloyds bank

- Budget coding manual houston independent school district form

Find out other Form MO 1040A Individual Income Tax Return SingleMarried One Income

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document